- Canada

- /

- Oil and Gas

- /

- TSX:MER

3 TSX Stocks Estimated To Be Undervalued For September 2024

Reviewed by Simply Wall St

The Canadian market experienced significant volatility in August, with a strong start and a subdued finish, ultimately recovering from an early-month dip of nearly 5%. As the economy continues to expand and inflation trends closer to target, investors are shifting their focus towards growth opportunities. In this context, identifying undervalued stocks can be crucial for capitalizing on potential gains during periods of market fluctuation.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$189.67 | CA$357.90 | 47% |

| Computer Modelling Group (TSX:CMG) | CA$12.74 | CA$22.26 | 42.8% |

| Alvopetro Energy (TSXV:ALV) | CA$5.04 | CA$9.00 | 44% |

| Kinaxis (TSX:KXS) | CA$147.32 | CA$279.54 | 47.3% |

| Obsidian Energy (TSX:OBE) | CA$9.26 | CA$18.08 | 48.8% |

| Africa Oil (TSX:AOI) | CA$2.06 | CA$3.66 | 43.8% |

| Calibre Mining (TSX:CXB) | CA$2.28 | CA$4.53 | 49.6% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| NFI Group (TSX:NFI) | CA$19.31 | CA$37.43 | 48.4% |

| NanoXplore (TSX:GRA) | CA$2.25 | CA$4.18 | 46.1% |

Let's uncover some gems from our specialized screener.

Africa Oil (TSX:AOI)

Overview: Africa Oil Corp., along with its subsidiaries, engages in oil and gas exploration and production in Kenya, Nigeria, and South Africa, with a market cap of CA$912.61 million.

Operations: Africa Oil Corp. generates revenue through its oil and gas exploration and production activities in Kenya, Nigeria, and South Africa.

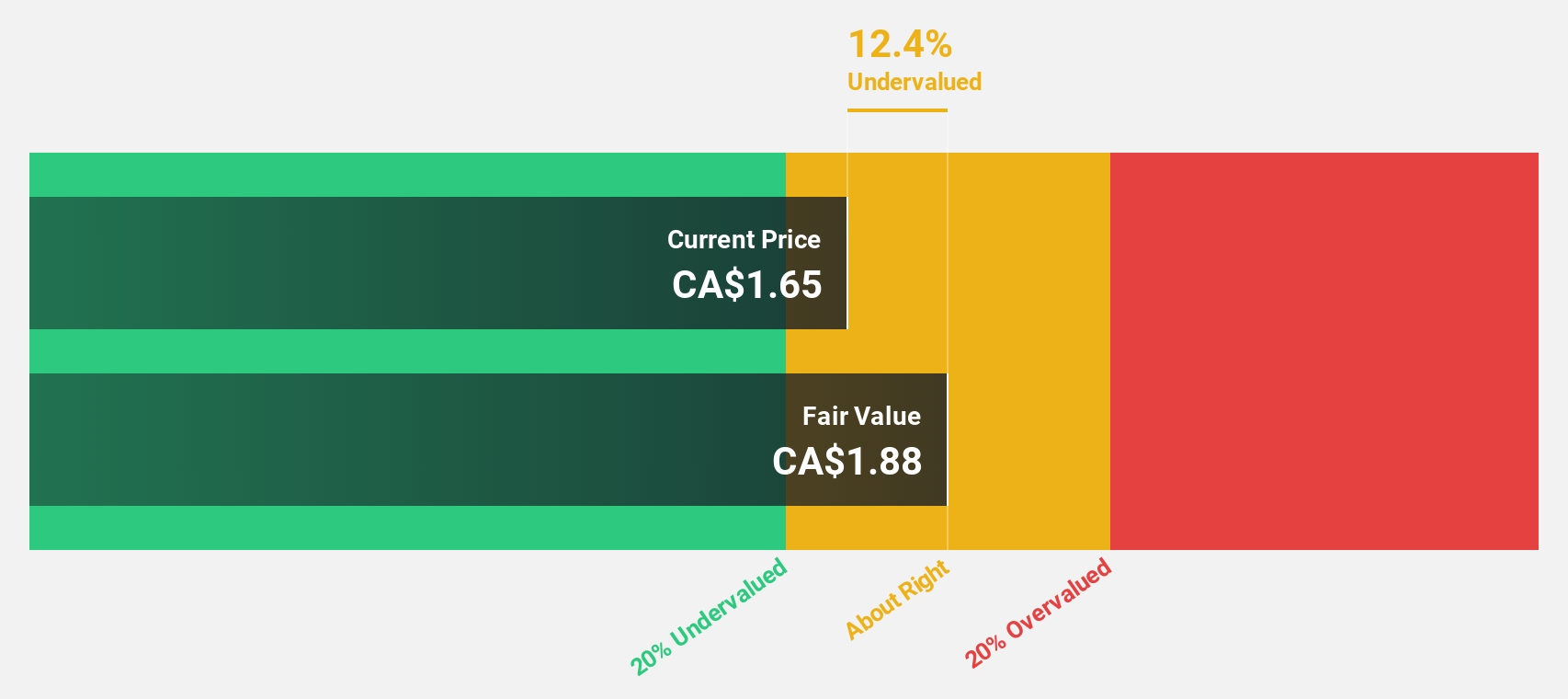

Estimated Discount To Fair Value: 43.8%

Africa Oil is trading at CA$2.06, significantly below its estimated fair value of CA$3.66, making it highly undervalued based on discounted cash flow analysis. Despite a challenging year with revenue dropping to US$16.9 million from US$210.5 million and net income falling sharply, the company is expected to become profitable within three years, with earnings forecasted to grow 62.75% annually and revenue projected to increase by 45.1% per year.

- Our expertly prepared growth report on Africa Oil implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Africa Oil with our comprehensive financial health report here.

B2Gold (TSX:BTO)

Overview: B2Gold Corp. is a gold producer with a market cap of CA$4.97 billion.

Operations: B2Gold Corp. generates revenue from three primary segments: Fekola Mine ($1.07 billion), Masbate Mine ($412.67 million), and Otjikoto Mine ($456.41 million).

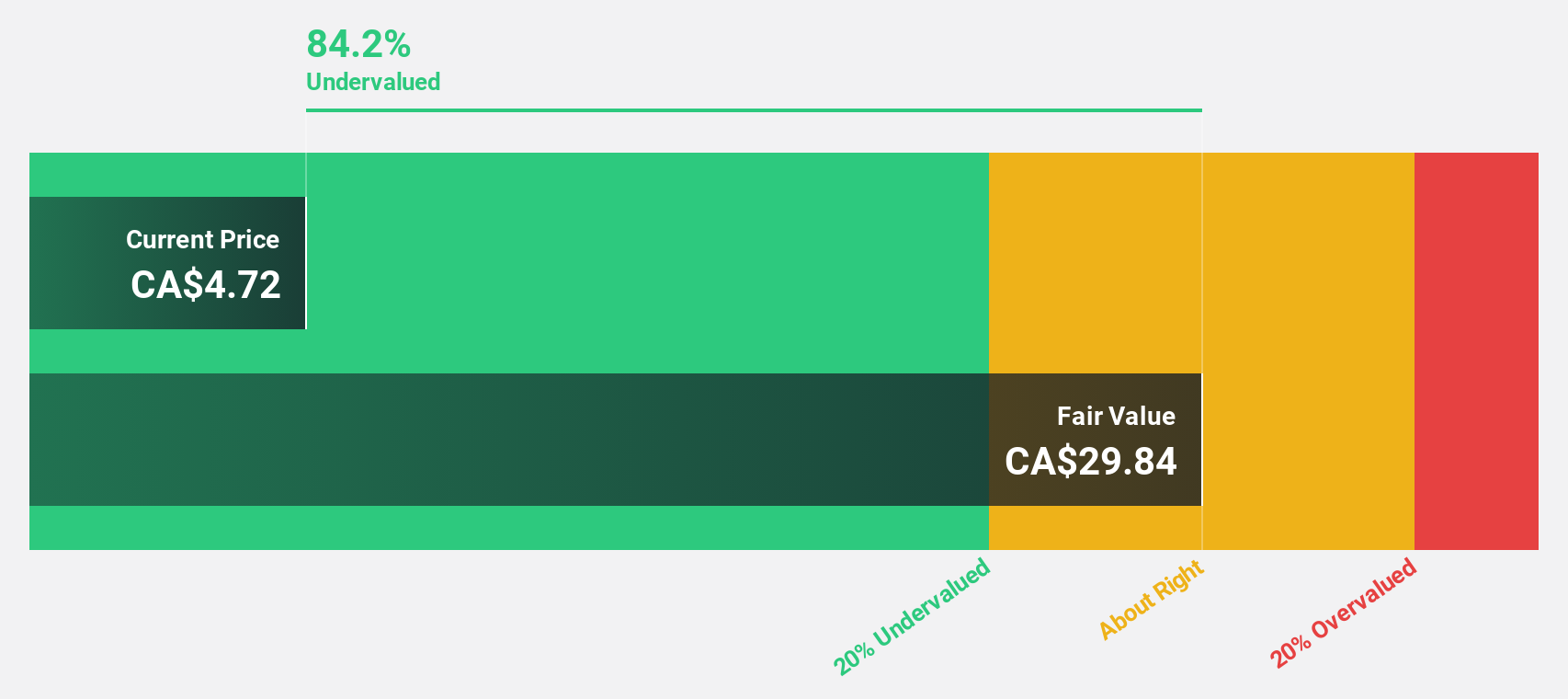

Estimated Discount To Fair Value: 10.8%

B2Gold, trading at CA$3.79, is undervalued based on its discounted cash flow analysis with a fair value estimate of CA$4.25. Despite recent impairments and lower production guidance for 2024 due to equipment issues, the company remains poised for future profitability with earnings expected to grow annually by 46.17%. However, the dividend yield of 5.69% is not well covered by earnings or free cash flows, which may be a concern for income-focused investors.

- Insights from our recent growth report point to a promising forecast for B2Gold's business outlook.

- Click here to discover the nuances of B2Gold with our detailed financial health report.

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc., with a market cap of CA$93.26 billion, acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally.

Operations: Revenue from Constellation Software Inc. primarily comes from its Software & Programming segment, generating $9.27 billion.

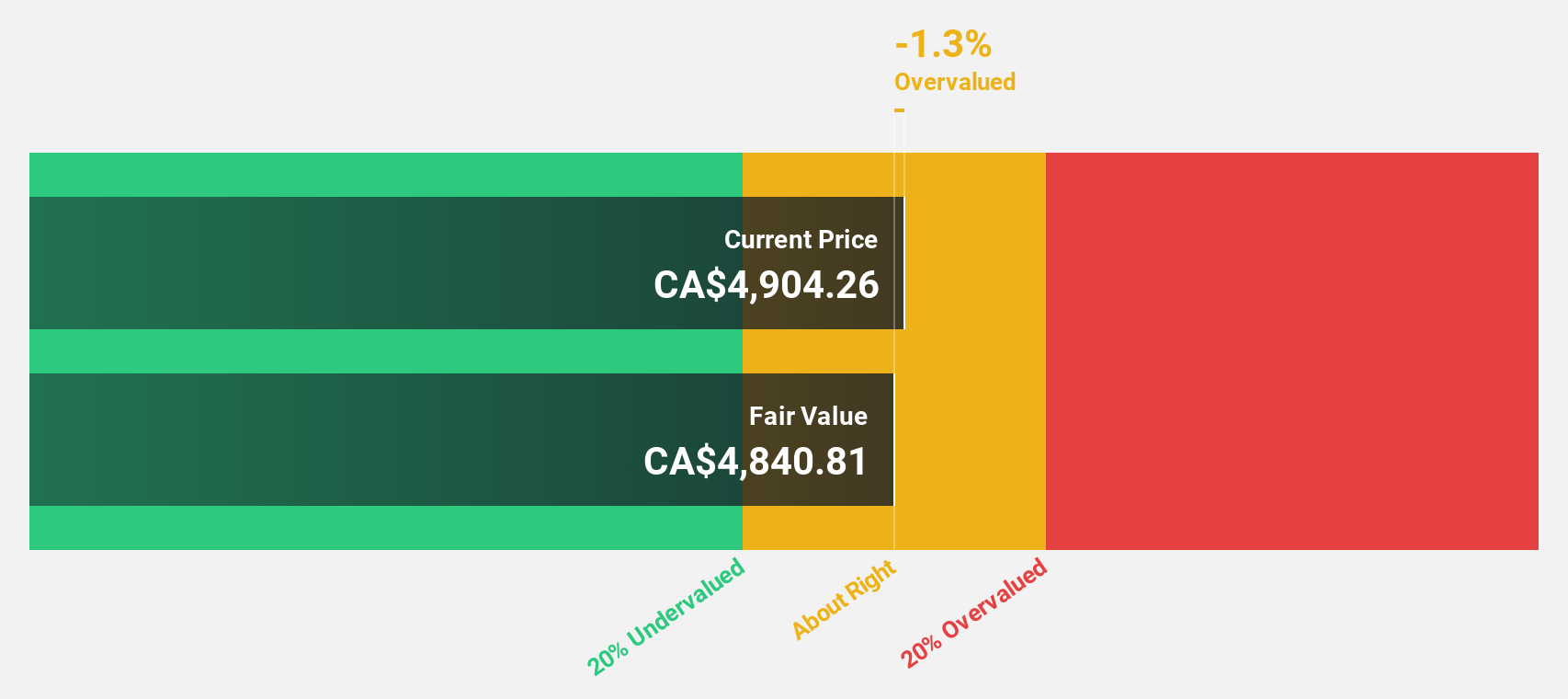

Estimated Discount To Fair Value: 20.5%

Constellation Software, trading at CA$4,400.69, is undervalued based on discounted cash flow analysis with a fair value estimate of CA$5,535.62. Recent earnings showed significant growth with Q2 revenue reaching US$2.47 billion and net income at US$177 million. Despite high debt levels and some insider selling, the company's earnings are forecast to grow significantly faster than the Canadian market over the next three years, supported by its recent business expansions like Omegro's launch.

- Our growth report here indicates Constellation Software may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Constellation Software.

Taking Advantage

- Get an in-depth perspective on all 30 Undervalued TSX Stocks Based On Cash Flows by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MER

Meren Energy

Operates as an oil and gas exploration and production company in Nigeria, Namibia, South Africa, and Equatorial Guinea.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives