- Canada

- /

- Capital Markets

- /

- TSXV:NFD.A

Investors Appear Satisfied With Northfield Capital Corporation's (CVE:NFD.A) Prospects

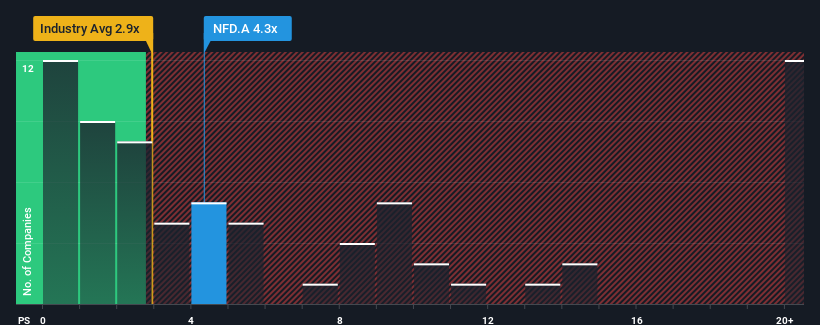

Northfield Capital Corporation's (CVE:NFD.A) price-to-sales (or "P/S") ratio of 4.3x may not look like an appealing investment opportunity when you consider close to half the companies in the Capital Markets industry in Canada have P/S ratios below 2.9x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Northfield Capital

How Has Northfield Capital Performed Recently?

Recent times have been quite advantageous for Northfield Capital as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Northfield Capital, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Northfield Capital's Revenue Growth Trending?

In order to justify its P/S ratio, Northfield Capital would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 77%. Still, revenue has fallen 23% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 71% shows the industry is even less attractive on an annualised basis.

In light of this, it's understandable that Northfield Capital's P/S sits above the majority of other companies. Nonetheless, there's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does Northfield Capital's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite experiencing declining revenues, Northfield Capital has been able to maintain its high P/S off the back of its recentthree-year revenue not being as bad as the forecasts for a struggling industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under any additional threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Otherwise, it's hard to see the share price falling strongly in the near future if its outlook remains more positive than the rest of its peers.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Northfield Capital (2 are significant) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Northfield Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:NFD.A

Excellent balance sheet slight.

Market Insights

Community Narratives