- Canada

- /

- Diversified Financial

- /

- TSX:ECN

Amidst increasing losses, Investors bid up ECN Capital (TSE:ECN) 31% this past week

ECN Capital Corp. (TSE:ECN) shareholders will doubtless be very grateful to see the share price up 40% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 74% in the last three years, significantly under-performing the market.

While the stock has risen 31% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for ECN Capital

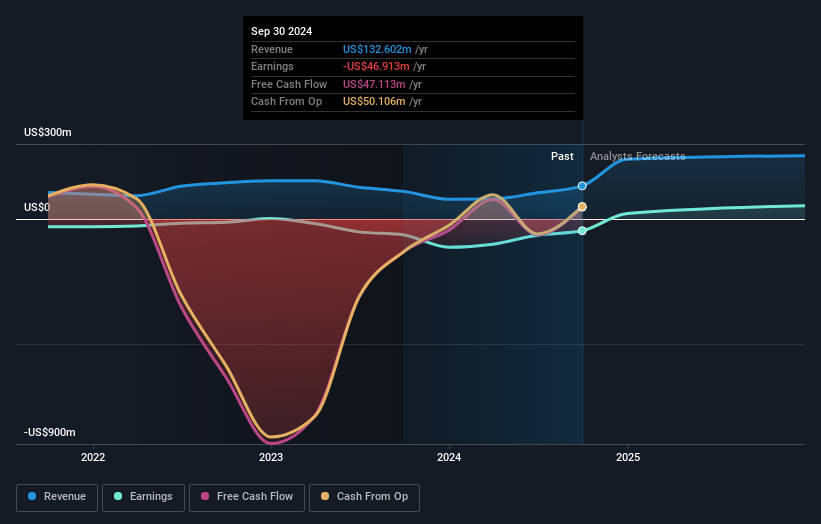

Because ECN Capital made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, ECN Capital's revenue dropped 2.1% per year. That is not a good result. The share price fall of 20% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think ECN Capital will earn in the future (free profit forecasts).

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for ECN Capital the TSR over the last 3 years was -29%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

ECN Capital shareholders are up 21% for the year (even including dividends). But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 13% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if ECN Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ECN

ECN Capital

ECN Capital Corp. originates, manages, and advises on credit assets on behalf of its partners in North America.

High growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives