- Canada

- /

- Oil and Gas

- /

- TSX:GRN

We're Interested To See How Greenlane Renewables (TSE:GRN) Uses Its Cash Hoard To Grow

Just because a business does not make any money, does not mean that the stock will go down. By way of example, Greenlane Renewables (TSE:GRN) has seen its share price rise 162% over the last year, delighting many shareholders. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given its strong share price performance, we think it's worthwhile for Greenlane Renewables shareholders to consider whether its cash burn is concerning. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Greenlane Renewables

Does Greenlane Renewables Have A Long Cash Runway?

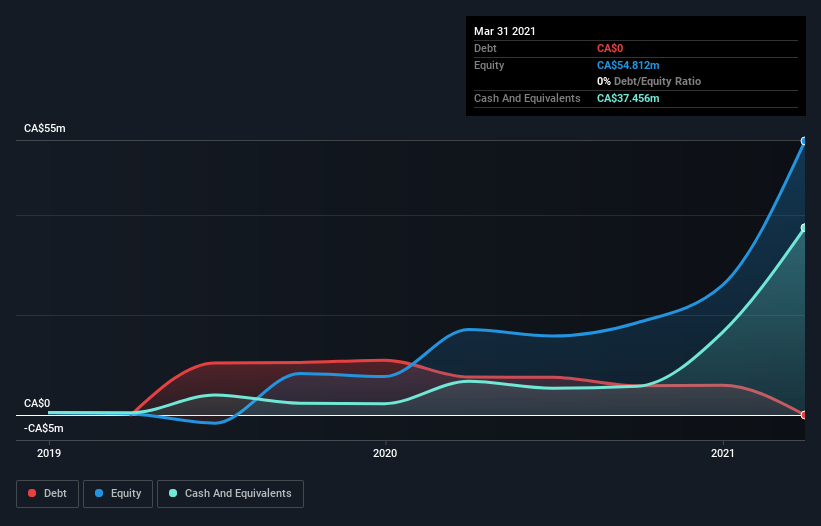

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In March 2021, Greenlane Renewables had CA$37m in cash, and was debt-free. Looking at the last year, the company burnt through CA$1.6m. That means it had a cash runway of very many years as of March 2021. Notably, however, analysts think that Greenlane Renewables will break even (at a free cash flow level) before then. In that case, it may never reach the end of its cash runway. The image below shows how its cash balance has been changing over the last few years.

How Well Is Greenlane Renewables Growing?

Greenlane Renewables managed to reduce its cash burn by 67% over the last twelve months, which suggests it's on the right flight path. Arguably, however, the revenue growth of 164% during the period was even more impressive. Considering these factors, we're fairly impressed by its growth trajectory. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Greenlane Renewables Raise Cash?

There's no doubt Greenlane Renewables seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of CA$185m, Greenlane Renewables' CA$1.6m in cash burn equates to about 0.9% of its market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

Is Greenlane Renewables' Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Greenlane Renewables' cash burn. In particular, we think its revenue growth stands out as evidence that the company is well on top of its spending. And even its cash burn reduction was very encouraging. There's no doubt that shareholders can take a lot of heart from the fact that analysts are forecasting it will reach breakeven before too long. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. Taking a deeper dive, we've spotted 3 warning signs for Greenlane Renewables you should be aware of, and 1 of them is potentially serious.

Of course Greenlane Renewables may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:GRN

Greenlane Renewables

Provides biogas desulfurization and upgrading systems and services worldwide.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.