- Canada

- /

- Aerospace & Defense

- /

- TSX:MAL

Clairvest Group And 2 Other Canadian Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

As the Canadian market navigates through a period of economic uncertainty, marked by strong employment figures and moderated inflation expectations, small-cap stocks have shown resilience amid broader market dynamics. In this environment, identifying companies with strong fundamentals becomes crucial, as they are often better positioned to withstand economic fluctuations and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Clairvest Group | NA | -8.94% | -11.82% | ★★★★★★ |

| TWC Enterprises | 3.89% | 13.21% | 11.52% | ★★★★★★ |

| Itafos | 23.13% | 10.69% | 44.01% | ★★★★★★ |

| Mako Mining | 5.45% | 22.24% | 62.70% | ★★★★★★ |

| Grown Rogue International | 26.48% | 33.74% | 4.14% | ★★★★★☆ |

| Corby Spirit and Wine | 58.35% | 10.79% | -4.77% | ★★★★☆☆ |

| Soma Gold | 142.85% | 31.11% | 38.09% | ★★★★☆☆ |

| Dundee | 1.89% | -35.40% | 52.34% | ★★★★☆☆ |

| Golconda Gold | 7.15% | 5.60% | 23.42% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Clairvest Group (TSX:CVG)

Simply Wall St Value Rating: ★★★★★★

Overview: Clairvest Group Inc. is a private equity firm focusing on mid-market growth equity investments, buyouts, industry consolidation, and acquisitions with a market cap of CA$1.02 billion.

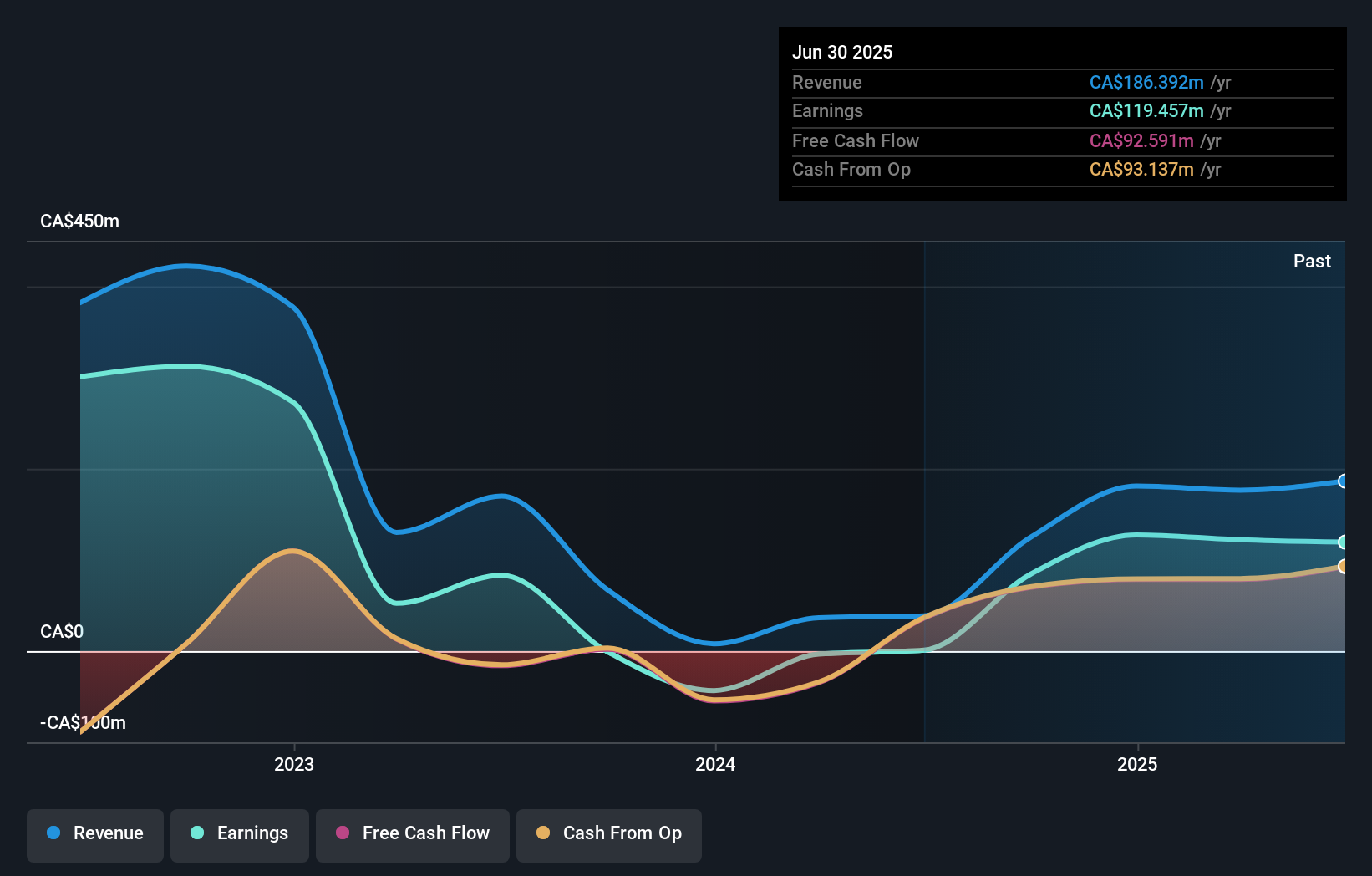

Operations: Clairvest Group generates revenue primarily from its venture capital activities, amounting to CA$186.39 million. The company has a market cap of CA$1.02 billion.

Clairvest Group, with its nimble stature, has demonstrated impressive earnings growth of 10,701% over the past year, surpassing the broader Capital Markets industry. The firm boasts a price-to-earnings ratio of 8.5x, which is notably lower than the Canadian market average of 16.8x, suggesting potential value. Despite a 11.8% annual earnings decline over five years, Clairvest remains debt-free, which aligns with its strong financial health. Recent activities include the repurchase of 8,100 shares for CAD 0.6 million, reflecting confidence in its market position. The company’s participation in industry events like the Battery Show North America highlights its proactive engagement within the sector.

- Click here and access our complete health analysis report to understand the dynamics of Clairvest Group.

Explore historical data to track Clairvest Group's performance over time in our Past section.

Magellan Aerospace (TSX:MAL)

Simply Wall St Value Rating: ★★★★★★

Overview: Magellan Aerospace Corporation, with a market cap of CA$949.80 million, engineers and manufactures aeroengine and aerostructure components for aerospace markets in Canada, the United States, and Europe through its subsidiaries.

Operations: Magellan Aerospace generates revenue primarily from its aerospace segment, amounting to CA$974.91 million. The company's financial performance is reflected in its gross profit margin, which stands at 9.50%.

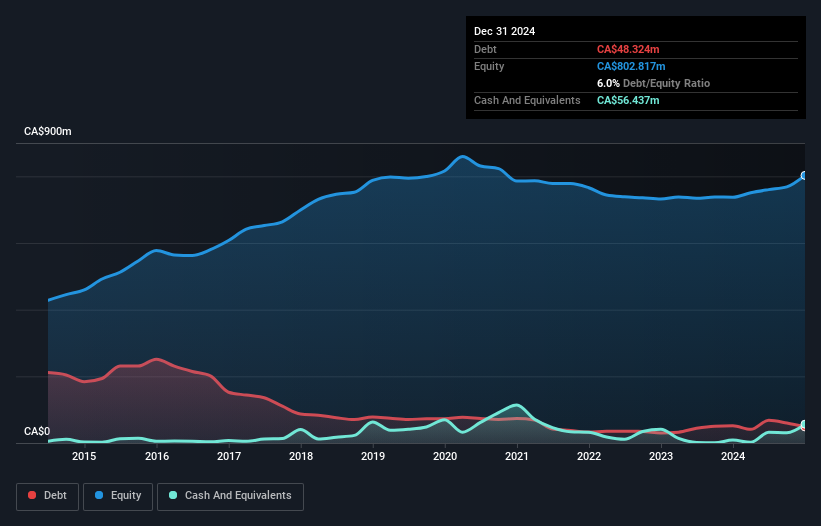

Magellan Aerospace, a Canadian aerospace firm, showcases a robust performance with earnings growth of 120.9% over the past year, outpacing the industry average of 26.7%. Trading at 42.1% below its estimated fair value, it presents a compelling investment opportunity. The company has reduced its debt to equity ratio from 8.9% to 7.8% over five years, indicating improved financial health. Recent earnings for the second quarter showed sales of CAD 249.79 million, slightly up from last year's CAD 242.91 million, though net income dipped to CAD 5.37 million from CAD 7.45 million previously.

- Click to explore a detailed breakdown of our findings in Magellan Aerospace's health report.

Assess Magellan Aerospace's past performance with our detailed historical performance reports.

Valeura Energy (TSX:VLE)

Simply Wall St Value Rating: ★★★★★★

Overview: Valeura Energy Inc. is involved in the exploration, development, and production of petroleum and natural gas in Thailand and Turkey, with a market capitalization of CA$731.80 million.

Operations: Valeura Energy generates revenue primarily from its oil and gas exploration and production segment, amounting to $651.12 million.

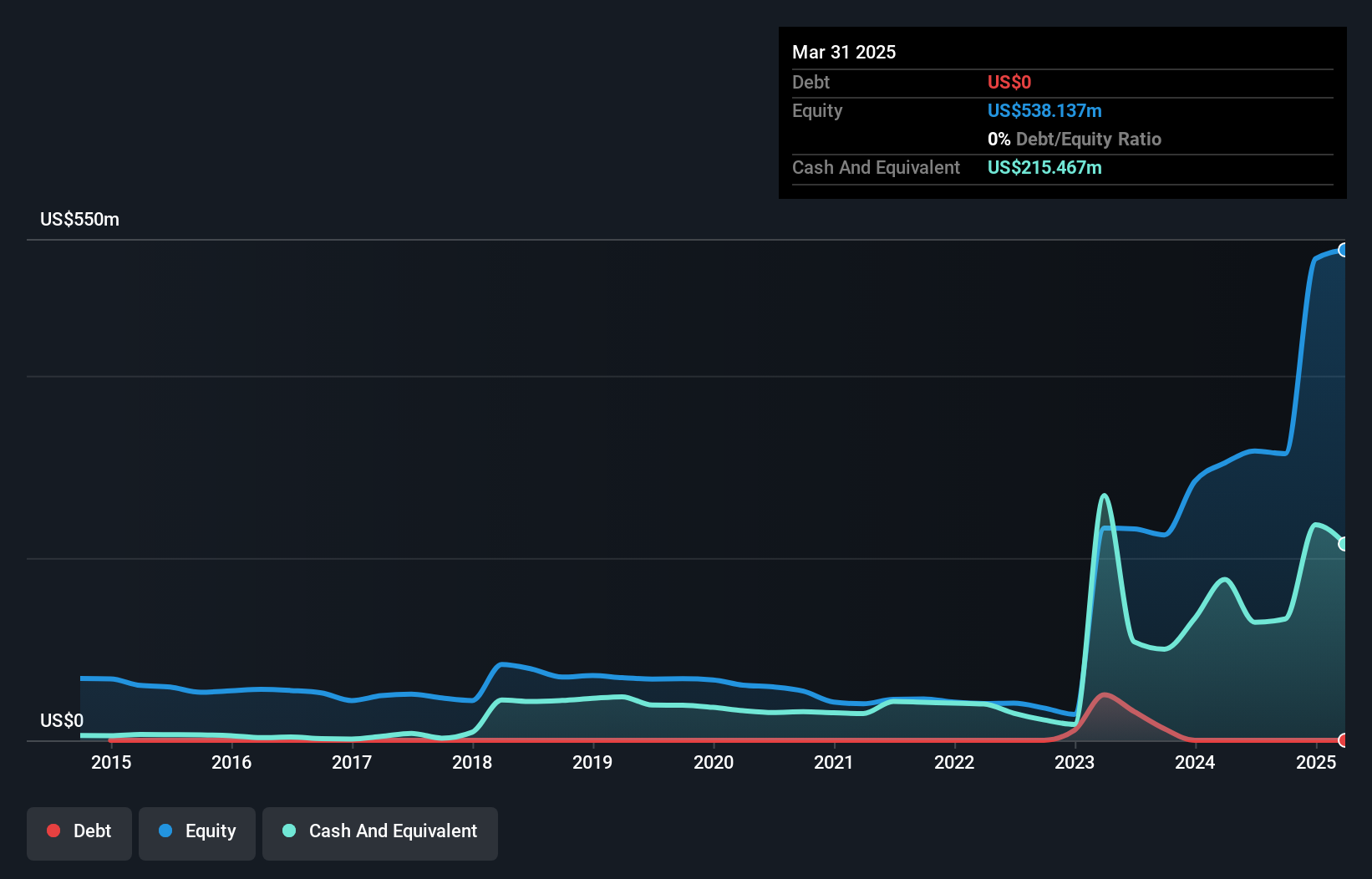

Valeura Energy, a nimble player in the oil and gas sector, has shown impressive growth with earnings surging 378% last year, significantly outpacing the industry average of 7.8%. The firm is debt-free, which supports its financial flexibility and strategic initiatives like the farm-in agreement with PTTEP in Thailand. Recent production results for Q3 2025 reveal an increase to 23 mbbls/d, up by 6.2% from Q2, signaling operational recovery post-downtime. Despite a forecasted revenue decline over three years, Valeura's market valuation remains attractive at CA$12.45 per share amid ongoing buybacks worth CAD 6.88 million.

Key Takeaways

- Investigate our full lineup of 49 TSX Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MAL

Magellan Aerospace

Through its subsidiaries, engineers and manufactures aeroengine and aerostructure components for aerospace markets in Canada, the United States, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives