- Canada

- /

- Metals and Mining

- /

- TSX:MDI

Global Undervalued Small Caps With Insider Action May 2025

Reviewed by Simply Wall St

In the current global market environment, small-cap stocks have faced significant challenges, with indices such as the Russell 2000 experiencing notable declines amid Treasury market volatility and renewed tariff threats. Despite these headwinds, opportunities may exist for investors seeking value in this segment, particularly where insider actions suggest confidence in a company's future prospects. Identifying good stocks often involves assessing factors like financial health and growth potential, especially when broader economic indicators show mixed signals but hint at areas of resilience and recovery.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Atturra | 28.7x | 1.2x | 35.58% | ★★★★★☆ |

| Nexus Industrial REIT | 6.3x | 2.8x | 22.08% | ★★★★★☆ |

| Savills | 24.1x | 0.5x | 41.95% | ★★★★☆☆ |

| Lion Rock Group | 4.9x | 0.4x | 49.53% | ★★★★☆☆ |

| Tristel | 29.9x | 4.2x | 4.17% | ★★★★☆☆ |

| Sing Investments & Finance | 7.3x | 3.7x | 39.68% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.4x | 1.7x | 12.06% | ★★★★☆☆ |

| Cloetta | 15.7x | 1.1x | 45.17% | ★★★☆☆☆ |

| Italmobiliare | 11.5x | 1.5x | -207.83% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.2x | 47.75% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

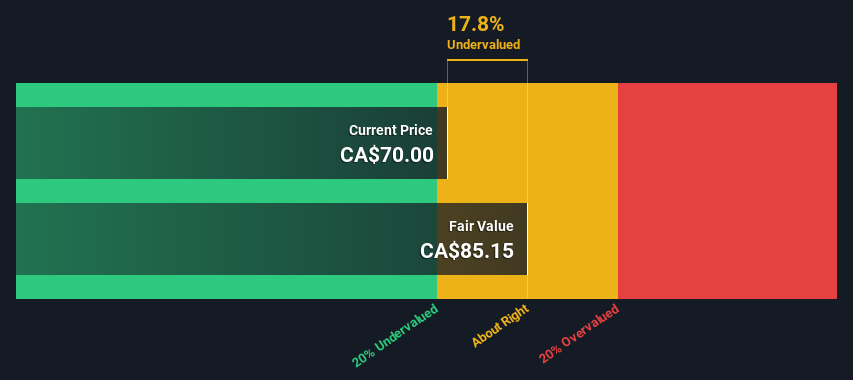

Clairvest Group (TSX:CVG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Clairvest Group is a Canadian private equity management firm that focuses on investing in and partnering with entrepreneurial companies, with a market cap of CA$1.25 billion.

Operations: Clairvest Group's revenue stream is primarily derived from venture capital investments, with a reported revenue of CA$180.88 million in the most recent period. The company consistently achieves a gross profit margin of 100%, indicating no cost of goods sold is recorded against its revenue. Operating expenses are a significant component, with general and administrative expenses reaching CA$31.48 million recently. Net income margins have varied significantly over time, recently reaching 70.45%.

PE: 8.0x

Clairvest Group, a smaller company in the investment sector, recently announced a share repurchase program, aiming to buy back up to 718,192 shares by March 2026. This move reflects insider confidence in the company's potential despite past earnings declining annually by 10.8% over five years. Their funding relies entirely on external borrowing, adding risk but also opportunity for growth if managed well. With strategic buybacks and careful financial management, they could navigate their challenges effectively.

- Take a closer look at Clairvest Group's potential here in our valuation report.

Evaluate Clairvest Group's historical performance by accessing our past performance report.

