- Canada

- /

- Oil and Gas

- /

- TSX:EFR

Evaluating Energy Fuels After G7 Considers Rare Earth Price Floors in 2025

Reviewed by Bailey Pemberton

If you’re following Energy Fuels, you’ve probably noticed the wild ride this stock has taken. Just in the past month, shares have rocketed up more than 50%, and if you zoom out, its five-year return sits at an eye-popping 944.4%. That sort of growth is hard to ignore, and it’s got everyone from new investors to seasoned pros asking whether the upside still outweighs the risk.

The buzz isn’t just speculation, either. Global headlines have been swirling about government efforts to shore up critical minerals supply chains, including rare earths. With talk of G7 price floors and the U.S. exploring billions in funding for domestic projects, Energy Fuels finds itself at the center of a newly energized conversation about resource security. These macro moves have fueled a surge in the share price, even as pullbacks (like last week’s dip of -2.2%) remind us just how sensitive this name is to news flow and sentiment shifts. Still, the year-to-date return of 187.3% and the staggering 209.2% gain over the past year show that investors have been willing to pay up for the future potential.

But what does all this mean for Energy Fuels’ valuation right now? Is the stock getting ahead of itself, or are there still signs it’s flying under the radar? If you’re weighing your next move, it helps to know that Energy Fuels currently scores a 2 out of 6 on our undervaluation checks. Next, we’ll dig into what those different valuation approaches actually reveal, and I’ll also share a smarter way to judge if this stock is a real bargain, so stay tuned.

Energy Fuels scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Energy Fuels Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company's future cash flows and then discounting those amounts back to their value today. In other words, the model estimates what Energy Fuels is worth now based on how much cash it is expected to generate in the years ahead.

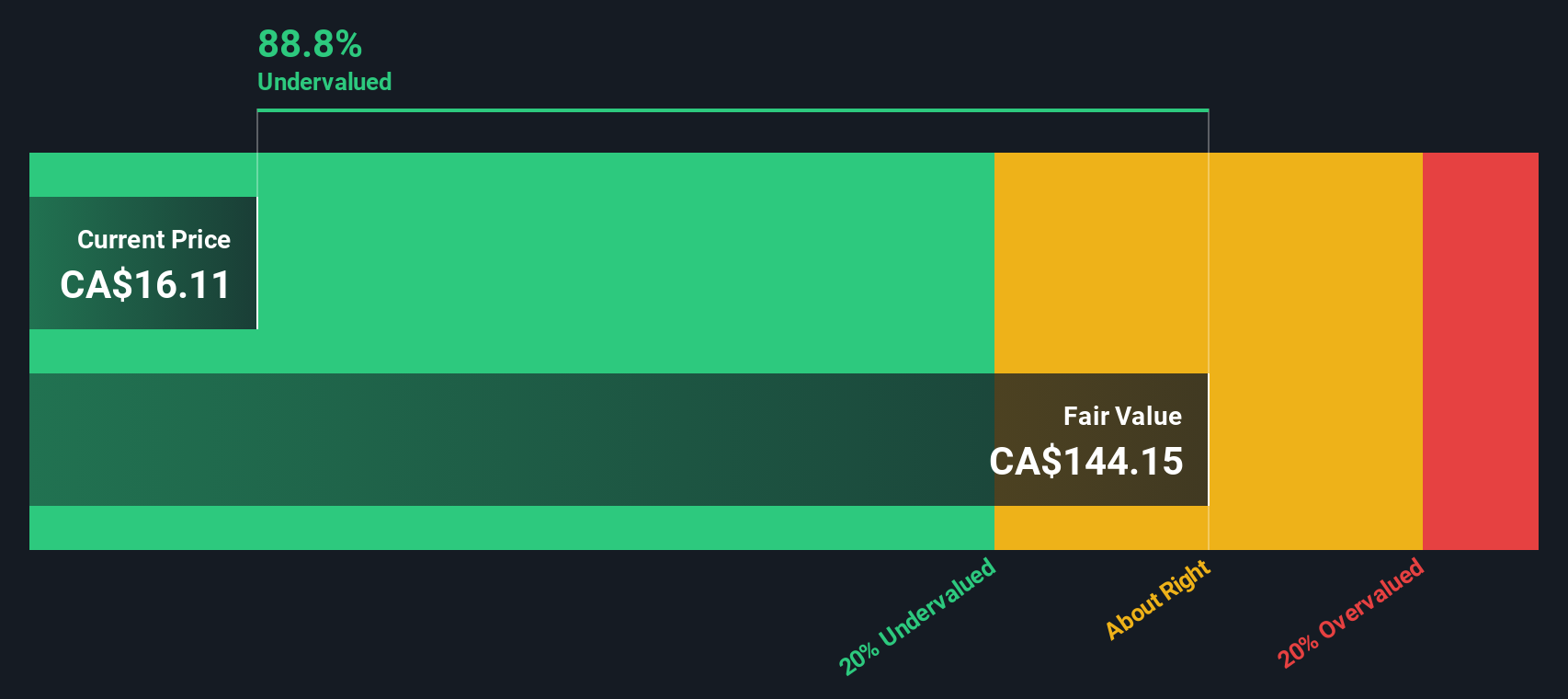

Looking at Energy Fuels' numbers, its most recent Free Cash Flow (FCF) was negative at $-131.2 Million, reflecting heavy investment and growth-stage losses. However, analysts expect the company to turn a corner, projecting FCF to rise steadily and reach $1.41 Billion by 2035. While detailed estimates only go out through 2029, with FCF forecast to hit $389.4 Million that year, further gains are extrapolated using historical trends and sector models.

Based on these cash flow projections, the DCF analysis calculates an intrinsic fair value of $146.13 per share. Given where the stock trades today, that implies it is trading at an 83.9% discount to its underlying value. In other words, Energy Fuels appears deeply undervalued by this methodology, offering significant potential upside if these projections materialize.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Energy Fuels is undervalued by 83.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Energy Fuels Price vs Book (P/B)

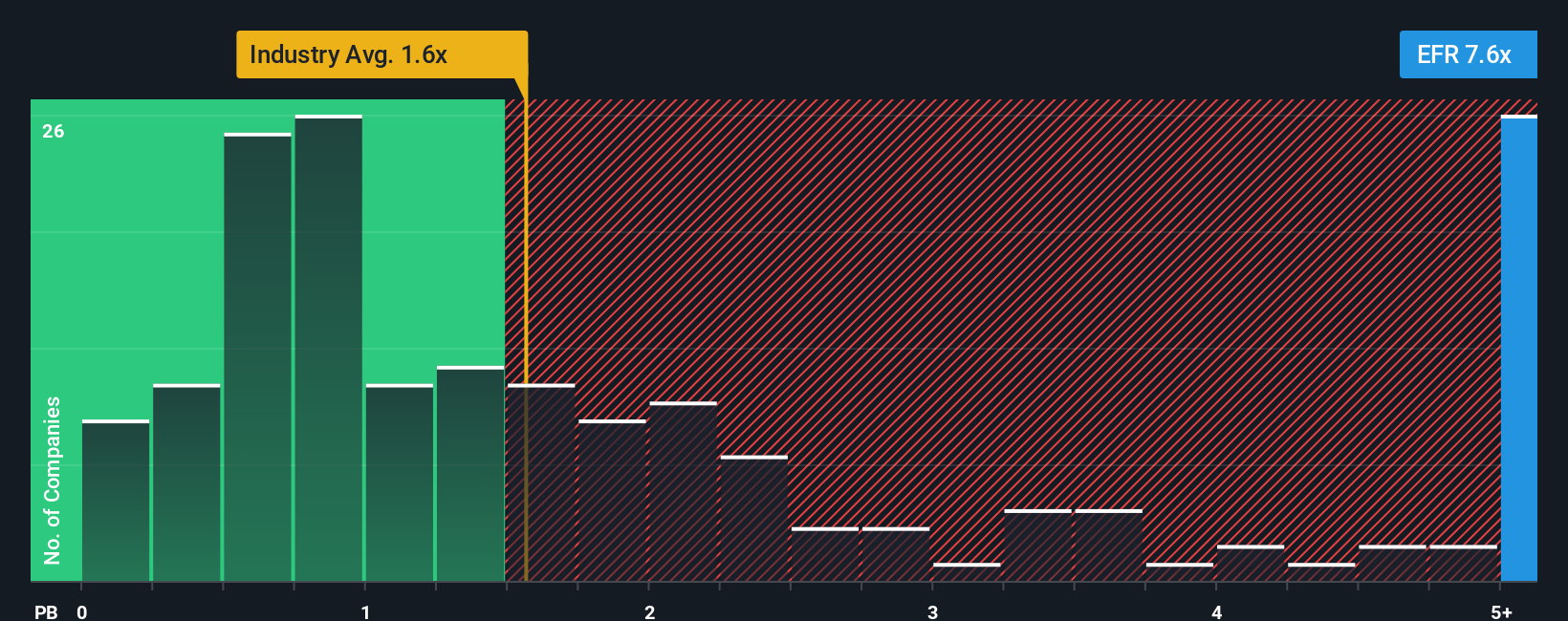

The Price-to-Book (P/B) ratio is a common tool for valuing companies, especially those that are not currently posting large profits. It works well in capital-intensive sectors like Oil and Gas, where assets on the balance sheet are significant and where profits can swing dramatically from year to year. For stable, established companies, a lower P/B ratio often signals value, but high ratios might be justified for companies with strong growth prospects or unique assets.

Currently, Energy Fuels trades at a P/B ratio of 6.06x. This is not only above the Oil and Gas industry average of 1.52x, but also higher than its closest peer group average of 4.53x. This suggests the market is ascribing a premium, possibly due to expectations regarding its rare earths strategy and projected growth. Comparing to industry or peer averages gives a baseline, but does not capture unique elements such as the company’s above-average growth or higher risk profile.

This is where Simply Wall St's proprietary “Fair Ratio” comes in. Unlike basic peer or industry comparisons, the Fair Ratio weighs Energy Fuels' earnings growth, sector prospects, profit margins, risks and market cap to estimate what a reasonable P/B ratio truly is for this business. By using this more nuanced approach, investors can look beyond short-term sentiment and better judge fair value.

Given that the Fair Ratio for Energy Fuels is closely aligned with its current P/B multiple, the stock appears to be priced about right on this measure. The market appears to be fairly reflecting both its future growth prospects and its associated risks.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Energy Fuels Narrative

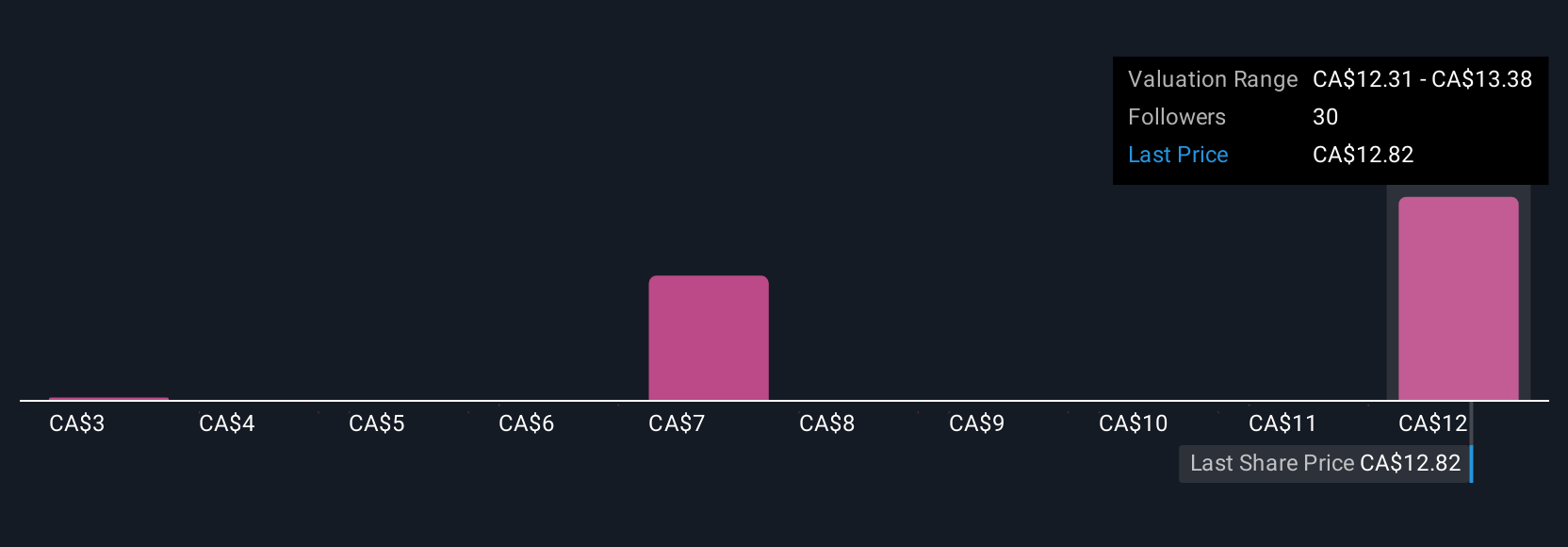

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your investment story for a company; it is how you connect the numbers to assumptions about future sales, profits, margins and risks, resulting in your own fair value forecast.

On Simply Wall St's Community page, millions of investors publish and review Narratives, making it easy to see a wide range of perspectives that tie a business' story directly to a financial forecast and fair value. These Narratives help you decide when to buy or sell by clearly showing the difference between Fair Value and the current share price. Since they are updated dynamically whenever news or earnings arrive, you are always basing decisions on the latest information.

For instance, among Energy Fuels Narratives, one investor might see aggressive growth from rare earths and forecast a fair value above CA$20.85, while another, wary of project funding risks, sets a much lower figure at CA$14.50. Comparing these stories side by side lets you easily check what assumptions drive each view and decide which scenario you believe in most, all with minimal effort or complexity.

Do you think there's more to the story for Energy Fuels? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Fuels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EFR

Energy Fuels

Engages in the exploration, recovery, recycling, exploration, operation, development, permitting, evaluation, and sale of uranium mineral properties in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives