- Canada

- /

- Oil and Gas

- /

- CNSX:XOP

Market Might Still Lack Some Conviction On Canadian Overseas Petroleum Limited (CSE:XOP) Even After 44% Share Price Boost

Those holding Canadian Overseas Petroleum Limited (CSE:XOP) shares would be relieved that the share price has rebounded 44% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 68% share price drop in the last twelve months.

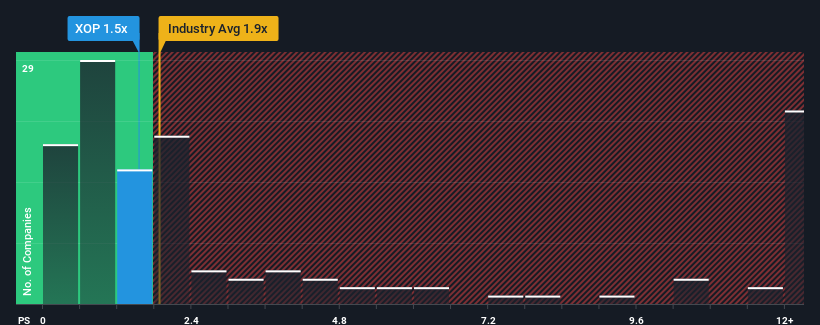

Although its price has surged higher, it's still not a stretch to say that Canadian Overseas Petroleum's price-to-sales (or "P/S") ratio of 1.5x right now seems quite "middle-of-the-road" compared to the Oil and Gas industry in Canada, where the median P/S ratio is around 1.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Canadian Overseas Petroleum

How Has Canadian Overseas Petroleum Performed Recently?

Canadian Overseas Petroleum hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Canadian Overseas Petroleum's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Canadian Overseas Petroleum?

The only time you'd be comfortable seeing a P/S like Canadian Overseas Petroleum's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 2.3% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 40% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 3.9%, which is noticeably less attractive.

In light of this, it's curious that Canadian Overseas Petroleum's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Canadian Overseas Petroleum's P/S

Canadian Overseas Petroleum appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, Canadian Overseas Petroleum's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 4 warning signs for Canadian Overseas Petroleum (3 make us uncomfortable!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:XOP

Canadian Overseas Petroleum

Engages in the identification, acquisition, exploration, and development of oil and natural gas reserves in the United States, Canada, the United Kingdom, Bermuda, and sub-Saharan Africa.

Slightly overvalued with imperfect balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026