Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Kelt Exploration (TSE:KEL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Kelt Exploration

How Fast Is Kelt Exploration Growing Its Earnings Per Share?

Kelt Exploration has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, Kelt Exploration's EPS shot from CA$0.32 to CA$0.72, over the last year. Year on year growth of 129% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

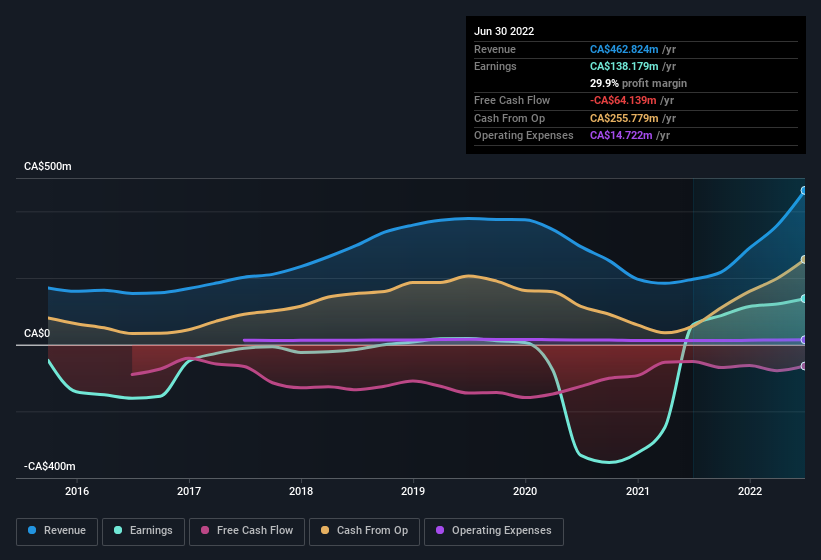

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Kelt Exploration shareholders is that EBIT margins have grown from 33% to 37% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Kelt Exploration.

Are Kelt Exploration Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The CA$2.6m worth of shares that insiders sold during the last 12 months pales in comparison to the CA$6.5m they spent on acquiring shares in the company. This adds to the interest in Kelt Exploration because it suggests that those who understand the company best, are optimistic. We also note that it was the CEO, President & Non-Independent Director, David Wilson, who made the biggest single acquisition, paying CA$4.1m for shares at about CA$5.31 each.

The good news, alongside the insider buying, for Kelt Exploration bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enviable stake in the company, worth CA$213m. This totals to 17% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, David Wilson, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Kelt Exploration with market caps between CA$526m and CA$2.1b is about CA$2.1m.

The Kelt Exploration CEO received total compensation of just CA$717k in the year to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Kelt Exploration Worth Keeping An Eye On?

Kelt Exploration's earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Kelt Exploration belongs near the top of your watchlist. Before you take the next step you should know about the 1 warning sign for Kelt Exploration that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, Kelt Exploration isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kelt Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:KEL

Kelt Exploration

An oil and gas company, engages in the exploration, development, and production of crude oil and natural gas resources primarily in Western Canada.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.