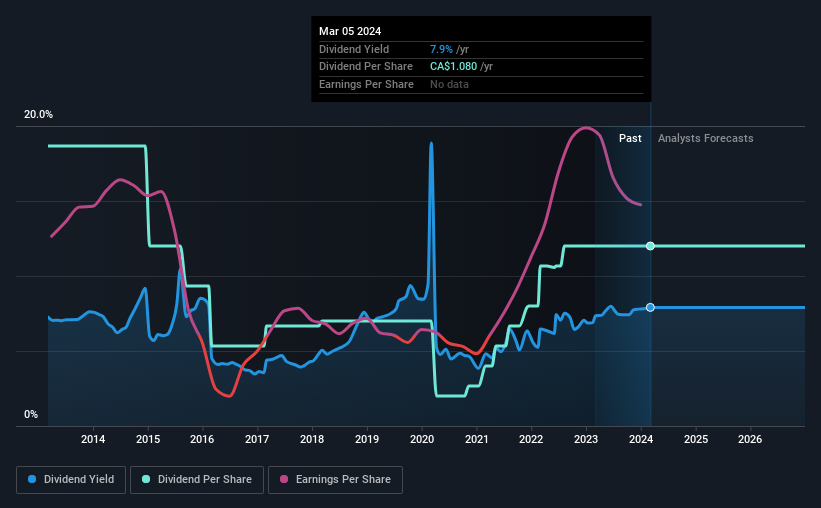

Freehold Royalties Ltd. (TSE:FRU) will pay a dividend of CA$0.09 on the 15th of April. This makes the dividend yield 7.9%, which will augment investor returns quite nicely.

Check out our latest analysis for Freehold Royalties

Freehold Royalties' Earnings Easily Cover The Distributions

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, the company's dividend was higher than its profits, and made up 79% of cash flows. The company could be more focused on returning cash to shareholders, but this could indicate that growth opportunities are few and far between.

Looking forward, earnings per share is forecast to rise by 130.4% over the next year. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 48% which would be quite comfortable going to take the dividend forward.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The annual payment during the last 10 years was CA$1.68 in 2014, and the most recent fiscal year payment was CA$1.08. The dividend has shrunk at around 4.3% a year during that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Freehold Royalties' Dividend Might Lack Growth

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's encouraging to see that Freehold Royalties has been growing its earnings per share at 49% a year over the past five years. Strong earnings is nice to see, but unless this can be sustained on minimal reinvestment of profits, we would question whether dividends will follow suit.

Freehold Royalties' Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Freehold Royalties' payments, as there could be some issues with sustaining them into the future. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. We don't think Freehold Royalties is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for Freehold Royalties that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FRU

Freehold Royalties

Acquires and manages royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Canada and the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success