- Canada

- /

- Oil and Gas

- /

- TSX:HWX

Headwater Exploration (TSX:HWX) Is Up 7.4% After Q2 Earnings Miss and Buyback Has The Bull Case Changed?

Reviewed by Simply Wall St

- Headwater Exploration recently announced its second quarter and half-year 2025 earnings, reporting declines in revenue and net income for the quarter compared to the previous year, and completed a small share buyback program.

- While six-month financials showed modest revenue growth, quarterly profit softness highlights changing conditions for the company’s operations this year.

- We’ll explore how this quarter’s weaker profitability is shaping Headwater Exploration’s investment narrative going forward.

What Is Headwater Exploration's Investment Narrative?

Being a shareholder in Headwater Exploration means believing in its ability to keep delivering production growth and navigate earnings headwinds, even as the company’s Q2 results showed a pullback in both revenue and profit. The company’s higher first-half sales look encouraging, but the recent drop in quarterly earnings does raise questions about the resilience of margins and cash flows, especially as dividend payments remain sizable and free cash flow coverage is stretched. With a modest share buyback program recently completed, management seems to be signaling confidence, though the repurchase was small relative to outstanding shares. The biggest short-term catalysts remain tied to potential production gains and the integration of new board members, while the chief risks now include weaker commodity prices feeding directly into profits, and whether the current dividend level is sustainable if softer quarters continue. The recent earnings miss has not led to large share price volatility so far, suggesting the market sees the news as manageable for now, but ongoing underperformance versus peers and the Canadian market remains a key issue that could reshape sentiment if profit softness persists. On the other hand, maintaining the current dividend could prove challenging if profitability continues to slip.

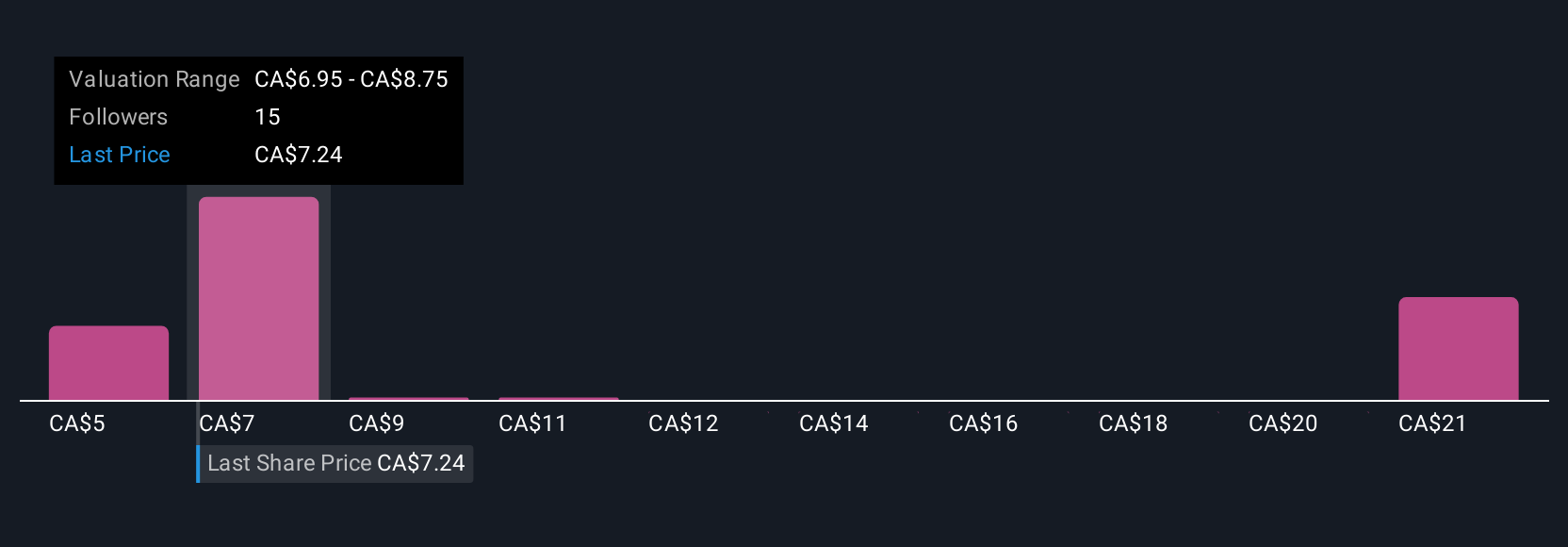

Headwater Exploration's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Build Your Own Headwater Exploration Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Headwater Exploration research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Headwater Exploration research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Headwater Exploration's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Headwater Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HWX

Headwater Exploration

Engages in the exploration, development, and production of petroleum and natural gas resources in Canada.

Flawless balance sheet and good value.

Market Insights

Community Narratives