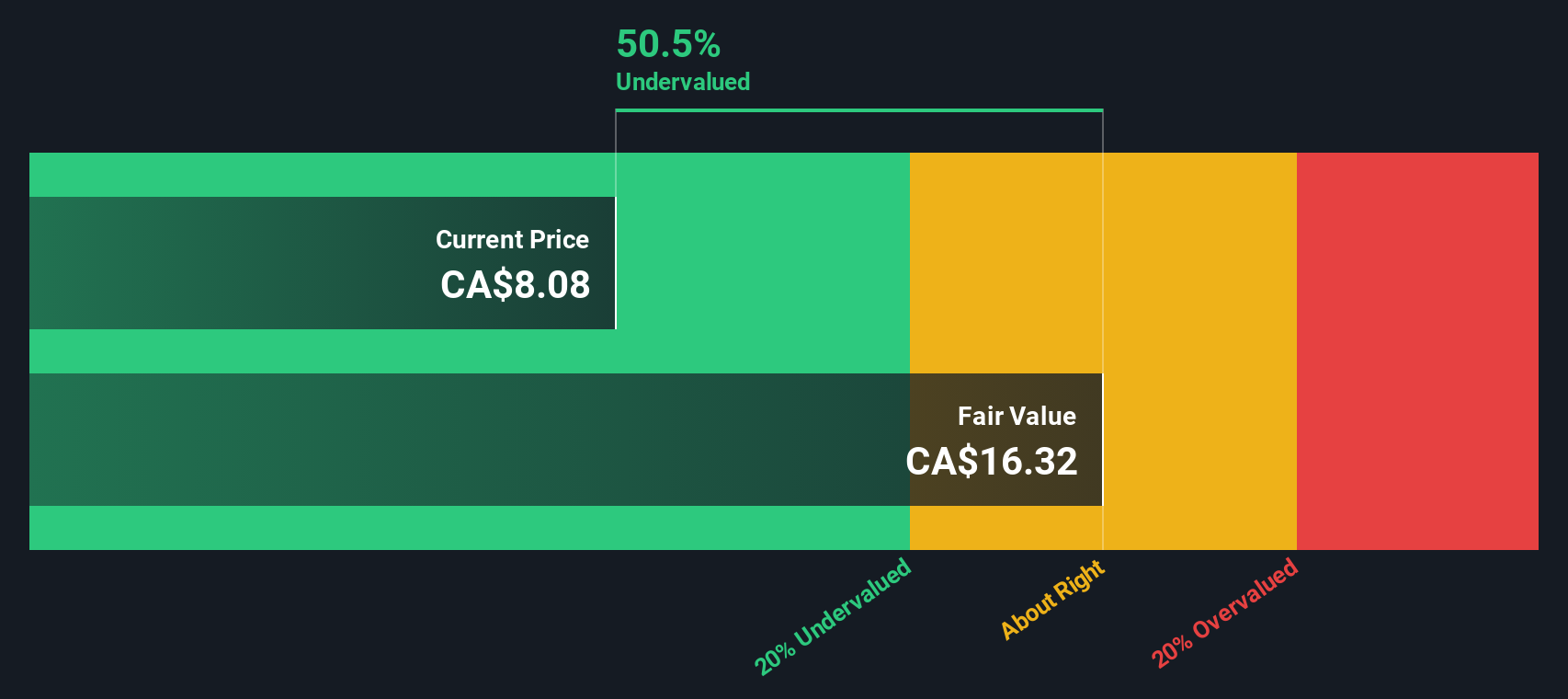

Major Drilling Group International (TSX:MDI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Major Drilling Group International is a leading provider of drilling services for companies in the mining and mineral exploration industry, with a market capitalization of CA$0.92 billion.

Operations: The company's revenue primarily stems from its drilling operations, with the latest reported figure at CA$708.07 million. The gross profit margin has shown variability, most recently recorded at 19.10%. Operating expenses have been a significant component of costs, with general and administrative expenses being notable within this category.

PE: 19.6x

Major Drilling Group International, a smaller player in the drilling industry, recently reported CAD 160.73 million in third-quarter sales, up from CAD 132.82 million last year, yet faced a net loss of CAD 9.1 million compared to CAD 2.31 million previously. Insider confidence is evident with recent share purchases by insiders over the past six months, suggesting belief in future growth potential. Despite lower profit margins and reliance on external borrowing for funding, earnings are projected to grow annually by nearly 19%.

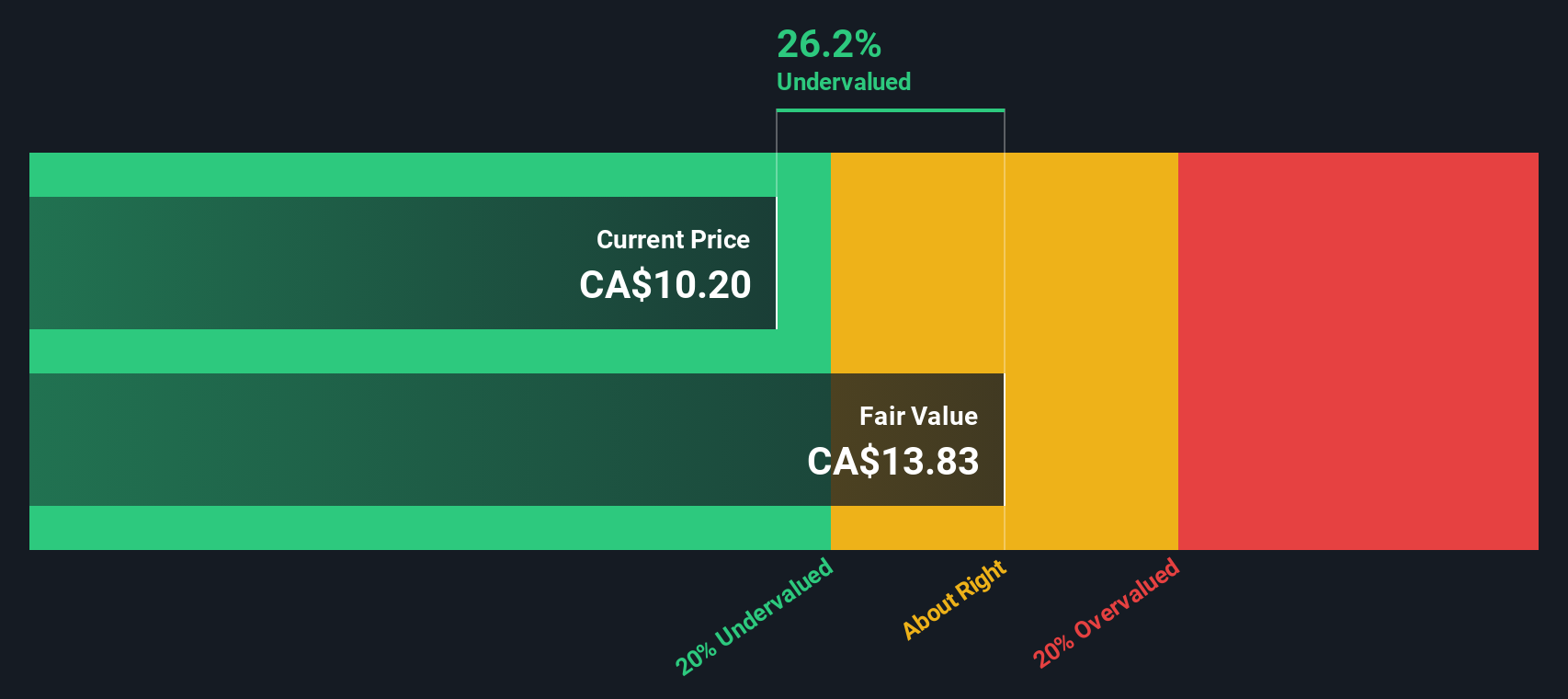

Vitalhub (TSX:VHI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vitalhub is a company that specializes in developing healthcare software solutions, with a market capitalization of CA$75.01 million.

Operations: Vitalhub generates revenue primarily from its healthcare software segment, with recent figures showing CA$75.01 million. The company's gross profit margin has shown variation over time, most recently recorded at 80.86%. Operating expenses include notable allocations to R&D and general administrative costs, indicating significant investment in development and management functions.

PE: 199.4x

Vitalhub, operating in the healthcare technology sector, showcases potential through its recent revenue growth to CAD 21.67 million for Q1 2025 from CAD 15.26 million a year prior. Despite a dip in net income to CAD 1.16 million, the company's earnings are projected to grow significantly at over 55% annually. Insider confidence is evident with share purchases over the past months, suggesting belief in future performance despite current reliance on external borrowing for funding needs.

- Delve into the full analysis valuation report here for a deeper understanding of Vitalhub.

Examine Vitalhub's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Gain an insight into the universe of 176 Undervalued Global Small Caps With Insider Buying by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MDI

Major Drilling Group International

Provides contract drilling services to mining and mineral exploration companies in the United States, Canada, South and Central America, Australasia, and Africa.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives