- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

Canadian Natural Resources (TSX:CNQ) Reports Strong Q2 Earnings and Declares $0.525 Dividend, Signaling Growth

Reviewed by Simply Wall St

Strengths: Core Advantages Driving Sustained Success For Canadian Natural Resources

Canadian Natural Resources (CNQ) has demonstrated robust operational performance, with production reaching 1.29 million BOEs per day, an 8% increase compared to Q2 2023. The financial health of the company is evident, generating adjusted funds flow of $3.6 billion and adjusted net earnings from operations of $1.9 billion, as highlighted by CFO Mark Stainthorpe. The company has also shown strong returns to shareholders, distributing $1.1 billion in dividends and repurchasing $800 million in shares. Cost efficiency is another strength, with primary heavy oil operating costs down 12% from the previous year. CNQ's diverse portfolio of long-life, low-decline assets further supports its stability and growth potential.

Additionally, CNQ is considered good value based on its Price-To-Earnings Ratio (12.5x) compared to the peer average (16.6x). The stock is trading at CA$45.25, significantly below its estimated fair value of CA$81.55, indicating potential for substantial upside. Analysts are in agreement, with a target price more than 20% higher than the current share price.

Weaknesses: Critical Issues Affecting Canadian Natural Resources' Performance and Areas For Growth

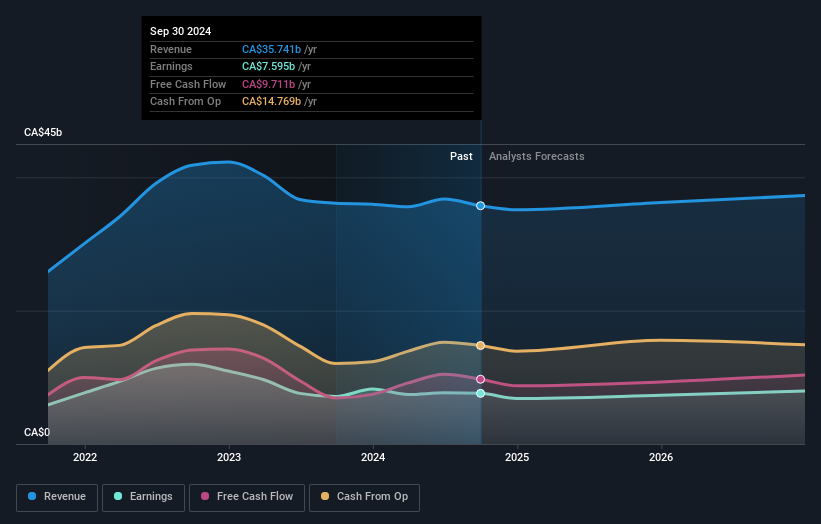

Despite its strengths, CNQ faces some critical issues. The company's Pelican Lake production has declined by 5% from the previous year, and operating costs in this segment have increased by 4%. Additionally, CNQ's Price-To-Earnings Ratio (12.5x) is higher than the Canadian Oil and Gas industry average (11.7x), suggesting it is expensive relative to its industry peers. The company's revenue is forecast to decline by 1.6% per year over the next three years, and its earnings growth of 1.1% per year is expected to lag behind the Canadian market's 14.9% annual growth rate. These factors highlight areas where CNQ needs to improve to maintain its competitive edge.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

CNQ has several opportunities for growth. The company is targeting to drill a SAGD pad at Jackfish in the second half of 2024, with production expected to commence in Q3 2025. The commissioning of the TMX pipeline represents a significant market expansion opportunity. CNQ is also exploring enhanced oil recovery techniques, with early results showing a 20% reduction in solvent injection. Long-term production growth projects, such as the naphtha recover tailings treatment project, further bolster CNQ's future prospects. These initiatives could enhance CNQ's market position and capitalize on emerging opportunities in the oil and gas sector.

Threats: Key Risks and Challenges That Could Impact Canadian Natural Resources' Success

CNQ faces several threats that could impact its success. Market pricing volatility remains a concern, as highlighted by CFO Mark Stainthorpe. Regulatory uncertainty, particularly regarding fiscal regimes for CO2 emissions capture, poses a significant risk. The company also faces competition and market risks, with additional Enbridge debottlenecking and the TMX pipeline being critical to future volume capture. Economic factors, such as weaker product margins in the U.S., could also impact demand. These external factors threaten CNQ's growth and market share, requiring strategic management to navigate these challenges effectively.

Conclusion

Canadian Natural Resources has shown strong operational performance and financial health, with significant returns to shareholders and cost efficiency gains. However, challenges such as declining Pelican Lake production and higher operating costs in that segment, combined with a higher Price-To-Earnings Ratio compared to the Canadian Oil and Gas industry average, indicate areas for improvement. The company's strategic initiatives, including new drilling projects and enhanced oil recovery techniques, present substantial growth opportunities. While market pricing volatility and regulatory uncertainties pose risks, the stock's current trading price below its estimated fair value suggests potential for significant upside, making it a compelling investment despite the competitive pressures and forecasted revenue decline.

Taking Advantage

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives