- Canada

- /

- Energy Services

- /

- TSX:EFX

Is It Too Late To Consider Enerflex After A 176.6% Five Year Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Enerflex is still good value after a strong run, you are not alone. This breakdown will help you decide if the current price still leaves room on the table.

- The stock has cooled slightly in the last week, down 1.9%, but that comes after climbing 4.2% over the past month, 29.8% year to date, 48.2% over the last year, 138.9% over three years, and 176.6% over five years.

- Recent headlines have focused on Enerflex's expanding role in energy infrastructure and gas compression services, with investors paying close attention to how its long term contracts and project pipeline could support cash flows. This backdrop helps explain why sentiment has shifted and why the market is now rethinking what the business might be worth over a full cycle.

- On our framework, Enerflex scores a 6/6 valuation check result, suggesting it screens as undervalued across every metric we track. Next, we will unpack those different valuation approaches before finishing with an even better way to think about what the market might be missing.

Approach 1: Enerflex Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back into today’s dollars.

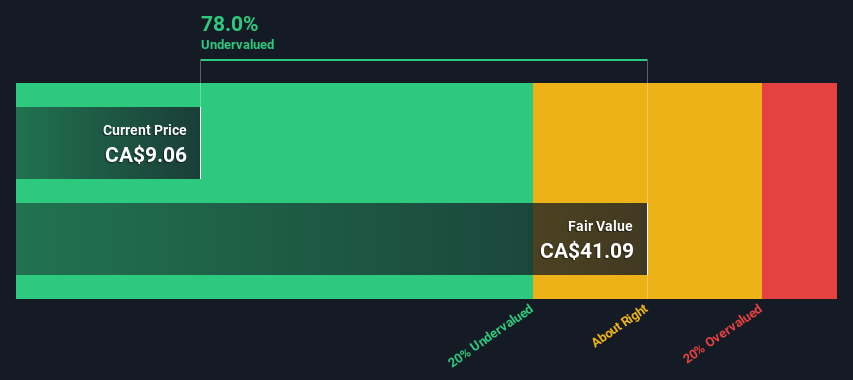

For Enerflex, the latest twelve month Free Cash Flow is about $167.7 Million, and analysts expect this to rise steadily as large projects convert into cash. Based on a 2 Stage Free Cash Flow to Equity model, near term forecasts are combined with longer term projections generated by Simply Wall St, with Free Cash Flow estimated to reach roughly the mid $400 Million range in ten years.

When all those future cash flows are discounted back, the model arrives at an intrinsic value of about CA$88.54 per share. That implies the stock is trading at a 78.5% discount to its estimated fair value, suggesting the market is heavily underpricing Enerflex’s long term cash generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Enerflex is undervalued by 78.5%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: Enerflex Price vs Earnings

For profitable businesses like Enerflex, the Price to Earnings ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of current profits. In general, faster growing and lower risk companies can justify a higher PE multiple, while slower growth or higher uncertainty usually call for a lower, more conservative PE.

Enerflex currently trades on a PE of about 12.2x, which sits below both the Energy Services industry average of roughly 14.8x and the broader peer group average of around 18.8x. On those simple comparisons, the stock looks inexpensive relative to similar companies earning profits today.

Simply Wall St’s Fair Ratio framework goes a step further by estimating the PE that would make sense for Enerflex specifically, given its earnings growth outlook, profit margins, risk profile, industry positioning and market cap. For Enerflex, that Fair Ratio is around 12.6x, only slightly above the current 12.2x. That tight gap suggests the market is pricing the stock close to where you might expect once its fundamentals and risks are properly accounted for.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

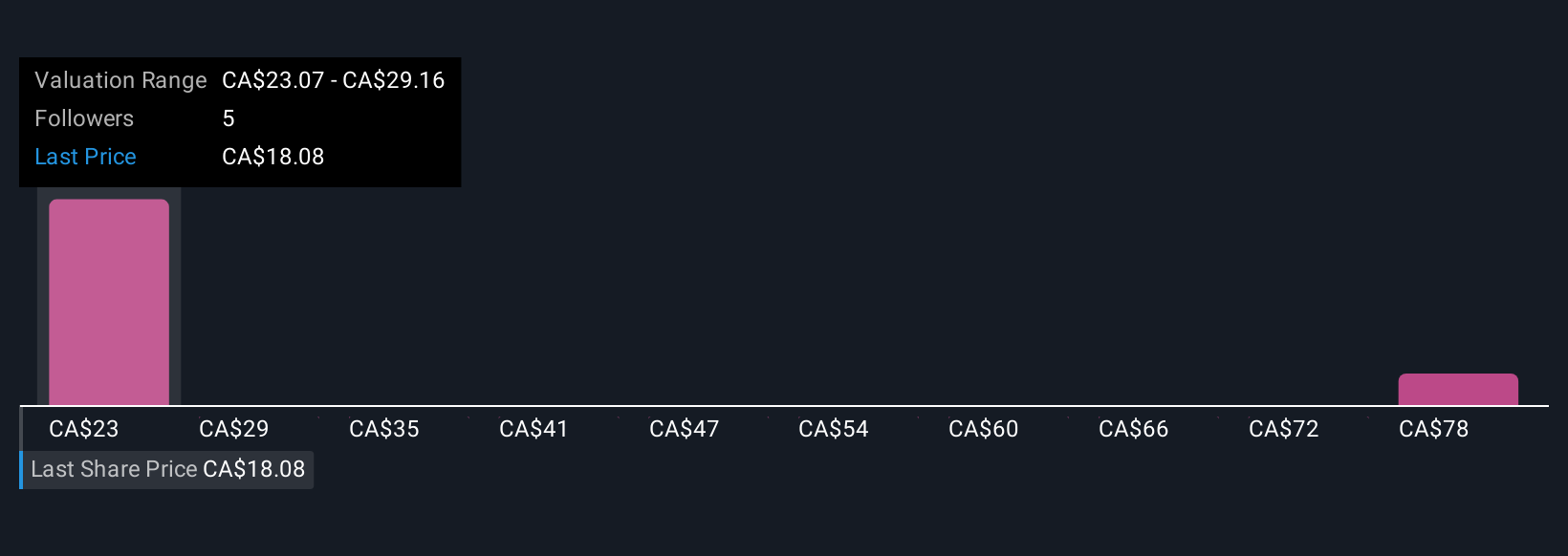

Upgrade Your Decision Making: Choose your Enerflex Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, a simple way for you to tell the story behind your numbers by linking your view of Enerflex’s future revenues, earnings and margins to a financial forecast, and then to a fair value estimate that you can directly compare with today’s share price to decide whether to buy, hold or sell. On Simply Wall St’s Community page, used by millions of investors, Narratives make this process intuitive and accessible, updating dynamically as new news, earnings, or guidance arrives so that your thesis and fair value stay current without you rebuilding a model from scratch. For example, one Enerflex Narrative might lean bullish, assuming expanding margins, steady revenue growth and a higher future PE multiple that supports a fair value closer to the upper analyst target around CA$19.50. In contrast, a more cautious Narrative might assume slower growth, thinner margins, and a lower multiple that anchors fair value nearer the CA$14.50 end of the range, showing how two reasonable stories can lead to very different conclusions about upside.

Do you think there's more to the story for Enerflex? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enerflex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EFX

Enerflex

Offers energy infrastructure and energy transition solutions in North America, Latin America, and the Eastern Hemisphere.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026