- Canada

- /

- Capital Markets

- /

- TSXV:LPC

Lorne Park Capital Partners (CVE:LPC) Will Pay A Dividend Of CA$0.008

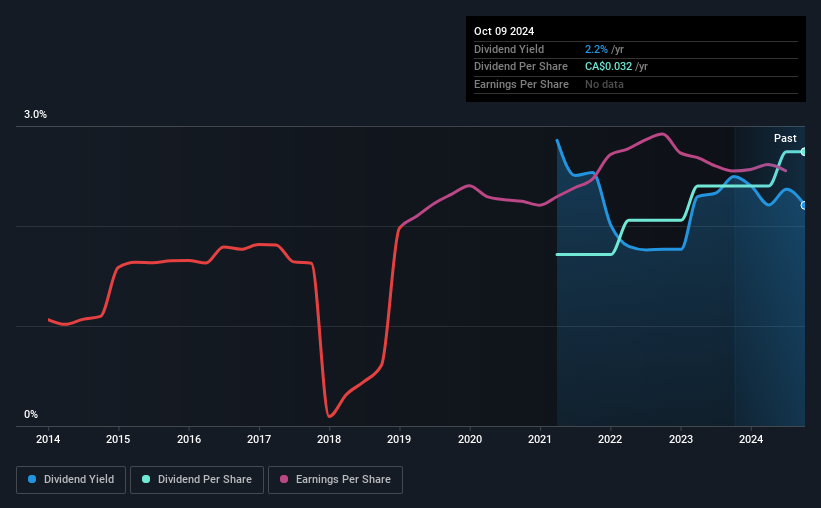

Lorne Park Capital Partners Inc. (CVE:LPC) has announced that it will pay a dividend of CA$0.008 per share on the 31st of October. The dividend yield will be 2.2% based on this payment which is still above the industry average.

Check out our latest analysis for Lorne Park Capital Partners

Estimates Indicate Lorne Park Capital Partners' Could Struggle to Maintain Dividend Payments In The Future

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, Lorne Park Capital Partners' dividend made up quite a large proportion of earnings but only 33% of free cash flows. This leaves plenty of cash for reinvestment into the business.

Over the next year, EPS could expand by 19.5% if the company continues along the path it has been on recently. Assuming the dividend continues along recent trends, we think the payout ratio could reach 98%, which probably can't continue without starting to put some pressure on the balance sheet.

Lorne Park Capital Partners Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. Since 2020, the dividend has gone from CA$0.02 total annually to CA$0.032. This means that it has been growing its distributions at 12% per annum over that time. The dividend has been growing rapidly, however with such a short payment history we can't know for sure if payment can continue to grow over the long term, so caution may be warranted.

Lorne Park Capital Partners Might Find It Hard To Grow Its Dividend

Investors could be attracted to the stock based on the quality of its payment history. It's encouraging to see that Lorne Park Capital Partners has been growing its earnings per share at 20% a year over the past five years. The payout ratio is very much on the higher end, which could mean that the growth rate will slow down in the future, and that could flow through to the dividend as well.

Our Thoughts On Lorne Park Capital Partners' Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 3 warning signs for Lorne Park Capital Partners (of which 1 is a bit concerning!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:LPC

Lorne Park Capital Partners

Provides portfolio management services to affluent Canadian investors, estates, trusts, endowments, and foundations in Canada and the United States.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.