Key Insights

- Cardinal Energy's Annual General Meeting to take place on 10th of May

- Salary of CA$350.0k is part of CEO M. Ratushny's total remuneration

- The total compensation is similar to the average for the industry

- Cardinal Energy's EPS grew by 30% over the past three years while total shareholder return over the past three years was 161%

It would be hard to discount the role that CEO M. Ratushny has played in delivering the impressive results at Cardinal Energy Ltd. (TSE:CJ) recently. Coming up to the next AGM on 10th of May, shareholders would be keeping this in mind. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is not extravagant.

See our latest analysis for Cardinal Energy

Comparing Cardinal Energy Ltd.'s CEO Compensation With The Industry

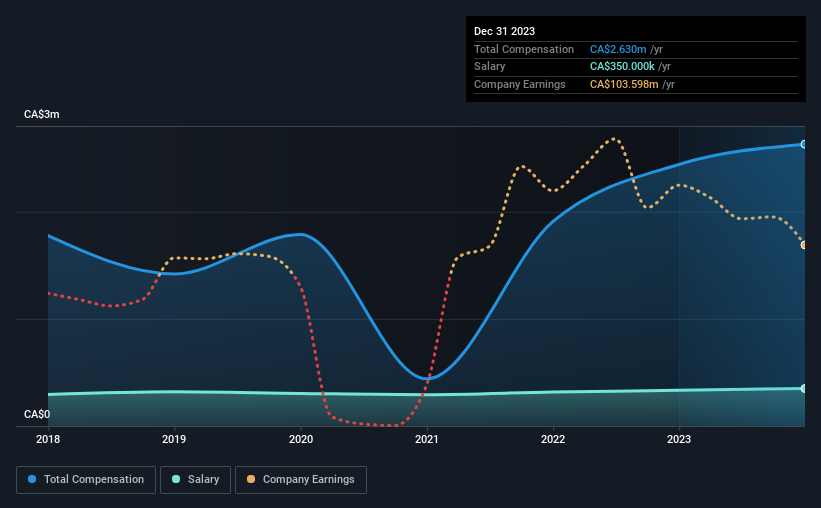

According to our data, Cardinal Energy Ltd. has a market capitalization of CA$1.1b, and paid its CEO total annual compensation worth CA$2.6m over the year to December 2023. That's a fairly small increase of 7.8% over the previous year. We think total compensation is more important but our data shows that the CEO salary is lower, at CA$350k.

In comparison with other companies in the Canadian Oil and Gas industry with market capitalizations ranging from CA$547m to CA$2.2b, the reported median CEO total compensation was CA$2.5m. This suggests that Cardinal Energy remunerates its CEO largely in line with the industry average. Moreover, M. Ratushny also holds CA$28m worth of Cardinal Energy stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CA$350k | CA$333k | 13% |

| Other | CA$2.3m | CA$2.1m | 87% |

| Total Compensation | CA$2.6m | CA$2.4m | 100% |

Speaking on an industry level, nearly 37% of total compensation represents salary, while the remainder of 63% is other remuneration. It's interesting to note that Cardinal Energy allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Cardinal Energy Ltd.'s Growth

Over the past three years, Cardinal Energy Ltd. has seen its earnings per share (EPS) grow by 30% per year. It saw its revenue drop 19% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Cardinal Energy Ltd. Been A Good Investment?

Boasting a total shareholder return of 161% over three years, Cardinal Energy Ltd. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 2 warning signs for Cardinal Energy you should be aware of, and 1 of them is potentially serious.

Important note: Cardinal Energy is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CJ

Cardinal Energy

Engages in the acquisition, exploration, development, optimization, and production of petroleum and natural gas in the provinces of Alberta, British Columbia, and Saskatchewan in Canada.

Adequate balance sheet and fair value.

Market Insights

Community Narratives