We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So we'll take a look at whether insiders have been buying or selling shares in Torrent Capital Ltd. (CVE:TORR).

What Is Insider Buying?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, most countries require that the company discloses such transactions to the market.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

See our latest analysis for Torrent Capital

The Last 12 Months Of Insider Transactions At Torrent Capital

The insider, George Armoyan, made the biggest insider sale in the last 12 months. That single transaction was for CA$202k worth of shares at a price of CA$0.63 each. That means that an insider was selling shares at slightly below the current price (CA$0.95). We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. However, while insider selling is sometimes discouraging, it's only a weak signal. We note that the biggest single sale was 60% of George Armoyan's holding. George Armoyan was the only individual insider to sell shares in the last twelve months.

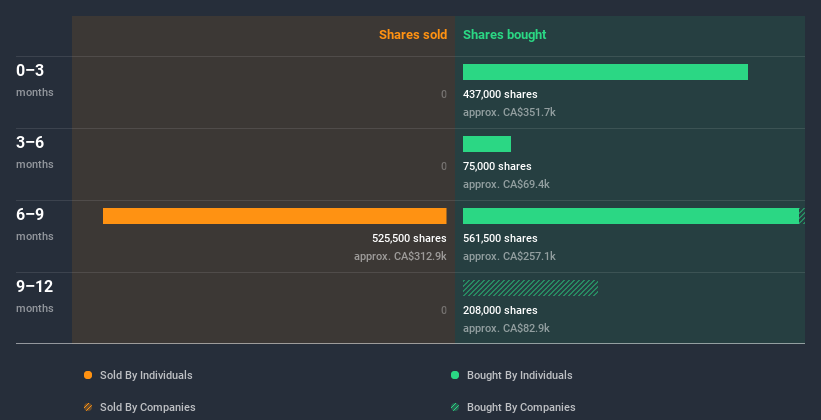

Happily, we note that in the last year insiders paid CA$689k for 1.03m shares. But they sold 525.50k shares for CA$320k. In the last twelve months there was more buying than selling by Torrent Capital insiders. The average buy price was around CA$0.67. To my mind it is good that insiders have invested their own money in the company. However, you should keep in mind that they bought when the share price was meaningfully below today's levels. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insiders at Torrent Capital Have Bought Stock Recently

Over the last three months, we've seen significant insider buying at Torrent Capital. Overall, two insiders shelled out CA$354k for shares in the company -- and none sold. This makes one think the business has some good points.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Insiders own 31% of Torrent Capital shares, worth about CA$7.1m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Torrent Capital Insiders?

It is good to see recent purchasing. We also take confidence from the longer term picture of insider transactions. Insiders likely see value in Torrent Capital shares, given these transactions (along with notable insider ownership of the company). While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. For example, Torrent Capital has 3 warning signs (and 1 which is significant) we think you should know about.

Of course Torrent Capital may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Torrent Capital, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Torrent Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:TORR

Torrent Capital

An investment company, primarily invests in the securities of public and private companies.

Flawless balance sheet slight.