- Canada

- /

- Oil and Gas

- /

- TSX:GEI

Has the Market Priced Gibson Energy Fairly After Its Midstream Expansion Gains?

Reviewed by Bailey Pemberton

- Wondering if Gibson Energy at around CA$26 is still a smart buy or if the easy money has already been made? You are not the only one looking for signals on whether the current price matches the underlying value.

- The stock has quietly put up solid numbers, climbing 4.8% over the last week, 9.9% over the past month, and 16.4% over the last year, with a 68.2% gain over five years that highlights both its performance record and changing risk perceptions.

- Recent headlines have focused on Gibson Energy expanding its midstream footprint and deepening long term infrastructure contracts with investment grade counterparties, moves that can support more stable cash flows and justify stronger valuations over time. At the same time, market chatter around Canadian energy infrastructure and regulatory developments has kept investors debating how durable these cash flows really are, which helps explain some of the momentum in the share price.

- Despite that track record, Gibson Energy only scores a 2/6 valuation check score. In the rest of this article we will break down what different valuation methods are saying and introduce a different way to think about fair value that we will come back to at the end.

Gibson Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Gibson Energy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those amounts back to today. For Gibson Energy, the model starts with last twelve month free cash flow of about CA$331.2 million and extends analyst forecasts out over several years. Beyond the initial analyst window, Simply Wall St extrapolates growth to build a full long term picture of potential cash generation.

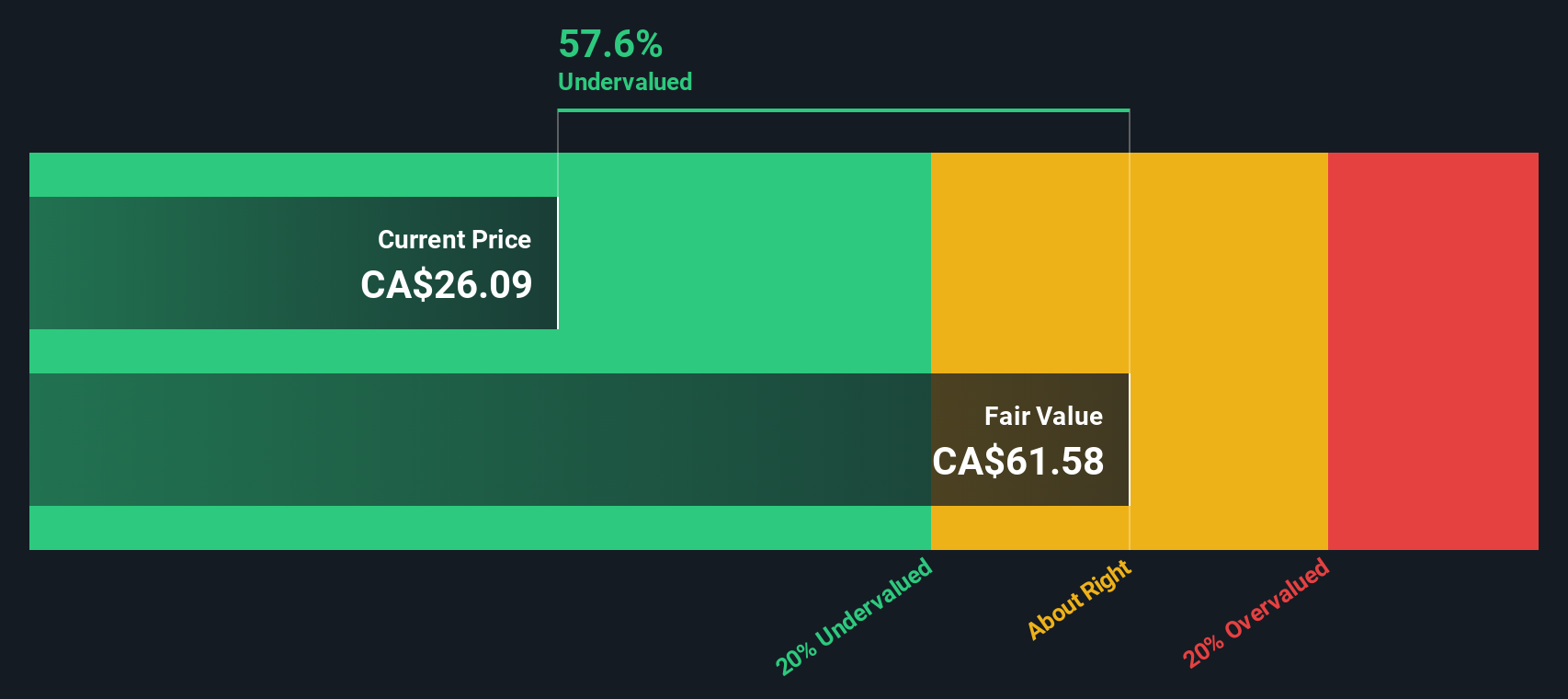

Under this 2 Stage Free Cash Flow to Equity approach, Gibson Energy is expected to grow free cash flow steadily, reaching roughly CA$465 million by 2035 based on the current projection path. When all those future cash flows are discounted back, the estimated intrinsic value comes out at around CA$61.58 per share. Compared with the current share price near CA$26, the DCF suggests the stock is about 57.6% undervalued, which indicates a sizable margin of safety if the cash flow assumptions hold.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Gibson Energy is undervalued by 57.6%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Gibson Energy Price vs Earnings

