- Canada

- /

- Capital Markets

- /

- TSX:CRWN

Increases to Crown Capital Partners Inc.'s (TSE:CRWN) CEO Compensation Might Cool off for now

In the past three years, the share price of Crown Capital Partners Inc. (TSE:CRWN) has struggled to grow and now shareholders are sitting on a loss. Per share earnings growth is also lacking, despite revenue growth. Shareholders will have a chance to take their concerns to the board at the next AGM on 12 May 2021 and vote on resolutions including executive compensation, which studies show may have an impact on company performance. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

Check out our latest analysis for Crown Capital Partners

Comparing Crown Capital Partners Inc.'s CEO Compensation With the industry

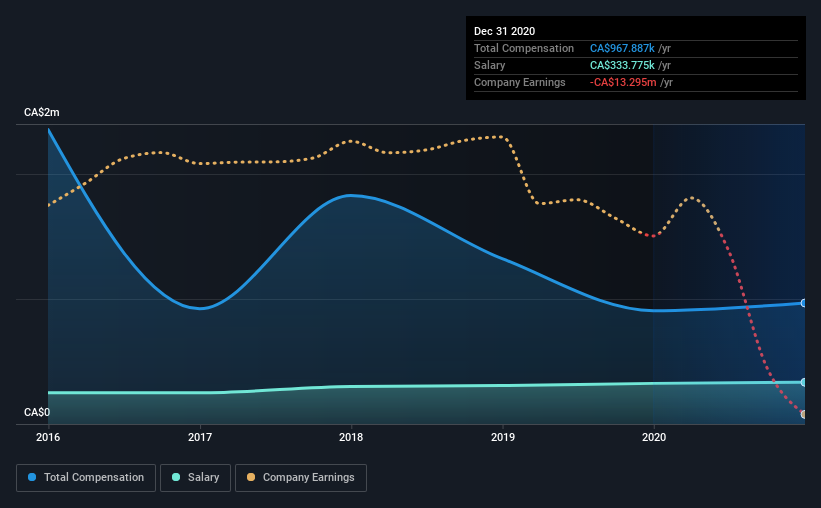

Our data indicates that Crown Capital Partners Inc. has a market capitalization of CA$47m, and total annual CEO compensation was reported as CA$968k for the year to December 2020. That's just a smallish increase of 6.8% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CA$334k.

In comparison with other companies in the industry with market capitalizations under CA$245m, the reported median total CEO compensation was CA$175k. Accordingly, our analysis reveals that Crown Capital Partners Inc. pays Chris Johnson north of the industry median. Furthermore, Chris Johnson directly owns CA$3.9m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$334k | CA$325k | 34% |

| Other | CA$634k | CA$582k | 66% |

| Total Compensation | CA$968k | CA$907k | 100% |

On an industry level, roughly 61% of total compensation represents salary and 39% is other remuneration. Crown Capital Partners pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Crown Capital Partners Inc.'s Growth Numbers

Crown Capital Partners Inc. has reduced its earnings per share by 112% a year over the last three years. In the last year, its revenue is up 77%.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Crown Capital Partners Inc. Been A Good Investment?

The return of -40% over three years would not have pleased Crown Capital Partners Inc. shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Crown Capital Partners that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:CRWN

Crown Capital Partners

A private equity firm specializing in acquisitions, special situations, management and leveraged buyouts, subordinated debt, recapitalizations, PIPES, industry consolidation, mezzanine, alternative debts, bridge loans, mezzanine debt, and growth capital investments in private and public middle market companies.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives