Gear Energy Ltd. (TSE:GXE) has announced that it will pay a dividend of CA$0.005 per share on the 27th of September. Based on this payment, the dividend yield on the company's stock will be 9.5%, which is an attractive boost to shareholder returns.

View our latest analysis for Gear Energy

Gear Energy's Projections Indicate Future Payments May Be Unsustainable

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, the company was paying out 131% of what it was earning and 76% of cash flows. The company could be more focused on returning cash to shareholders, but this could indicate that growth opportunities are few and far between.

Over the next year, EPS could expand by 0.9% if the company continues along the path it has been on recently. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 120% over the next year.

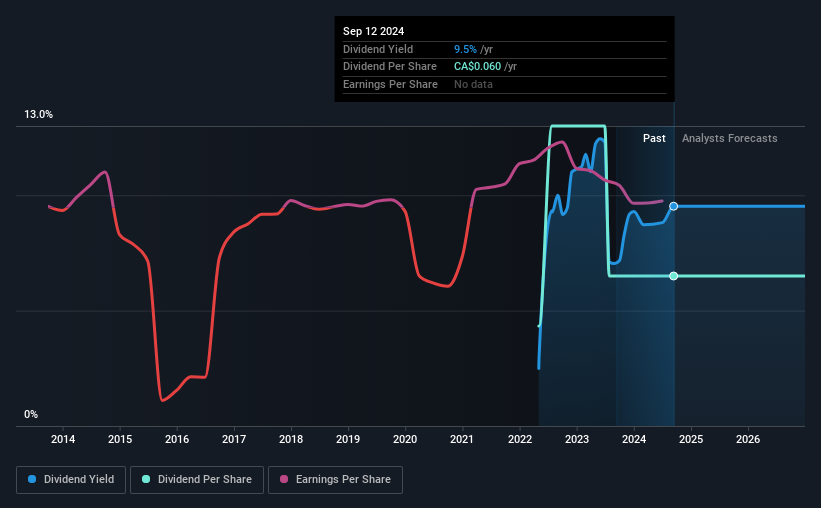

Gear Energy Doesn't Have A Long Payment History

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The annual payment during the last 2 years was CA$0.04 in 2022, and the most recent fiscal year payment was CA$0.06. This means that it has been growing its distributions at 22% per annum over that time. Gear Energy has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

Dividend Growth May Be Hard To Achieve

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Although it's important to note that Gear Energy's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time. The company is paying out a lot of its profits, even though it is growing those profits pretty slowly. Limited recent earnings growth and a high payout ratio makes it hard for us to envision strong future dividend growth, unless the company should have substantial pricing power or some form of competitive advantage.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The track record isn't great, and the payments are a bit high to be considered sustainable. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 3 warning signs for Gear Energy that investors should take into consideration. Is Gear Energy not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GXE

Gear Energy

An exploration and production company, engages in the acquiring, developing, and holding of interests in petroleum and natural gas properties and assets in Canada.

Excellent balance sheet second-rate dividend payer.