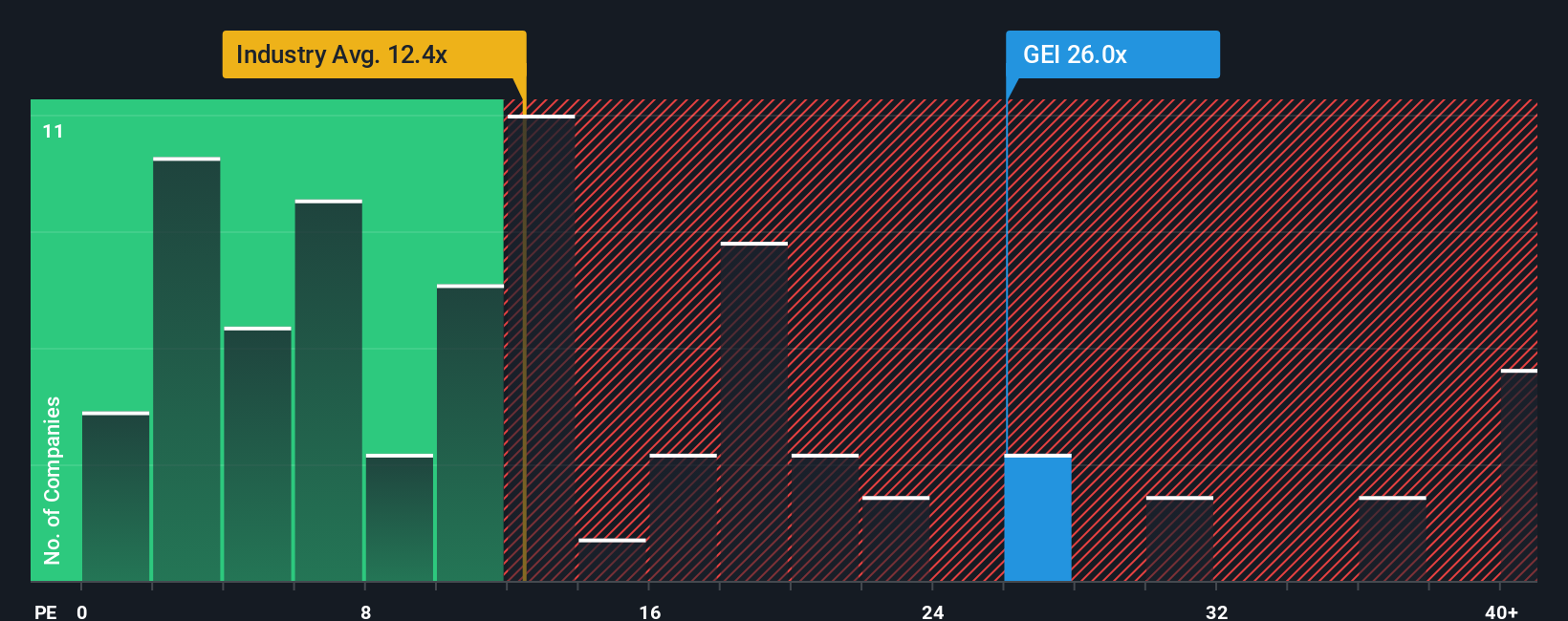

For profitable companies like Gibson Energy, the price to earnings ratio is a useful yardstick because it links what investors are paying directly to the profits the business is generating today. In general, higher growth and lower perceived risk can justify a higher PE multiple, while slower growth or greater uncertainty usually call for a lower, more conservative PE.

Gibson Energy currently trades on about 28.3x earnings, which is noticeably richer than both the broader Oil and Gas industry average of roughly 14.7x and a peer average near 16.3x. At first glance, that premium suggests the market is pricing in stronger, more resilient earnings than the typical infrastructure focused energy name.

To go a step further, Simply Wall St estimates a Fair Ratio of about 16.9x for Gibson Energy, a proprietary PE level that reflects its specific earnings growth outlook, profitability, size, industry context and risk profile. This tailored yardstick is more informative than a simple peer or industry comparison because it adjusts for the company’s own fundamentals rather than assuming all Oil and Gas businesses deserve the same multiple. With the actual PE of 28.3x sitting well above the 16.9x Fair Ratio, the shares appear overvalued on this earnings based lens.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Gibson Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Gibson Energy’s business to a concrete financial forecast and Fair Value by telling the story behind your assumptions for future revenue, earnings and margins, then comparing that Fair Value to the current share price to inform your own decision, all within an easy to use tool on Simply Wall St’s Community page that is used by millions of investors and automatically updates when new news or earnings arrive. For example, one investor might build a bullish Gibson Narrative that leans on long term export growth, margin expansion and buybacks to support a Fair Value above the CA$30.50 bullish target. A more cautious investor could create a conservative Narrative that emphasizes demand, customer and regulatory risks and lands closer to the CA$24.00 bearish target, giving both a clear, numbers based way to act on their own story.

Do you think there's more to the story for Gibson Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GEI

Gibson Energy

Engages in the gathering, storing, optimizing, and processing of liquids and refined products in Canada and the United States.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026