Uncovering 3 Promising Canadian Small Caps Backed By Solid Fundamentals

Reviewed by Simply Wall St

With Canada's election now concluded, a significant source of uncertainty has been lifted, allowing the government to focus on key issues such as trade and economic growth. As policymakers consider fiscal stimulus and potential interest rate cuts to support the economy, investors may find opportunities in Canadian small-cap stocks that are backed by solid fundamentals.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 4.98% | 13.46% | 16.87% | ★★★★★★ |

| Yellow Pages | NA | -11.96% | -15.73% | ★★★★★★ |

| Pinetree Capital | 0.20% | 63.68% | 65.79% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Itafos | 28.17% | 11.62% | 53.49% | ★★★★★☆ |

| Mako Mining | 8.59% | 38.81% | 59.80% | ★★★★★☆ |

| Corby Spirit and Wine | 59.18% | 8.79% | -5.67% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Senvest Capital | 81.59% | -11.73% | -12.63% | ★★★★☆☆ |

| Dundee | 3.91% | -36.42% | 49.66% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

High Liner Foods (TSX:HLF)

Simply Wall St Value Rating: ★★★★★☆

Overview: High Liner Foods Incorporated is involved in the processing and marketing of prepared and packaged frozen seafood products across North America, with a market capitalization of CA$490.65 million.

Operations: High Liner Foods generates revenue primarily from the manufacturing and marketing of prepared and packaged frozen seafood, totaling $959.22 million. The company has a market capitalization of CA$490.65 million.

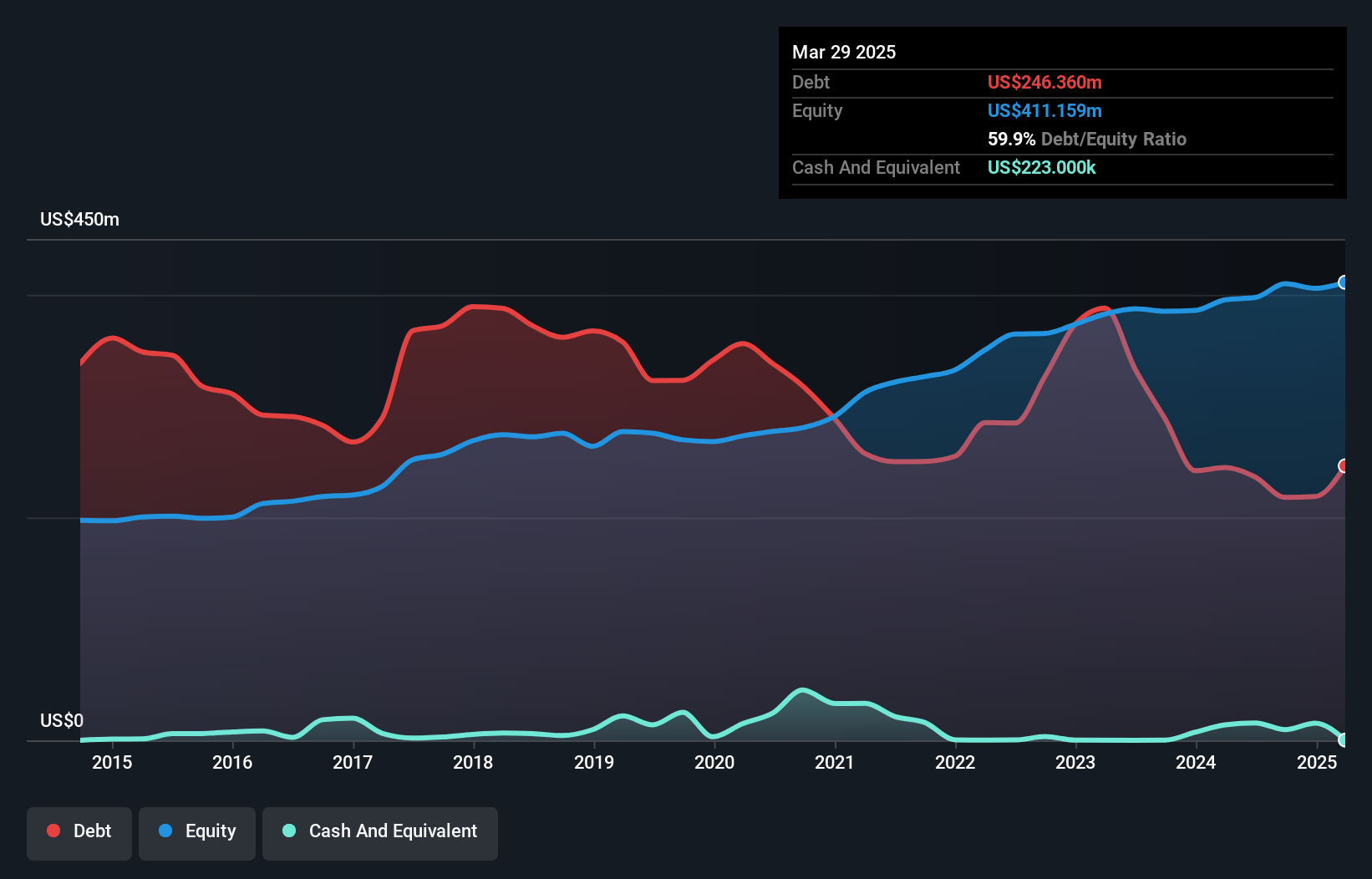

High Liner Foods has been making waves with its impressive earnings growth of 89.3% over the past year, outpacing the food industry's 29.4%. Despite a high net debt to equity ratio of 50.1%, the company has successfully reduced this from 127.2% over five years, signaling improved financial health. Trading at a significant discount of 62.2% below its estimated fair value, High Liner appears undervalued in the market. Recent changes include appointing PwC as their new auditor and exploring M&A opportunities while maintaining shareholder returns through dividends and share buybacks, reflecting a balanced strategic approach for future growth.

- Click to explore a detailed breakdown of our findings in High Liner Foods' health report.

Explore historical data to track High Liner Foods' performance over time in our Past section.

Sprott (TSX:SII)

Simply Wall St Value Rating: ★★★★★★

Overview: Sprott Inc. is a publicly owned asset management holding company with a market cap of CA$1.90 billion.

Operations: Sprott generates revenue primarily through asset management services. The company's net profit margin is 25%, reflecting its profitability relative to total revenue.

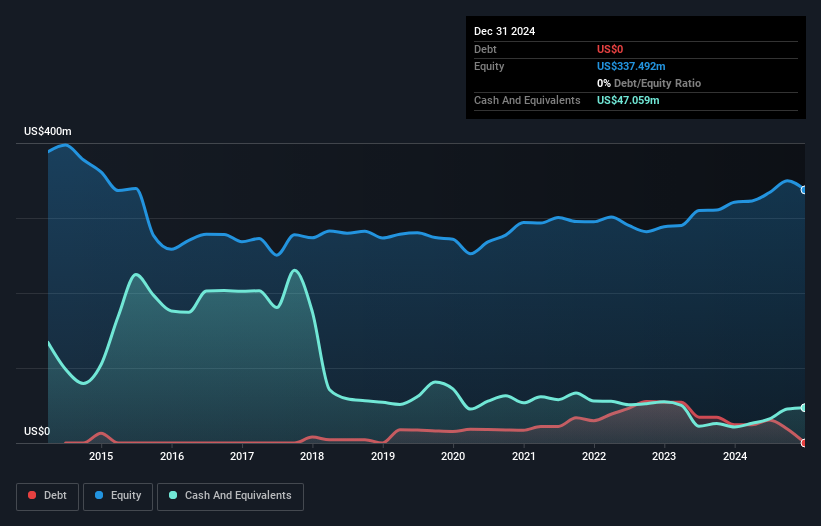

Sprott, a notable player in the investment management sector, has seen its earnings grow 19% annually over the past five years. The company is debt-free, a significant shift from having a debt-to-equity ratio of 7.2% five years ago. Recent financials highlight revenue for Q1 2025 at US$43 million and net income at US$11.96 million, both showing slight year-over-year improvements. A share repurchase program is underway with 49,706 shares bought back for CAD2.66 million this year alone. Sprott's strategic focus on precious metals ETFs positions it well in the capital markets industry despite recent insider selling activity.

- Click here and access our complete health analysis report to understand the dynamics of Sprott.

Examine Sprott's past performance report to understand how it has performed in the past.

Tamarack Valley Energy (TSX:TVE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tamarack Valley Energy Ltd. is involved in the exploration, development, production, and sale of oil, natural gas, and natural gas liquids in the Western Canadian sedimentary basin with a market cap of CA$1.85 billion.

Operations: Tamarack Valley Energy generates revenue through the sale of oil, natural gas, and natural gas liquids. Its financial performance is influenced by fluctuations in commodity prices and production costs.

Tamarack Valley Energy, a promising player in the Canadian oil and gas sector, reported notable earnings growth of 339.8% over the past year, outpacing industry trends. The company has effectively reduced its debt to equity ratio from 40.3% to 36.2% over five years, indicating prudent financial management. Despite high net debt of CA$807 million posing risks, Tamarack's efficient drilling in Clearwater and strategic waterflood initiatives are likely to enhance production and reduce costs. First-quarter results showed revenue of CA$332 million with a net income of CA$64 million compared to a loss last year, reflecting improved operations and profitability.

Next Steps

- Access the full spectrum of 44 TSX Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade High Liner Foods, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if High Liner Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HLF

High Liner Foods

Processes and markets prepared and packaged frozen seafood products in North America.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives