- Canada

- /

- Oil and Gas

- /

- TSX:BTE

Baytex Energy (TSX:BTE) Valuation in Focus After Record Well Results and Analyst Upgrades

Reviewed by Simply Wall St

Baytex Energy (TSX:BTE) has attracted investor attention after announcing record results in its Pembina Duvernay wells and strong heavy oil returns from its Eagle Ford assets. The company’s latest quarter was notable not only for its headline numbers but also for two successful refracturing projects that extended production life and boosted capital efficiency. Following these updates, several analysts have voiced renewed confidence in Baytex and are encouraging investors to take a fresh look at what the company may have in store for the rest of the year.

This series of positive developments comes at an interesting time for Baytex’s shares. The stock has rallied 5% over the past day and jumped nearly 30% in the past three months, which marks a sharp turnaround after declining more than 38% over the past year. For longer-term holders, the experience has been mixed, with the stock gaining over three times its value in five years but posting significant losses over shorter periods. The recent rebound suggests that investors are either warming up to the growth story or rethinking the risks after several challenging quarters.

With momentum building and fresh operational achievements in focus, the key question is whether the market is undervaluing Baytex’s prospects or if anticipated growth has already been factored into the share price.

Most Popular Narrative: 25.3% Undervalued

According to community narrative, Baytex Energy shares are considered undervalued by 25.3% at the current price, based on future earnings, potential growth, and prevailing risks. The analysis uses a discount rate of 5.95% to estimate fair value and draws on several company-specific catalysts and headwinds.

*Baytex Energy's continuous improvement in drilling and completion efficiencies, particularly in the Eagle Ford and Pembina Duvernay plays, is expected to lead to improved capital costs and better production performance. This will likely impact revenue and net margins positively.*

Wondering how a traditional energy company achieves such a high valuation? The story focuses on expectations for significant changes in earnings, revenue, and future profits. Can Baytex’s operations and financial plans meet these expectations? Explore the bold forecasts underlying this narrative’s price target—it may surprise even seasoned investors.

Result: Fair Value of $3.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, tariff uncertainty and a potential drop in oil prices remain factors that could quickly change the outlook for Baytex’s share performance.

Find out about the key risks to this Baytex Energy narrative.Another View: Discounted Cash Flow Model

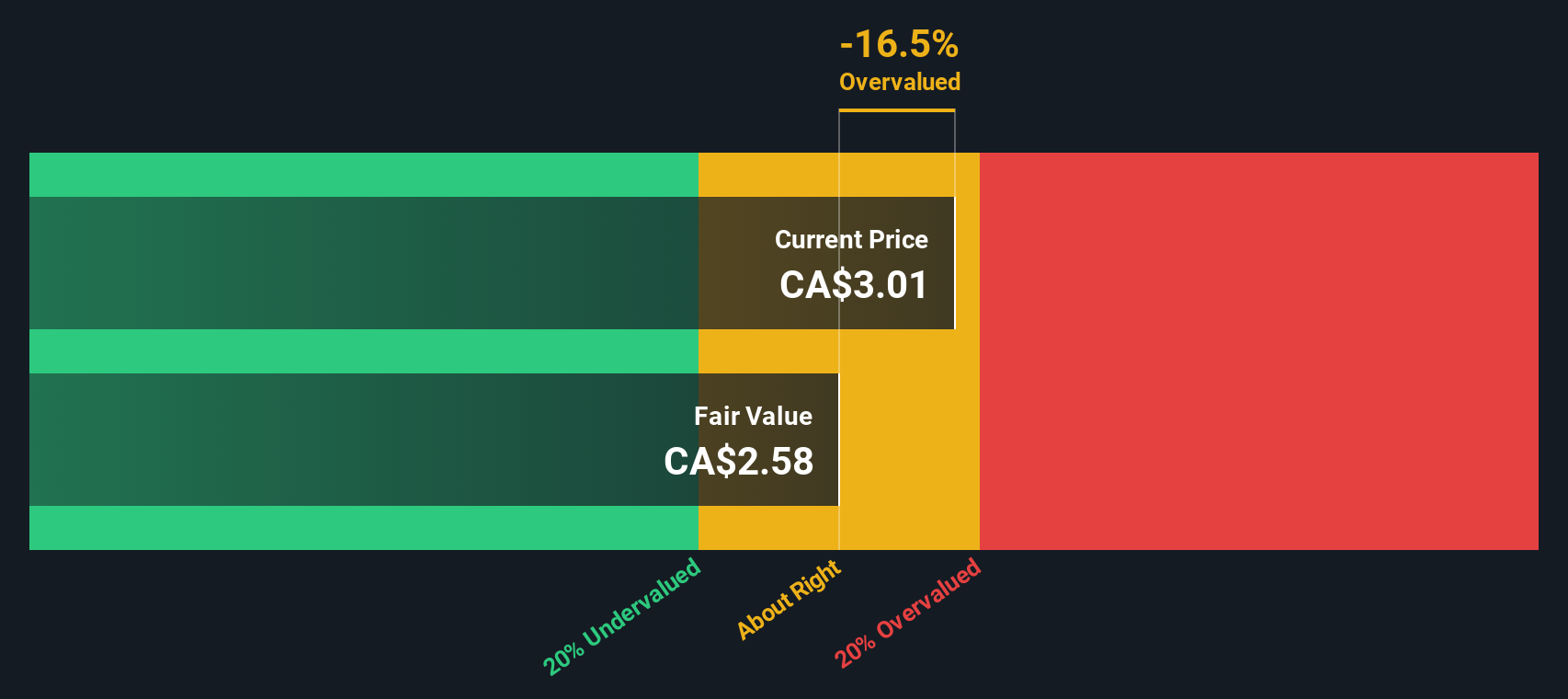

While community sentiment points to significant undervaluation, our DCF model tells a different story and suggests the current share price may actually be above Baytex’s estimated fair value. Could the market know something that analysts do not?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Baytex Energy Narrative

If you have a different perspective on Baytex or want to dig deeper into the numbers yourself, you can put together your own narrative in just a few minutes and do it your way.

A great starting point for your Baytex Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Angles?

Smart investors keep their options open and never settle for just one opportunity. Expand your horizon with fresh ideas beyond Baytex Energy. Here are three compelling avenues you can pursue right now. Make your next move before the window closes and uncover new potential for your portfolio:

- Target reliable income by scanning high-yield opportunities with dividend stocks with yields > 3% to find companies that consistently deliver dividend returns above 3%.

- Uncover cutting-edge potential in the healthcare sector by checking out healthcare AI stocks for innovative businesses shaping the future with artificial intelligence in medicine.

- Tap into the promise of undervalued shares by using undervalued stocks based on cash flows to identify stocks with strong cash flow and attractive pricing that the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baytex Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BTE

Baytex Energy

An energy company, engages in the acquisition, development, and production of crude oil and natural gas in the Western Canadian Sedimentary Basin and in the Eagle Ford, the United States.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives