IGM Financial (TSE:IGM) First Quarter 2025 Results

Key Financial Results

- Revenue: CA$960.9m (up 7.8% from 1Q 2024).

- Net income: CA$233.8m (up 4.7% from 1Q 2024).

- Profit margin: 24% (in line with 1Q 2024).

- EPS: CA$0.98 (up from CA$0.94 in 1Q 2024).

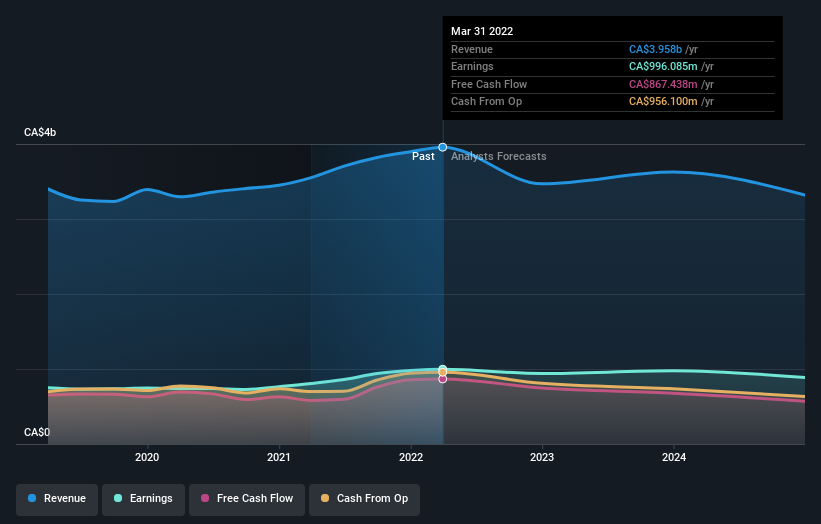

All figures shown in the chart above are for the trailing 12 month (TTM) period

IGM Financial EPS Misses Expectations

Revenue was in line with analyst estimates. Earnings per share (EPS) missed analyst estimates by 5.8%.

Looking ahead, revenue is forecast to stay flat during the next 3 years compared to a 12% decline forecast for the Capital Markets industry in Canada.

Performance of the Canadian Capital Markets industry.

The company's share price is broadly unchanged from a week ago.

Balance Sheet Analysis

Just as investors must consider earnings, it is also important to take into account the strength of a company's balance sheet. We have a graphic representation of IGM Financial's balance sheet and an in-depth analysis of the company's financial position.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:IGM

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives