- Canada

- /

- Retail REITs

- /

- TSX:PMZ.UN

Undervalued Small Caps With Insider Action On TSX In February 2025 Canada

Reviewed by Simply Wall St

In February 2025, the Canadian market is navigating a complex landscape as the Bank of Canada cuts rates amid tariff uncertainties and a recent contraction in GDP, while expectations for economic rebound remain cautiously optimistic. Against this backdrop, small-cap stocks on the TSX are drawing attention for their potential value opportunities, particularly those with insider action that may signal confidence in future performance.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Primaris Real Estate Investment Trust | 12.2x | 3.3x | 45.12% | ★★★★★★ |

| Nexus Industrial REIT | 12.0x | 3.0x | 27.61% | ★★★★★★ |

| First National Financial | 13.4x | 3.8x | 46.30% | ★★★★★☆ |

| Savaria | 29.2x | 1.6x | 31.09% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.1x | -4424.73% | ★★★★☆☆ |

| Calfrac Well Services | 11.5x | 0.2x | 49.93% | ★★★★☆☆ |

| Baytex Energy | NA | 0.8x | -117.06% | ★★★★☆☆ |

| Saturn Oil & Gas | 2.0x | 0.6x | -73.17% | ★★★☆☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.5x | 19.85% | ★★★☆☆☆ |

| StorageVault Canada | NA | 4.5x | -644.95% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Clairvest Group (TSX:CVG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Clairvest Group is a Canadian private equity management firm that specializes in investing in and partnering with entrepreneurial companies, with a market cap of CA$1.33 billion.

Operations: The company generates revenue primarily from its venture capital segment. Over the periods analyzed, it consistently achieved a gross profit margin of 100%. Operating expenses have varied, with notable fluctuations impacting net income margins. Recent data shows a significant improvement in net income margin to 67.50% as of September 30, 2024.

PE: 12.0x

Clairvest Group, a Canadian investment firm, recently showcased its potential at major conferences in the U.S., highlighting its strategic direction. Despite past earnings declines of 9.8% annually over five years, recent financials show significant improvement with CAD 54.53 million in revenue for Q2 2024 and a net income of CAD 38.95 million, reversing prior losses. Insider confidence is evident from share purchases between July and September 2024. However, reliance on external borrowing adds risk to their funding strategy.

- Get an in-depth perspective on Clairvest Group's performance by reading our valuation report here.

Explore historical data to track Clairvest Group's performance over time in our Past section.

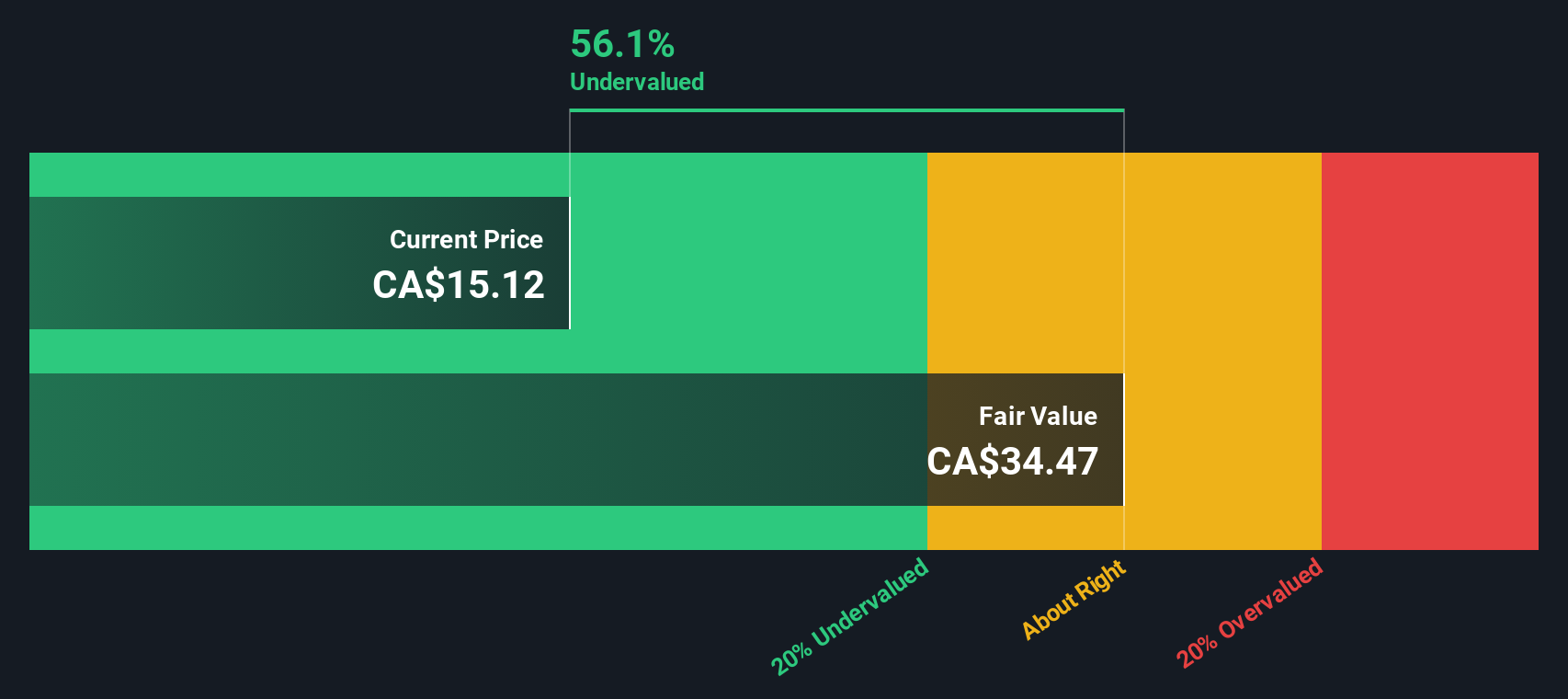

Primaris Real Estate Investment Trust (TSX:PMZ.UN)

Simply Wall St Value Rating: ★★★★★★

Overview: Primaris Real Estate Investment Trust focuses on the ownership, management, and development of its investment properties with a market capitalization of CA$1.76 billion.

Operations: Primaris Real Estate Investment Trust generates revenue primarily through the ownership, management, and development of its investment properties. As of the latest reported period, the company achieved a gross profit margin of 56.92%. Operating expenses and non-operating expenses are significant components impacting net income. The net income margin reached 26.69% in the most recent quarter, reflecting improved profitability compared to earlier periods.

PE: 12.2x

Primaris Real Estate Investment Trust, a smaller player in Canada's market, showcases potential for growth with earnings forecasted to increase by 22.15% annually. Despite relying entirely on external borrowing for funding, insider confidence is evident as an individual recently acquired 20,000 shares valued at C$271,600. The company has consistently increased its monthly distribution to C$0.0717 per unit as of January 2025. This dividend stability suggests a commitment to rewarding investors while navigating financial challenges effectively.

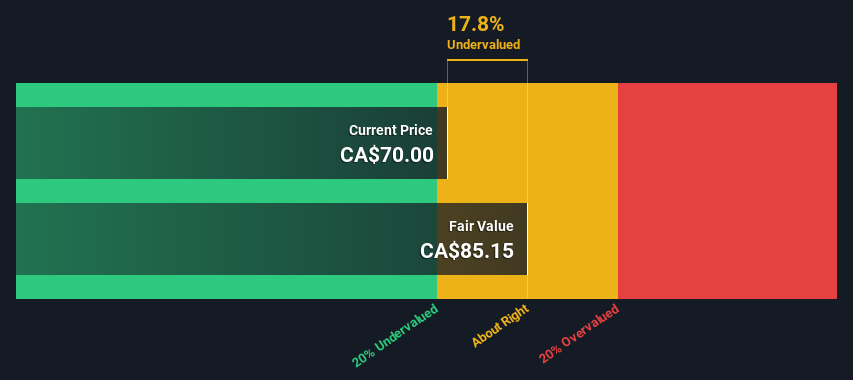

Parex Resources (TSX:PXT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Parex Resources is an oil and gas company focused on exploration and production, with a market cap of approximately CAD 3.45 billion.

Operations: The primary revenue stream is from oil and gas exploration and production, with recent quarterly revenues reaching $1.16 billion. The cost of goods sold was reported at $328.24 million, contributing to a gross profit margin of 71.63%. Operating expenses include significant allocations for depreciation and amortization, as well as general and administrative costs.

PE: 3.6x

Parex Resources, a Canadian small-cap company, demonstrates insider confidence with President Imad Mohsen purchasing 23,915 shares valued at approximately US$497K, reflecting an 86% increase in their holdings. Despite a forecasted earnings decline of 61.3% annually over the next three years and reduced profit margins from 49.1% to 22.8%, the company maintains strategic alliances in Colombia and completed a share buyback of 4.39%. Recent production guidance suggests stable output between 43,000-47,000 boe/d for fiscal year 2025.

Seize The Opportunity

- Click through to start exploring the rest of the 27 Undervalued TSX Small Caps With Insider Buying now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PMZ.UN

Primaris Real Estate Investment Trust

Primaris is Canada’s only enclosed shopping centre focused REIT, with ownership interests primarily in leading enclosed shopping centres located in growing mid-sized markets.

Very undervalued with solid track record.

Market Insights

Community Narratives