- Canada

- /

- Oil and Gas

- /

- TSX:FRU

Assessing Freehold Royalties (TSX:FRU) Valuation After Its Newly Declared CAD 0.09 Dividend for 2026

Reviewed by Simply Wall St

Freehold Royalties (TSX:FRU) just reaffirmed its income appeal, with the board declaring a CAD 0.09 per share dividend payable on January 15, 2026, to shareholders of record on December 31.

See our latest analysis for Freehold Royalties.

The dividend news lands as the share price trades around CA$15.01, with a solid 90 day share price return of 10.9 percent and a standout 1 year total shareholder return of 32.6 percent, suggesting momentum is quietly building.

If this kind of income story has your attention, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover other under the radar opportunities with strong alignment between insiders and shareholders.

Yet with Freehold trading modestly below analyst targets and showing robust long term returns, investors must ask whether the current price still understates its cash generation or whether the market is already incorporating expectations of future growth.

Price-to-Earnings of 19.1x: Is it justified?

On a price-to-earnings basis, Freehold Royalties trades at 19.1 times earnings, a level that screens as good value against its closest peers even after the recent rally to CA$15.01.

The price to earnings multiple compares what investors pay today with the company’s current profits, making it a useful gauge for income focused energy names where steady cash generation is key.

Against a peer average of 27.7 times earnings, Freehold’s lower multiple hints that the market may not be fully crediting its track record of becoming profitable over the past five years and its high quality earnings profile.

However, when set against the broader Canadian Oil and Gas industry’s lower 14.2 times earnings, Freehold looks more richly valued. This suggests investors are willing to pay a premium for its royalty model and governance while still getting a discount relative to direct peers.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 19.1x (ABOUT RIGHT)

However, softer revenue growth and a modest premium to the broader sector mean that any drop in commodity prices or drilling activity could quickly challenge sentiment.

Find out about the key risks to this Freehold Royalties narrative.

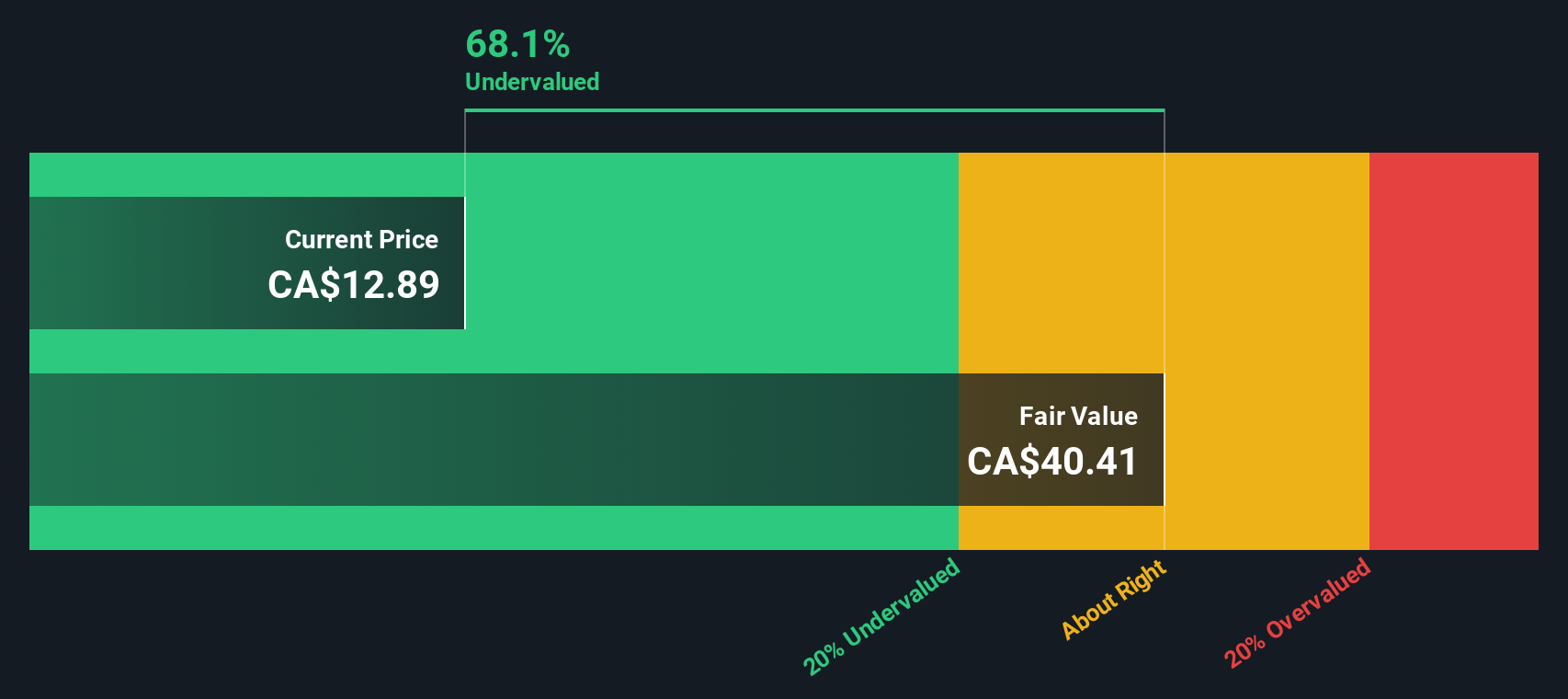

Another View: DCF Points to Deeper Value

While earnings multiples suggest Freehold is about fairly priced, our DCF model paints a different picture, with fair value estimated near CA$42.47 versus the current CA$15.01. If the cash flows prove durable, the market may eventually close such a wide gap.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Freehold Royalties for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Freehold Royalties Narrative

If you would rather test the numbers yourself and challenge this view, you can build a personalized Freehold story in just minutes: Do it your way.

A great starting point for your Freehold Royalties research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Freehold may fit your strategy today, but you may miss other high potential opportunities our screener surfaces right now if you focus on it alone.

- Look for potential price reratings early by targeting resilient growth stories through these 3639 penny stocks with strong financials before broader market attention is reflected in the share price.

- Explore transformative innovation by focusing on companies with real revenue potential in these 26 AI penny stocks, where structural trends could be an important driver of business performance.

- Identify quality at sensible prices by focusing on companies trading at attractive cash flow levels with these 908 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FRU

Freehold Royalties

Acquires and manages royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Canada and the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion