- Canada

- /

- Oil and Gas

- /

- TSX:CCO

Cameco (TSX:CCO) Reports CAD 70 Million Net Income Turnaround

Reviewed by Simply Wall St

Cameco (TSX:CCO) recently reported a robust turnaround in its first-quarter earnings, with net income surging to CAD 70 million compared to a loss the previous year. This strong financial performance was underscored by increased uranium and fuel services production volumes. Additionally, the election of two new board members may signify a focus on solidifying leadership. Over the past month, Cameco's share price climbed by 38% despite the broader market's 2% decline over the last week. These developments appear to have countered the broader market's recent downturn, reinforcing investor confidence in the company's trajectory.

Buy, Hold or Sell Cameco? View our complete analysis and fair value estimate and you decide.

The recent surge in Cameco's share price, coupled with a significant rebound in earnings, aligns well with the company's anticipated growth trajectory. This momentum is reflective of bullish market conditions bolstered by increased uranium production and strategic leadership changes. Over the past five years, Cameco's total shareholder return was very large at 447.35%, showcasing its robust long-term performance. However, this impressive return contrasts with the Canadian Oil and Gas industry's past year, where Cameco outperformed with a positive return against the industry's 0.5% decline.

Cameco's 38% share price increase this month indicates strong market confidence, partially driven by the company's strategic positioning in emerging markets like Poland and Ukraine. This positions Cameco to potentially capitalize on rising energy security concerns. Furthermore, enhanced operational efficiencies at existing uranium facilities and a strong pipeline of long-term contracts are expected to support revenue and earnings growth, mitigating market volatility risks.

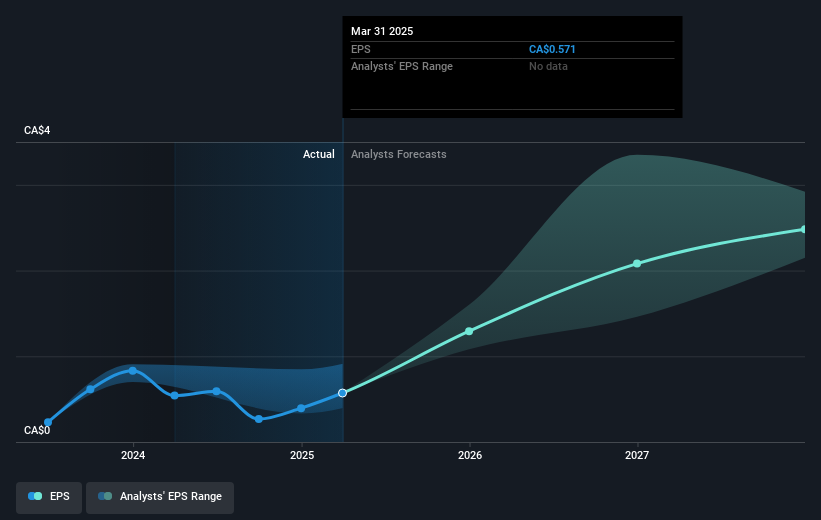

Despite these optimistic signs, potential U.S. tariffs and production uncertainties remain as threats to Cameco's revenue projections. The current share price remains close to the consensus price target of CA$82.16, suggesting room for upside if earnings and revenue forecasts are met. Analysts predict Cameco's earnings to significantly grow, potentially reaching CA$1.1 billion by 2028, with an implied price-to-earnings ratio that needs to adjust from 159.2x to 38.0x to support this valuation. Investors are encouraged to assess these projections in line with their own analysis to determine future company value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives