- Canada

- /

- Capital Markets

- /

- TSX:CRWN

Crown Capital Partners Inc. (TSE:CRWN) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the Crown Capital Partners Inc. (TSE:CRWN) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 86% share price decline.

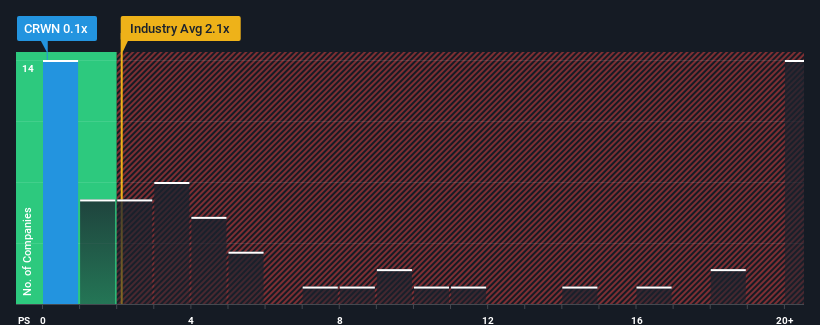

Following the heavy fall in price, Crown Capital Partners' price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now compared to the Capital Markets industry in Canada, where around half of the companies have P/S ratios above 2.1x and even P/S above 10x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Crown Capital Partners

How Has Crown Capital Partners Performed Recently?

For instance, Crown Capital Partners' receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Crown Capital Partners will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Crown Capital Partners' earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Crown Capital Partners' is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 6.3% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 20% shows it's a great look while it lasts.

With this information, we find it very odd that Crown Capital Partners is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What We Can Learn From Crown Capital Partners' P/S?

Crown Capital Partners' recently weak share price has pulled its P/S back below other Capital Markets companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at the figures, it's surprising to see Crown Capital Partners currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

Plus, you should also learn about these 4 warning signs we've spotted with Crown Capital Partners.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CRWN

Crown Capital Partners

A private equity firm specializing in acquisitions, special situations, management and leveraged buyouts, subordinated debt, recapitalizations, PIPES, industry consolidation, mezzanine, alternative debts, bridge loans, mezzanine debt, and growth capital investments in private and public middle market companies.

Low and slightly overvalued.

Market Insights

Community Narratives