- Canada

- /

- Capital Markets

- /

- TSX:ONEX

Is the Loss of Nigel S. Wright Changing the Investment Case for Onex (TSX:ONEX)?

Reviewed by Sasha Jovanovic

- Onex Corporation recently announced the passing of Nigel S. Wright, Co-Head of Onex Partners and a respected figure who joined the company in 1997, played a significant role in establishing Onex’s London office, and helped grow its European operations.

- Mr. Wright’s influential leadership and deep industry relationships made him an integral part of Onex’s long-term expansion and presence in global markets.

- We'll explore how the loss of Mr. Wright, a driving force behind Onex's European growth, could reshape its investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Onex's Investment Narrative?

For anyone considering Onex, the core thesis rests on the company’s access to quality deals, steady cash flows from private equity and credit, and management’s disciplined capital allocation, evident in consistent buybacks and dividends. Board changes and earnings growth patterns have mattered lately, but the recent loss of Nigel S. Wright adds a new dimension to the risk profile. His leadership fueled Onex’s European expansion, and uncertainty could arise as the company adjusts, especially across existing European investments and ongoing M&A talks such as the R&Q Insurance Holdings opportunity. Initial signs from recent trading and financial results suggest the immediate impact may be manageable, with catalysts like continued buybacks and revenue from acquisitions still intact for now. However, longer-term leadership succession could become more relevant for shareholders, potentially altering risk perceptions.

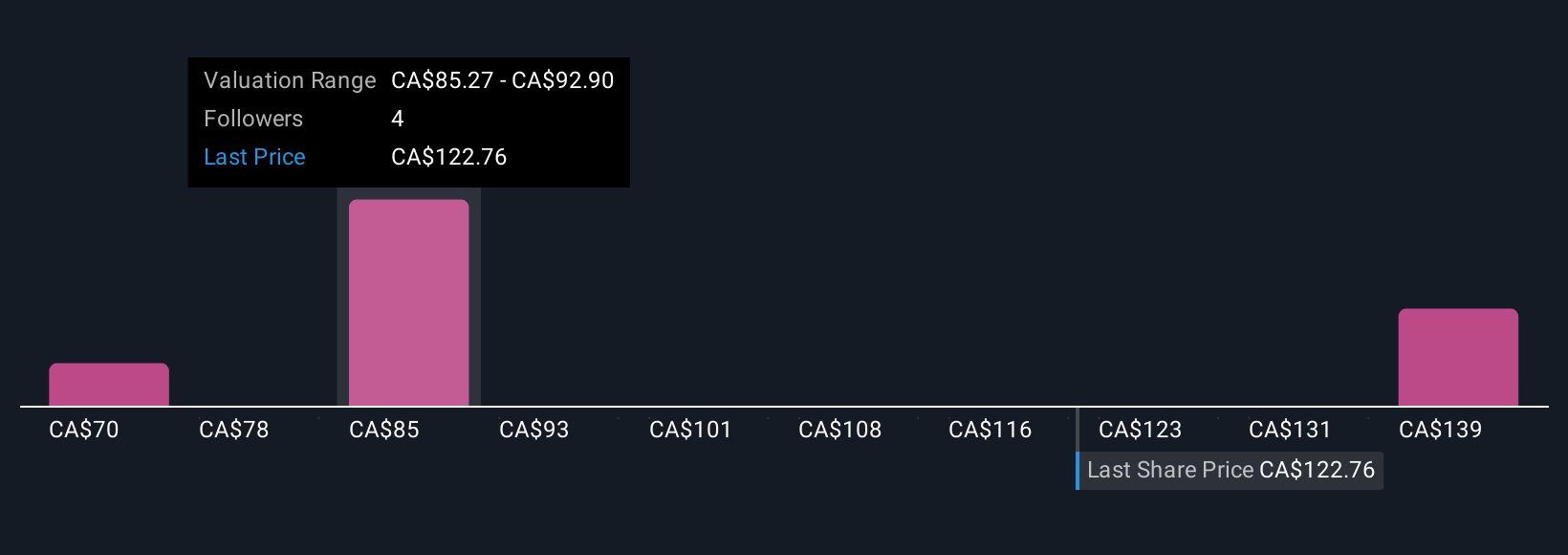

But, as strong as recent results are, leadership changes can bring unexpected challenges that shouldn't be overlooked. Onex's share price has been on the slide but might be up to 33% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 3 other fair value estimates on Onex - why the stock might be worth 42% less than the current price!

Build Your Own Onex Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Onex research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Onex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Onex's overall financial health at a glance.

No Opportunity In Onex?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ONEX

Onex

A private equity firm specializing in acquisitions and platform acquisitions.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives