- Canada

- /

- Capital Markets

- /

- TSX:GCG.A

Discovering Hidden Canadian Gems With Strong Potential

Reviewed by Simply Wall St

As we approach the end of 2025, Canadian markets have shown robust performance with the TSX up by a solid 27%, buoyed by positive economic indicators and stable interest rates from the Bank of Canada. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking to capitalize on market momentum.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.62% | 30.86% | ★★★★★★ |

| Itafos | 20.68% | 9.86% | 37.00% | ★★★★★★ |

| Mako Mining | 5.29% | 37.41% | 60.51% | ★★★★★★ |

| Soma Gold | 37.84% | 26.84% | 22.13% | ★★★★★★ |

| Melcor Developments | 47.67% | 8.75% | 12.05% | ★★★★☆☆ |

| Corby Spirit and Wine | 54.56% | 11.67% | -4.04% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.68% | -3.30% | -0.82% | ★★★★☆☆ |

| Dundee | 1.46% | -35.04% | 52.59% | ★★★★☆☆ |

| Hemlo Mining | NA | 26.48% | 134.47% | ★★★★☆☆ |

| Goldmoney | 48.12% | -46.91% | 0.88% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Guardian Capital Group (TSX:GCG.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guardian Capital Group Limited operates through its subsidiaries to provide investment services across Canada, the United States, the United Kingdom, and internationally with a market capitalization of CA$1.56 billion.

Operations: Guardian Capital Group Limited generates significant revenue from its corporate activities and investments, amounting to CA$36.16 million. The company's market capitalization stands at approximately CA$1.56 billion.

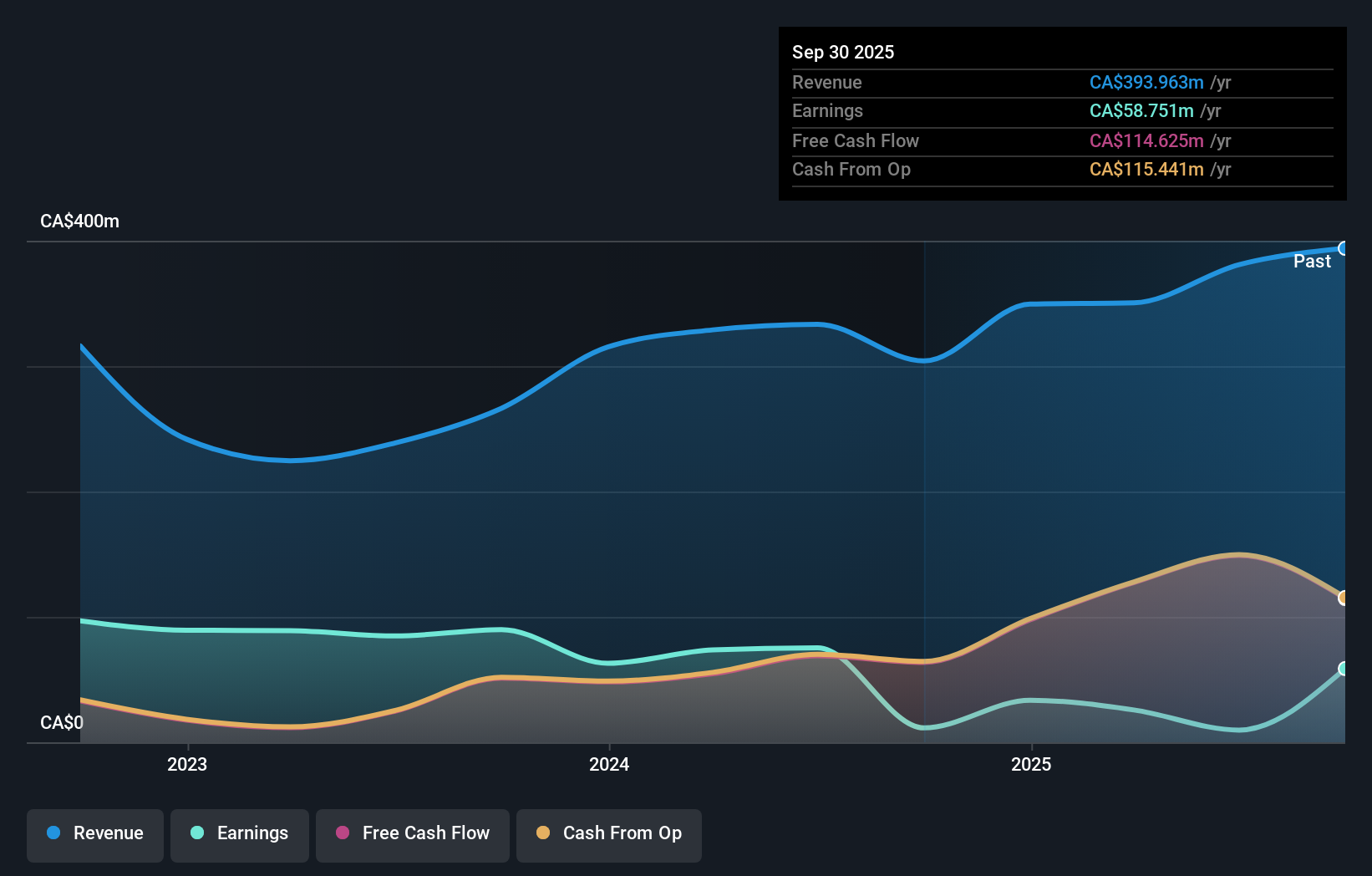

Guardian Capital Group, a nimble player in the Canadian market, has shown impressive growth with earnings surging by 74.4% over the past year, outpacing the industry average of 6.4%. Despite a slight uptick in its debt-to-equity ratio from 10.3 to 10.4 over five years, it maintains strong financial health with interest payments well covered by EBIT at a multiple of 3.3x and more cash than total debt. A notable CA$197 million one-off gain influenced recent results, while its price-to-earnings ratio of 8.6x suggests good value compared to the broader market's 15.9x average.

- Click here to discover the nuances of Guardian Capital Group with our detailed analytical health report.

Assess Guardian Capital Group's past performance with our detailed historical performance reports.

Melcor Developments (TSX:MRD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Melcor Developments Ltd. is a real estate development company operating in the United States and Canada, with a market capitalization of approximately CA$462.02 million.

Operations: The company generates revenue primarily from its Land segment, which accounts for CA$274.01 million, and its Golf segment, contributing CA$12.38 million.

Melcor Developments has been making waves with a notable earnings growth of 412.9% over the past year, outpacing the Real Estate industry's 23.3% increase. The company's debt to equity ratio improved from 65.4% to 47.7% in five years, though its net debt to equity remains high at 41.2%. With interest payments well covered by EBIT at an impressive 8.4 times, Melcor is trading significantly below its estimated fair value by about 83.8%. Recent share buybacks further highlight management's confidence in its prospects, having repurchased shares worth CAD1.95 million this year alone.

Itafos (TSXV:IFOS)

Simply Wall St Value Rating: ★★★★★★

Overview: Itafos Inc. is a company engaged in the production of phosphate and specialty fertilizers, with a market capitalization of CA$560.38 million.

Operations: Itafos generates revenue primarily from its Conda and Arraias segments, with Conda contributing $511.34 million and Arraias adding $42.20 million.

Itafos, a notable player in the phosphate industry, has seen significant financial improvements. Its debt to equity ratio impressively decreased from 256.3% to 20.7% over five years, indicating stronger financial health. The company's earnings skyrocketed by 1121%, outpacing the chemicals industry's growth of 147%. Recent earnings reports showed net income climbing to US$36 million for Q3 2025, up from US$18 million a year prior. Itafos also declared a special dividend of CAD0.17 per share, reflecting its robust performance and cash flow positivity with levered free cash flow at US$39 million as of September 2025.

- Dive into the specifics of Itafos here with our thorough health report.

Explore historical data to track Itafos' performance over time in our Past section.

Where To Now?

- Dive into all 47 of the TSX Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GCG.A

Guardian Capital Group

Through its subsidiaries, primarily engages in the provision of investment services in Canada, the United States, the United Kingdom, and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026