The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Athabasca Oil (TSE:ATH), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Athabasca Oil with the means to add long-term value to shareholders.

See our latest analysis for Athabasca Oil

How Fast Is Athabasca Oil Growing Its Earnings Per Share?

Over the last three years, Athabasca Oil has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Athabasca Oil's EPS skyrocketed from CA$0.77 to CA$1.11, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 44%.

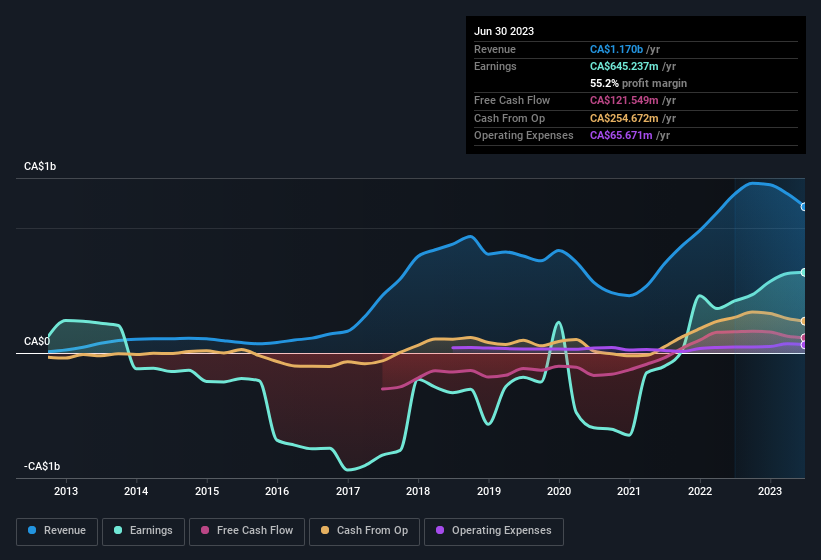

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Unfortunately, Athabasca Oil's revenue dropped 8.0% last year, but the silver lining is that EBIT margins improved from 12% to 16%. While not disastrous, these figures could be better.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Athabasca Oil.

Are Athabasca Oil Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Even though some insiders sold down their holdings, their actions speak louder than words with CA$603k more invested than sold by people who know they company best. This overall confidence in the company at current the valuation signals their optimism. It is also worth noting that it was Independent Chairman of the Board Ronald Eckhardt who made the biggest single purchase, worth CA$193k, paying CA$2.75 per share.

The good news, alongside the insider buying, for Athabasca Oil bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at CA$35m. This considerable investment should help drive long-term value in the business. Even though that's only about 1.7% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is Athabasca Oil Worth Keeping An Eye On?

For growth investors, Athabasca Oil's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. Before you take the next step you should know about the 1 warning sign for Athabasca Oil that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, Athabasca Oil isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ATH

Athabasca Oil

Engages in the exploration, development, and production of thermal and light oil resource plays in the Western Canadian Sedimentary Basin in Alberta, Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.