- Canada

- /

- Oil and Gas

- /

- TSX:EFR

Why Energy Fuels (TSX:EFR) Is Up 6.6% After Uranium Demand Jumps On Nuclear Interest – And What's Next

Reviewed by Sasha Jovanovic

- Recently, Energy Fuels Inc. emerged as a top gainer on the Toronto Stock Exchange, as investors reacted to renewed global uranium demand and growing interest in nuclear energy as a lower-carbon power source.

- This surge in attention highlights how Energy Fuels’ uranium extraction and recovery focus is aligning with policy and industry momentum toward sustainable energy solutions, despite ongoing profitability pressures.

- We’ll now examine how this renewed uranium enthusiasm and focus on sustainable nuclear power could reshape Energy Fuels’ existing investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Energy Fuels Investment Narrative Recap

To own Energy Fuels, you need to believe that rising uranium demand and policy support for nuclear power will eventually translate into profitable production at scale. The recent share price jump on the Toronto Stock Exchange has sharpened focus on the near term catalyst of ramping low cost uranium output from Pinyon Plain, but it does not remove the key risk that high capital needs and ongoing losses could still pressure funding and potential dilution.

Among recent announcements, the Q3 2025 operating update on Pinyon Plain stands out here, with high grade ore mined, improving volumes and a 26% gross margin on uranium sales at an average price of US$72.38 per pound. This progress ties directly into the thesis that higher throughput and lower unit costs at White Mesa can gradually support better cash generation, even as investors weigh the funding requirements for Energy Fuels’ broader rare earth and heavy mineral sands ambitions.

Yet beneath the excitement around uranium demand, investors should be aware of how future project financing and potential dilution could...

Read the full narrative on Energy Fuels (it's free!)

Energy Fuels' narrative projects $553.4 million revenue and $237.8 million earnings by 2028. This requires 104.1% yearly revenue growth and a $330.9 million earnings increase from -$93.1 million today.

Uncover how Energy Fuels' forecasts yield a CA$33.62 fair value, a 56% upside to its current price.

Exploring Other Perspectives

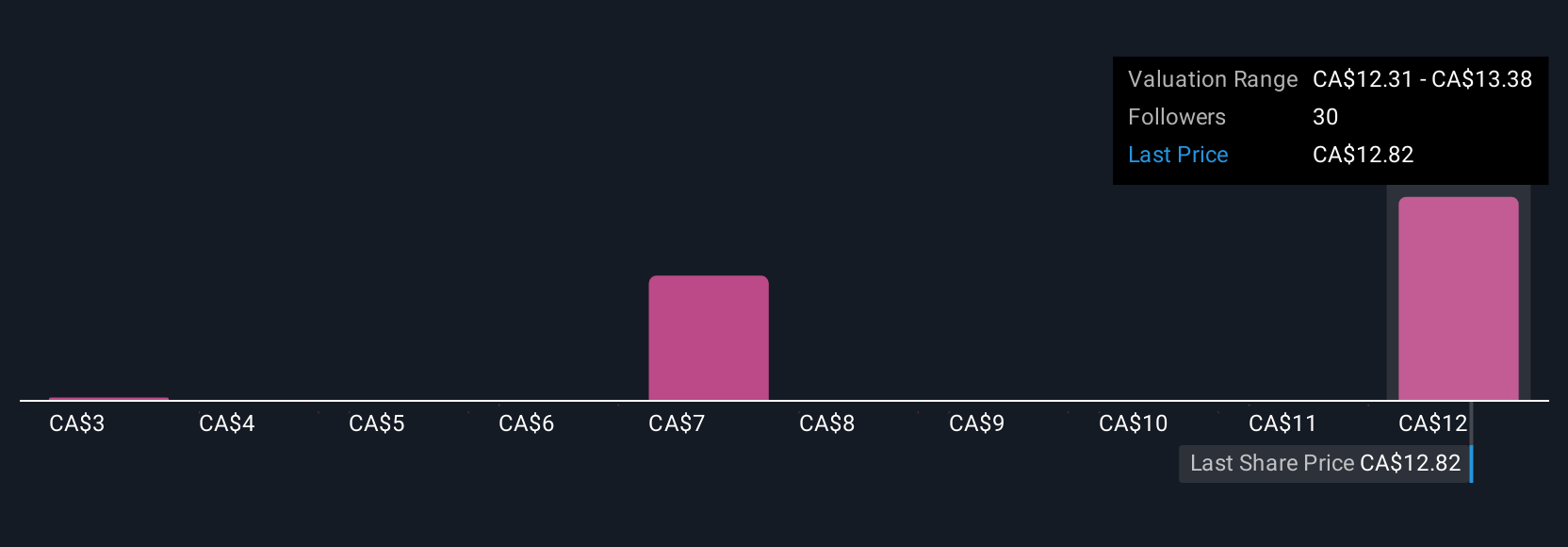

Eleven fair value estimates from the Simply Wall St Community span from US$2.57 to US$35.85 per share, underscoring how far apart individual views can be. Against that backdrop, the recent uranium price supported margin progress at Pinyon Plain highlights why some investors focus on production ramp up as a key driver of the company’s future performance, and why it can be useful to compare several perspectives before forming a view.

Explore 11 other fair value estimates on Energy Fuels - why the stock might be worth as much as 66% more than the current price!

Build Your Own Energy Fuels Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Energy Fuels research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Energy Fuels research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Energy Fuels' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Fuels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EFR

Energy Fuels

Engages in the exploration, recovery, recycling, exploration, operation, development, permitting, evaluation, and sale of uranium mineral properties in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026