- Canada

- /

- Oil and Gas

- /

- TSX:BTE

Baytex Energy (TSX:BTE) Reports CAD 791 Million Revenue In Strong Earnings

Reviewed by Simply Wall St

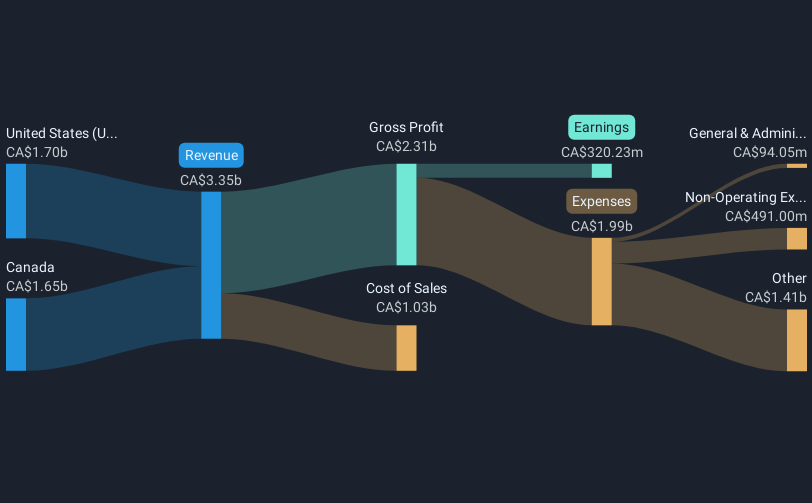

Baytex Energy (TSX:BTE) recently announced strong earnings, with a revenue of CAD 791 million and a significant shift from a net loss to a net income of CAD 70 million. Despite these positive earnings, the company's share price remained flat over the past month. This period saw mixed market conditions, with major indexes experiencing slight declines following a stretch of gains. Baytex's production results showed declines across various oil and gas categories, which may have exerted minimal pressure on its stock performance. Meanwhile, market-wide optimism, driven by relief over tariffs, likely provided some counterweight against negative production news.

We've identified 4 risks for Baytex Energy (1 is a bit concerning) that you should be aware of.

The recent strong earnings announced by Baytex Energy, with a net income of CA$70 million, present a potential shift in narrative as the company continues to enhance operational efficiencies, particularly in its Eagle Ford and Pembina Duvernay plays. However, mixed market conditions and production declines may have dampened immediate share price reactions. Despite this, the company's long-term performance over the past five years has been remarkable, with total returns, including share price and dividends, reaching a very large increase of 477.66%. This significant growth comparison to an underperformance against the Canadian Oil and Gas industry, which had a 1.2% decline over the past year, highlights differing investor reactions in varying time frames.

Looking ahead, the company's focus on operational improvements is poised to impact revenue and earnings positively. Despite this potential, analysts expect a revenue decline of 2.9% annually over the next three years, alongside earnings forecasts that indicate the company may not become profitable in this period. With a consensus price target of CA$4.38 and the current share price at CA$2.22, the potential 49.3% upside suggests analysts see more value than the market currently prices in. However, this assumes risks like tariff impacts and exchange rate fluctuations do not materialize adversely. As investors weigh these factors, the share price's proximity to the target remains a significant focus area for potential valuation adjustments.

Explore Baytex Energy's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baytex Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BTE

Baytex Energy

An energy company, engages in the acquisition, development, and production of crude oil and natural gas in the Western Canadian Sedimentary Basin and in the Eagle Ford, the United States.

Acceptable track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives