- Canada

- /

- Oil and Gas

- /

- TSX:FRU

Freehold Royalties (TSX:FRU): How Do Strong Q3 Results and Dividend News Shape Its Valuation?

Reviewed by Simply Wall St

Freehold Royalties (TSX:FRU) just delivered its third quarter results, showing an increase in both production and net income compared to last year. The company also reaffirmed its monthly dividend, which often attracts investors’ attention.

See our latest analysis for Freehold Royalties.

It is not surprising that Freehold Royalties’ strong quarterly numbers and sustained dividend have caught investors’ attention. The stock has gained momentum this year, with a 1-year total shareholder return of nearly 15% and a price now sitting at $14.89. Even after a solid 10% share price return over the past three months, its long-term total return remains impressive. This suggests the market is warming up to its steady performance and income prospects.

If stable income and recent growth trends are on your radar, now is a good time to broaden your view and discover fast growing stocks with high insider ownership

With the share price now inching closer to analysts’ targets and recent financials painting a positive picture, investors are left wondering if Freehold Royalties is still trading at a discount or if future growth is already reflected in the price.

Price-to-Earnings of 19x: Is it justified?

At a price-to-earnings ratio of 19x and last close of CA$14.89, Freehold Royalties appears more expensive than many of its Canadian oil and gas peers, raising questions about the premium investors are willing to pay.

The price-to-earnings (P/E) ratio measures how much investors are paying for each dollar of a company's profits. It is a fundamental tool for comparing valuations across the energy sector. Given the earnings profile of Freehold Royalties, this ratio is especially relevant for assessing whether investor enthusiasm is grounded in profitability or future growth expectations.

Despite a strong track record of earnings growth over the last five years, a 19x P/E stands out as notably higher than the Canadian oil and gas industry average of 14.7x. This suggests the stock is trading at a premium, potentially reflecting expectations for continued stable income or positive company-specific factors. However, when viewed against its peers, the current multiple looks stretched rather than justified by industry standards.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 19x (OVERVALUED)

However, ongoing flat annual revenue growth and a recent slowdown in momentum could challenge the bullish case if these trends continue.

Find out about the key risks to this Freehold Royalties narrative.

Another View: What Does Fair Value Say?

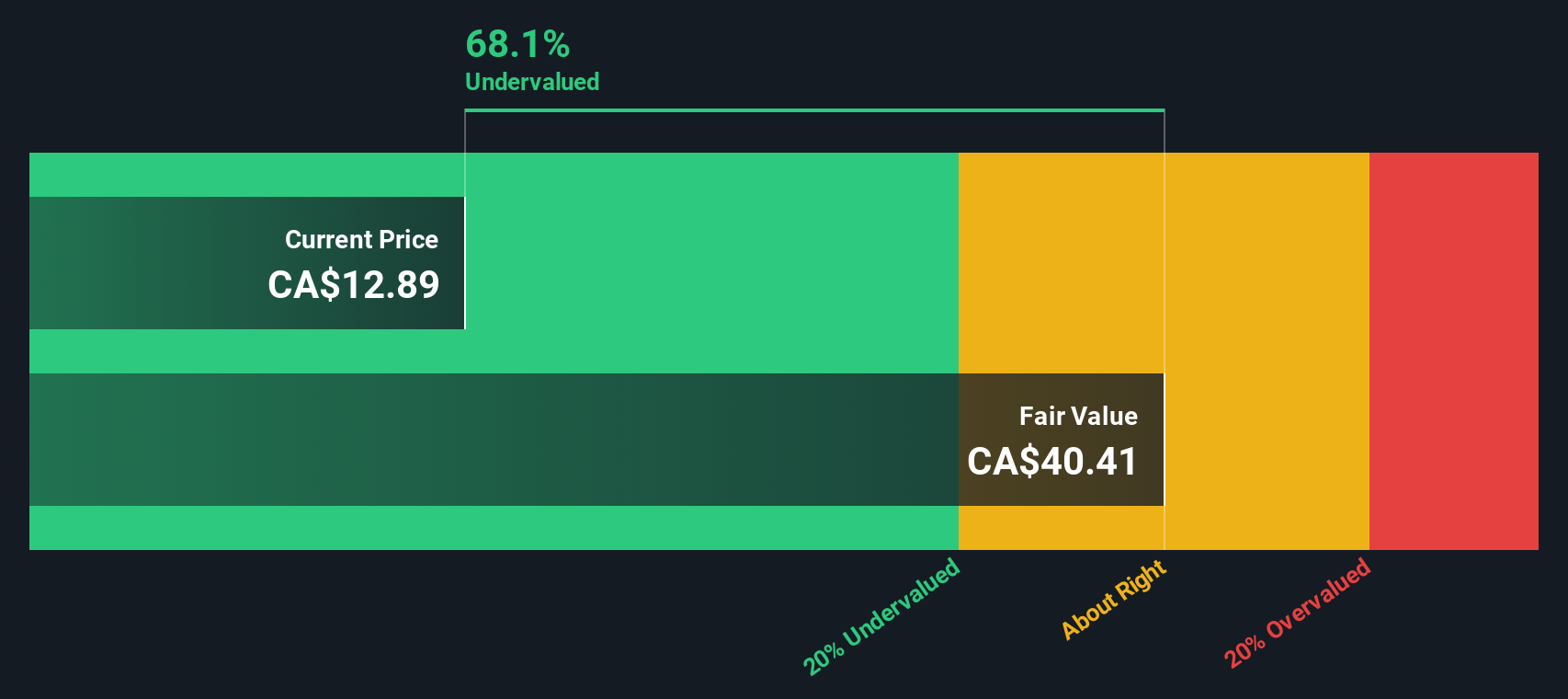

There is another way to evaluate Freehold Royalties, which is by estimating its fair value. According to our calculation, the stock is trading at a price 64.9% below this fair value estimate. This suggests the market may be overlooking the company's true worth. So, which view do you trust: relative multiples or the deeper fair value model?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Freehold Royalties for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Freehold Royalties Narrative

If you have a different viewpoint or want to dive into the numbers on your own terms, you can easily piece together your own narrative in just a few minutes. Do it your way

A great starting point for your Freehold Royalties research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why stop at one opportunity when there is a world of potential? Use the Simply Wall Street Screener to spot stocks you might wish you hadn't missed.

- Boost long-term returns by targeting companies with reliable payouts. Explore these 15 dividend stocks with yields > 3% for options presenting attractive yields and steady financial health.

- Jump ahead of the curve and take advantage of artificial intelligence trends. Search through these 25 AI penny stocks to discover companies fueling the next big wave of innovation.

- Capitalize on strong cash flow potential by scanning for these 926 undervalued stocks based on cash flows. These represent opportunities trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FRU

Freehold Royalties

Acquires and manages royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Canada and the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success