- Canada

- /

- Capital Markets

- /

- TSX:RCG

A Piece Of The Puzzle Missing From RF Capital Group Inc.'s (TSE:RCG) 26% Share Price Climb

The RF Capital Group Inc. (TSE:RCG) share price has done very well over the last month, posting an excellent gain of 26%. Looking further back, the 15% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

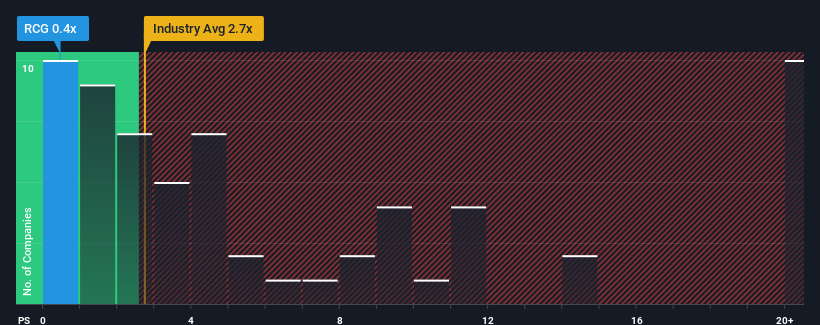

In spite of the firm bounce in price, RF Capital Group's price-to-sales (or "P/S") ratio of 0.4x might still make it look like a strong buy right now compared to the wider Capital Markets industry in Canada, where around half of the companies have P/S ratios above 2.7x and even P/S above 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for RF Capital Group

How Has RF Capital Group Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, RF Capital Group has been doing quite well of late. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on RF Capital Group will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For RF Capital Group?

The only time you'd be truly comfortable seeing a P/S as depressed as RF Capital Group's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 3.6%. The latest three year period has also seen a 19% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 21% during the coming year according to the dual analysts following the company. Meanwhile, the broader industry is forecast to contract by 72%, which would indicate the company is doing very well.

In light of this, it's quite peculiar that RF Capital Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Final Word

Shares in RF Capital Group have risen appreciably however, its P/S is still subdued. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into RF Capital Group's analyst forecasts has shown that it could be trading at a significant discount in terms of P/S, as it is expected to far outperform the industry. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for RF Capital Group (of which 1 is potentially serious!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:RCG

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026