- Canada

- /

- Diversified Financial

- /

- TSXV:MONT

Here's Why TIMIA Capital Corp.'s (CVE:TCA) CEO Might See A Pay Rise Soon

Shareholders will be pleased by the robust performance of TIMIA Capital Corp. (CVE:TCA) recently and this will be kept in mind in the upcoming AGM on 27 October 2021. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. In our analysis below, we discuss why we think the CEO compensation looks acceptable and the case for a raise.

See our latest analysis for TIMIA Capital

Comparing TIMIA Capital Corp.'s CEO Compensation With the industry

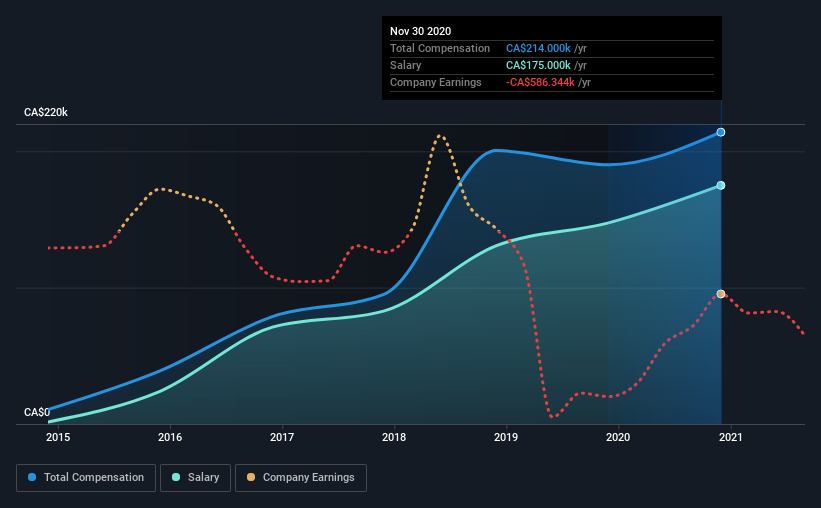

At the time of writing, our data shows that TIMIA Capital Corp. has a market capitalization of CA$23m, and reported total annual CEO compensation of CA$214k for the year to November 2020. Notably, that's an increase of 13% over the year before. We note that the salary portion, which stands at CA$175.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below CA$246m, reported a median total CEO compensation of CA$339k. That is to say, Mike Walkinshaw is paid under the industry median. What's more, Mike Walkinshaw holds CA$1.9m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$175k | CA$148k | 82% |

| Other | CA$39k | CA$43k | 18% |

| Total Compensation | CA$214k | CA$190k | 100% |

On an industry level, roughly 19% of total compensation represents salary and 81% is other remuneration. It's interesting to note that TIMIA Capital pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

TIMIA Capital Corp.'s Growth

Over the last three years, TIMIA Capital Corp. has shrunk its earnings per share by 13% per year. In the last year, its revenue is up 30%.

The decrease in EPS could be a concern for some investors. On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has TIMIA Capital Corp. Been A Good Investment?

Boasting a total shareholder return of 154% over three years, TIMIA Capital Corp. has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The company's overall performance, while not bad, could be better. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 6 warning signs for TIMIA Capital (1 can't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking to trade Montfort Capital, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:MONT

Montfort Capital

Acquires, manages, and builds companies that delivers private credit to diversified markets in North America.

Low and slightly overvalued.