- Canada

- /

- Oil and Gas

- /

- TSX:CCO

Cameco (TSX:CCO): Assessing Valuation After Strong Annual Results and Rising Investor Interest

Reviewed by Kshitija Bhandaru

See our latest analysis for Cameco.

Cameco’s shares have been climbing, with a notable 56% year-to-date share price return, which hints at renewed optimism around uranium demand and the company’s role in the energy transition. Meanwhile, its five-year total shareholder return of 833% shows just how much long-term investors have benefited from sticking with the stock through market cycles.

If you’re inspired by this kind of sustained momentum, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With Cameco’s strong returns and consistent financial growth, some investors may wonder if shares are still undervalued or if the recent rally has fully accounted for future prospects. Is there still room to buy, or is the market already one step ahead?

Most Popular Narrative: Fairly Valued

Cameco’s widely followed narrative sees the fair value at $116.94, nearly matching the latest closing price of $117.50. This suggests current prices are closely aligned with consensus expectations, but the underlying financial assumptions shape a compelling story for what could come next.

Cameco stands to benefit from a global wave of new nuclear construction, driven by heightened government policy support, net-zero emission mandates, and growing energy security concerns. These factors are likely to accelerate demand for uranium and nuclear fuel and could directly support higher long-term revenues.

Think this price only tells half the story? The valuation is built on ambitious revenue gains, margin expansion, and outsized future profit expectations. Want to know which bold numbers are driving this call and why analyst models demand higher multiples than most competitors? Dig deeper to uncover the financial engine that powers the consensus fair value.

Result: Fair Value of $116.94 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing operational challenges or project delays could quickly shift the outlook. This reminds investors that even strong narratives face real-world tests.

Find out about the key risks to this Cameco narrative.

Another View: Market Multiples Tell a Different Story

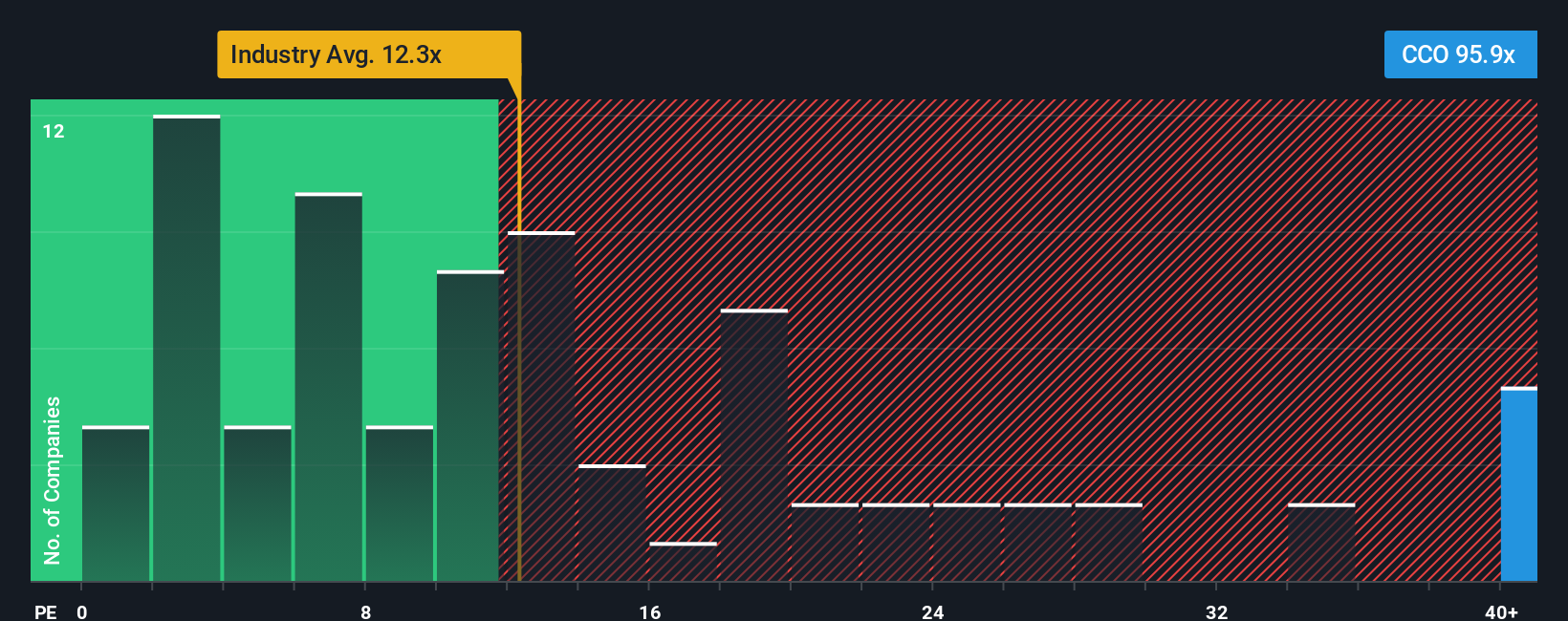

Looking at how Cameco is valued compared to other companies, its price-to-earnings ratio stands at 95.9 times earnings, which is dramatically higher than the industry average of 12.6 times and the peer average of 15.2 times. Even the fair ratio is just 19.1. This suggests investors are paying a big premium, but is that optimism justified or could it leave shares vulnerable if growth expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cameco for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cameco Narrative

If you want to look at the numbers from a fresh perspective or build your own case, you can create your personal take in under three minutes with Do it your way.

A great starting point for your Cameco research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities in the market move fast. Stay ahead and uncover the next potential winner with screener picks trusted by knowledgeable investors for smarter portfolio growth.

- Maximize your income by tapping into these 19 dividend stocks with yields > 3%, which offers impressive yields and helps balance any portfolio with reliable cash flow.

- Spot early movers in the booming world of artificial intelligence by checking out these 24 AI penny stocks, where rapid innovation meets significant growth potential.

- Get ahead of the crowd and track these 896 undervalued stocks based on cash flows, which might be priced below their fair value, giving you an edge before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives