- Canada

- /

- Capital Markets

- /

- TSX:CIX

CI Financial Corp. (TSE:CIX) Held Back By Insufficient Growth Even After Shares Climb 26%

CI Financial Corp. (TSE:CIX) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 78%.

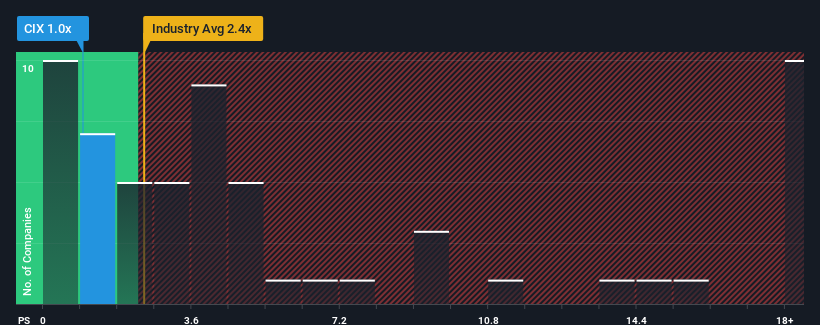

Although its price has surged higher, CI Financial may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1x, considering almost half of all companies in the Capital Markets industry in Canada have P/S ratios greater than 2.2x and even P/S higher than 10x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for CI Financial

How Has CI Financial Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, CI Financial has been doing quite well of late. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. Those who are bullish on CI Financial will be hoping that this isn't the case and the company continues to beat out the industry.

Want the full picture on analyst estimates for the company? Then our free report on CI Financial will help you uncover what's on the horizon.How Is CI Financial's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like CI Financial's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. The latest three year period has also seen an excellent 49% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 5.1% per year as estimated by the five analysts watching the company. Meanwhile, the broader industry is forecast to expand by 6.0% each year, which paints a poor picture.

With this in consideration, we find it intriguing that CI Financial's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From CI Financial's P/S?

The latest share price surge wasn't enough to lift CI Financial's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that CI Financial maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, CI Financial's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

We don't want to rain on the parade too much, but we did also find 2 warning signs for CI Financial (1 is potentially serious!) that you need to be mindful of.

If these risks are making you reconsider your opinion on CI Financial, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CIX

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success