- Canada

- /

- Consumer Finance

- /

- TSX:PRL

Why Investors Shouldn't Be Surprised By Propel Holdings Inc.'s (TSE:PRL) 26% Share Price Surge

Propel Holdings Inc. (TSE:PRL) shareholders have had their patience rewarded with a 26% share price jump in the last month. The last 30 days were the cherry on top of the stock's 330% gain in the last year, which is nothing short of spectacular.

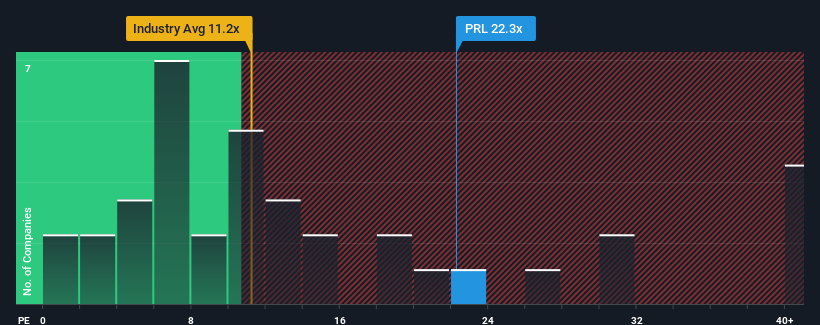

Following the firm bounce in price, Propel Holdings may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 22.3x, since almost half of all companies in Canada have P/E ratios under 15x and even P/E's lower than 7x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Propel Holdings has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Propel Holdings

How Is Propel Holdings' Growth Trending?

In order to justify its P/E ratio, Propel Holdings would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 74% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 183% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 42% per year as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 10% per annum, which is noticeably less attractive.

In light of this, it's understandable that Propel Holdings' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in Propel Holdings' shares has lifted the company's P/E to a fairly high level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Propel Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Propel Holdings, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Propel Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:PRL

Exceptional growth potential and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026