- Canada

- /

- Capital Markets

- /

- TSXV:LPC

A Quick Analysis On Lorne Park Capital Partners' (CVE:LPC) CEO Compensation

Bob Sewell is the CEO of Lorne Park Capital Partners Inc. (CVE:LPC), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Lorne Park Capital Partners.

View our latest analysis for Lorne Park Capital Partners

Comparing Lorne Park Capital Partners Inc.'s CEO Compensation With the industry

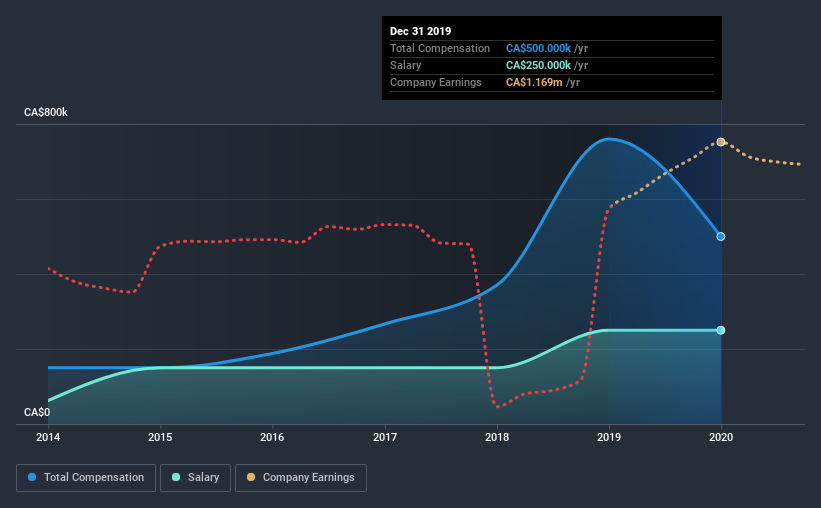

At the time of writing, our data shows that Lorne Park Capital Partners Inc. has a market capitalization of CA$31m, and reported total annual CEO compensation of CA$500k for the year to December 2019. That's a notable decrease of 34% on last year. We note that the salary portion, which stands at CA$250.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below CA$259m, we found that the median total CEO compensation was CA$196k. Accordingly, our analysis reveals that Lorne Park Capital Partners Inc. pays Bob Sewell north of the industry median. Furthermore, Bob Sewell directly owns CA$8.4m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CA$250k | CA$250k | 50% |

| Other | CA$250k | CA$510k | 50% |

| Total Compensation | CA$500k | CA$760k | 100% |

On an industry level, roughly 54% of total compensation represents salary and 46% is other remuneration. Lorne Park Capital Partners is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation.

Lorne Park Capital Partners Inc.'s Growth

Lorne Park Capital Partners Inc.'s earnings per share (EPS) grew 104% per year over the last three years. It achieved revenue growth of 22% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Lorne Park Capital Partners Inc. Been A Good Investment?

Boasting a total shareholder return of 50% over three years, Lorne Park Capital Partners Inc. has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As we touched on above, Lorne Park Capital Partners Inc. is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Importantly though, EPS growth and shareholder returns are very impressive over the last three years. As a result of the excellent all-round performance of the company, we believe CEO compensation is fair. The pleasing shareholder returns are the cherry on top. We wouldn't be wrong in saying that shareholders feel that Bob's performance creates value for the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 3 warning signs (and 1 which is concerning) in Lorne Park Capital Partners we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Lorne Park Capital Partners or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSXV:LPC

Lorne Park Capital Partners

Provides portfolio management services to affluent Canadian investors, estates, trusts, endowments, and foundations in Canada and the United States.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026