- Canada

- /

- Consumer Finance

- /

- TSX:CXI

We Ran A Stock Scan For Earnings Growth And Currency Exchange International (TSE:CXI) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Currency Exchange International (TSE:CXI), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Currency Exchange International with the means to add long-term value to shareholders.

Check out our latest analysis for Currency Exchange International

Currency Exchange International's Improving Profits

Currency Exchange International has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Currency Exchange International's EPS skyrocketed from US$1.41 to US$1.90, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 35%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While Currency Exchange International did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

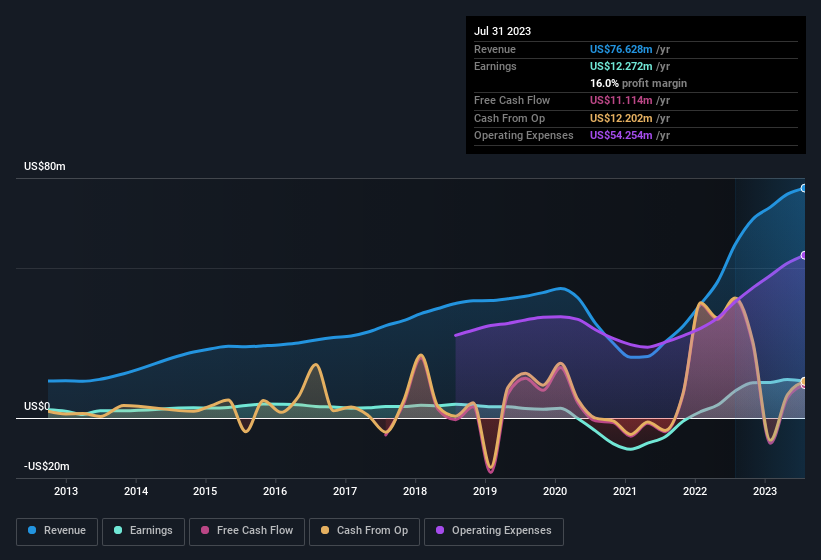

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Since Currency Exchange International is no giant, with a market capitalisation of CA$141m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Currency Exchange International Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Currency Exchange International insiders both bought and sold shares over the last twelve months, but they did end up spending US$25k more on stock than they received from selling it. At face value we can consider this a fairly encouraging sign for the company. Zooming in, we can see that the biggest insider purchase was by Director Mark Mickleborough for CA$29k worth of shares, at about CA$25.70 per share.

The good news, alongside the insider buying, for Currency Exchange International bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at US$36m. This considerable investment should help drive long-term value in the business. Those holdings account for over 26% of the company; visible skin in the game.

Is Currency Exchange International Worth Keeping An Eye On?

You can't deny that Currency Exchange International has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. These things considered, this is one stock worth watching. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Currency Exchange International is trading on a high P/E or a low P/E, relative to its industry.

The good news is that Currency Exchange International is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CXI

Currency Exchange International

Together with its subsidiary, Exchange Bank of Canada, provides foreign exchange technology and processing services in Canada and the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026