- Canada

- /

- Oil and Gas

- /

- TSX:EFR

Energy Fuels (TSX:EFR) Is Up 41.8% After First US Mined Dysprosium Oxide Production Milestone Has The Bull Case Changed?

Reviewed by Simply Wall St

- Earlier this week, Energy Fuels announced it is producing high-purity Dysprosium oxide at pilot scale from mined ores at its White Mesa Mill in Utah, marking the only commercial heavy rare earth oxide production from mined sources in the United States.

- This achievement highlights Energy Fuels' unique position in U.S. supply chains for critical minerals essential to advanced manufacturing, including technology and defense applications.

- We'll explore how the successful Dysprosium oxide production milestone supports Energy Fuels' push to diversify and expand critical mineral output.

Energy Fuels Investment Narrative Recap

To own Energy Fuels, investors must believe in the company's ability to capitalize on U.S. demand for critical minerals while scaling rare earth and uranium production. The initiation of high-purity Dysprosium oxide output at pilot scale spotlights progress on the rare earth side, but it does not materially shift the company’s most important short-term catalyst: sustained uranium production and successful inventory monetization. The primary risk remains potential cash flow pressure from deferring uranium sales amid uncertain market prices.

Among recent developments, strong uranium output at the Pinyon Plain mine, with over 638,700 pounds mined in the second quarter, reinforces Energy Fuels' core catalyst, operational uranium production supporting near-term revenue growth. This underpins the company’s goal of balancing critical mineral expansion with dependable uranium business, which remains essential for cash generation and financial stability.

However, against these production milestones, investors should be aware that if uranium spot prices persist at low levels, the company’s decision to hold inventory rather than sell could...

Read the full narrative on Energy Fuels (it's free!)

Energy Fuels' narrative projects $327.3 million revenue and $90.3 million earnings by 2028. This requires 67.5% yearly revenue growth and a $168 million increase in earnings from the current -$77.7 million.

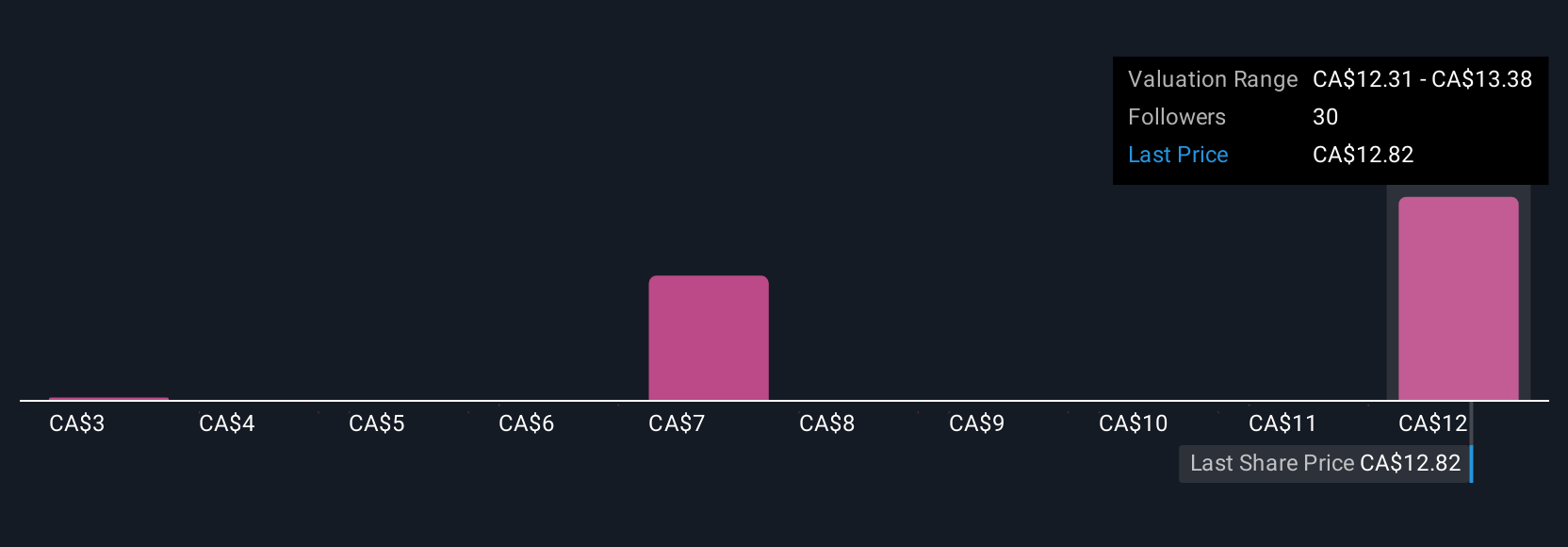

Uncover how Energy Fuels' forecasts yield a CA$13.38 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community range widely, from CA$2.73 to CA$13.38 per share. Investors see paths for both upside and downside, yet cash flow constraints from delayed uranium sales could have broader impacts on Energy Fuels’ future financial flexibility, highlighting why it is important to review multiple viewpoints.

Build Your Own Energy Fuels Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Energy Fuels research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Energy Fuels research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Energy Fuels' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Fuels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EFR

Energy Fuels

Engages in the exploration, recovery, recycling, exploration, operation, development, permitting, evaluation, and sale of uranium mineral properties in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives