- Canada

- /

- Consumer Finance

- /

- TSX:GSY

goeasy (TSX:GSY) Plans To Issue C$400 Million In Senior Unsecured Notes

Reviewed by Simply Wall St

Last week, goeasy (TSX:GSY) announced plans to issue $400 million in senior unsecured notes and entered a currency swap agreement to manage risks. This effort to optimize capital costs and bolster its financial position coincided with a share price increase of 11%. Despite broader market gains of 7%, goeasy's strategic financing steps likely contributed to its above-market performance. While broader trends show gains with banks and tech stocks leading, goeasy's proactive financial maneuvers during a volatile market may have added weight to its positive momentum. Overall, this reflects an alignment with general market trends.

We've identified 2 possible red flags for goeasy (1 can't be ignored) that you should be aware of.

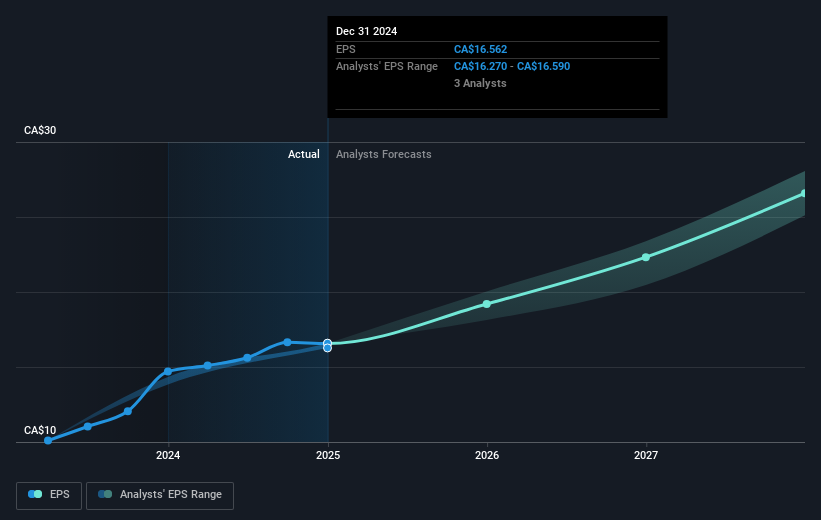

The announcement from goeasy regarding its decision to issue $400 million in senior unsecured notes signifies a proactive approach to managing capital costs and potential risks, aligning well with its strategic goals. This move, coupled with the stock's recent 11% increase, reflects investor confidence and might positively influence revenue and earnings forecasts. The strategic expansion into new loan products and automotive financing emphasizes diversification, potentially bolstering the company's growth in consumer finance.

Over the past five years, goeasy has experienced a total return of 376.93%, highlighting strong, sustained performance. In contrast, the last year saw underperformance against the Canadian Market's 7.4% gain and the Consumer Finance industry's 1.8% decline. However, the introduction of technological and AI integrations is aimed at enhancing operational efficiency, which could counteract recent relative underperformance and support revenue growth projections of 28% annually.

The current share price of CA$140.7 in relation to the consensus price target of CA$235.1 highlights a significant discount, suggesting room for appreciation. Analysts anticipate that advancements in product offerings and cost management could drive future revenue to CA$2.1 billion by 2028, supporting increased earnings. If goeasy can mitigate potential macroeconomic and regulatory challenges, its proactive financial steps may support a favorable trajectory towards the analyst target.

Gain insights into goeasy's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GSY

goeasy

Provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada.

Exceptional growth potential, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success