- Canada

- /

- Capital Markets

- /

- TSX:BAM

Reassessing Brookfield Asset Management (TSX:BAM)’s Valuation After Recent Short-Term Share Price Strength

Reviewed by Simply Wall St

Brookfield Asset Management (TSX:BAM) has quietly outperformed the broader Canadian financials sector over the past week, and that short term strength contrasts with a weaker year to date share performance.

See our latest analysis for Brookfield Asset Management.

With the share price now at $75.41, that solid 1 day and 7 day share price return sits against a softer year to date share price return and a negative 1 year total shareholder return, even though the 3 year total shareholder return remains very strong. This suggests longer term momentum is still intact despite the near term wobble.

If Brookfield’s moves have you rethinking where capital might compound best, it could be worth scanning fast growing stocks with high insider ownership as a curated shortlist of potential next ideas.

Given that backdrop, are investors overlooking Brookfield’s resilient earnings growth and modest upside to analyst targets, or does the current valuation already reflect the next leg of its asset management expansion?

Price-to-Earnings of 33.6x: Is it justified?

BAM's current share price of CA$75.41 equates to a 33.6x price-to-earnings multiple, which places it at a premium and implies elevated growth expectations.

The price-to-earnings ratio compares what investors pay for each dollar of current earnings, and for an asset manager like Brookfield, it often reflects beliefs about durable fee growth, performance income and capital light scalability. A richer multiple can signal the market is already baking in strong profitability and continued expansion of assets under management.

On one hand, BAM screens as good value relative to a peer group trading at around 50.3x earnings, hinting that investors are not paying as much for each dollar of profit as they are for some close comparables. On the other hand, the stock looks expensive versus the broader Canadian Capital Markets industry at 8.8x earnings, and even above an estimated fair price-to-earnings ratio of 24x that the market could gravitate towards if sentiment cools.

Explore the SWS fair ratio for Brookfield Asset Management

Result: Price-to-Earnings of 33.6x (OVERVALUED)

However, sustained underperformance or a sharp slowdown in fee related earnings growth could quickly compress that premium multiple and challenge the asset growth narrative.

Find out about the key risks to this Brookfield Asset Management narrative.

Another View: Our DCF Model Paints a Harsher Picture

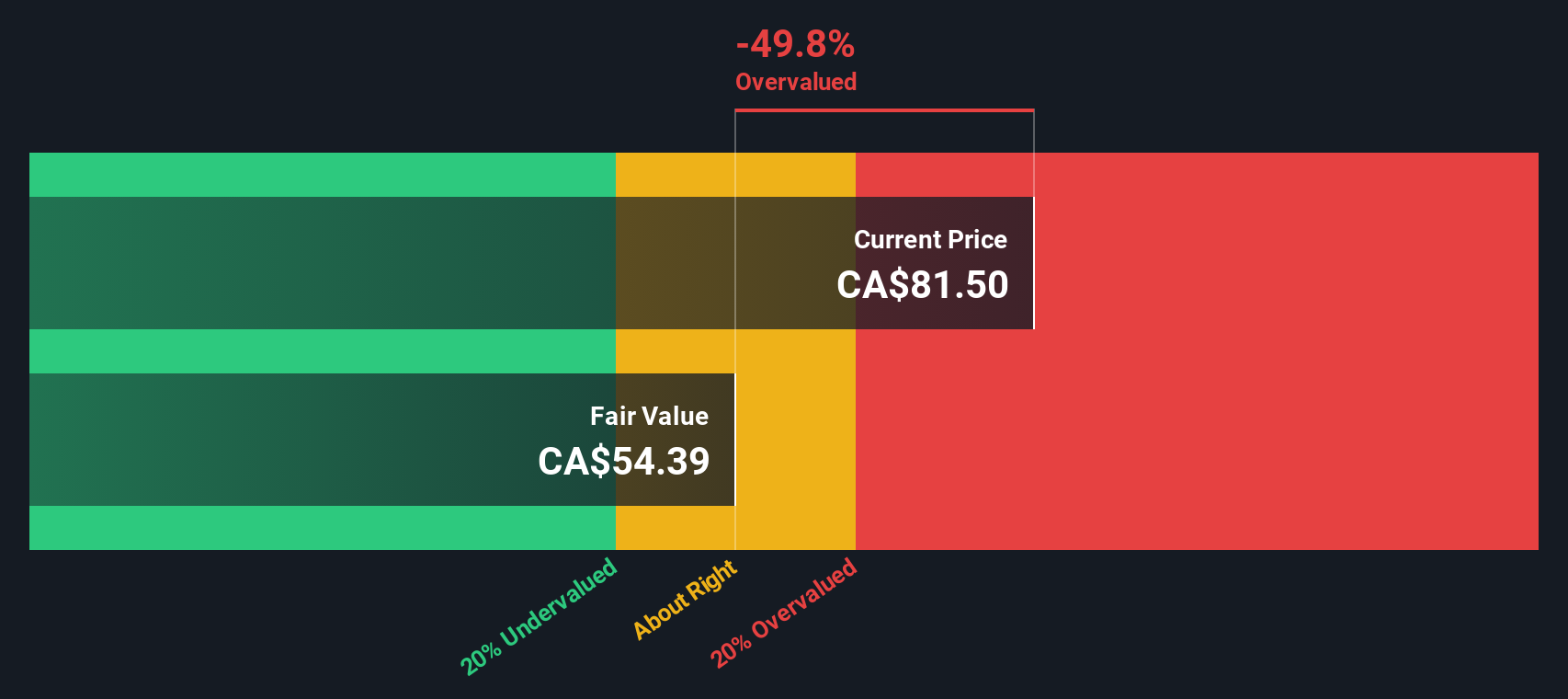

While the 33.6x earnings multiple already looks stretched, our DCF model is even less forgiving. It points to a fair value of around CA$58.49, which implies Brookfield may be overvalued by close to 29%. This raises the question: is the market overestimating the durability of today’s growth profile?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Asset Management for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 896 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Asset Management Narrative

If this perspective does not fully align with your own view, or you prefer hands on research, you can quickly build a tailored narrative in just a few minutes, Do it your way.

A great starting point for your Brookfield Asset Management research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential winner by using the Simply Wall St Screener to uncover stocks that match your exact strategy and risk profile.

- Secure your income game by scanning these 15 dividend stocks with yields > 3% that combine reliable payouts with the potential for long term total returns.

- Position yourself at the front of innovation by targeting these 27 AI penny stocks that could benefit most as artificial intelligence reshapes entire industries.

- Strengthen your value playbook by reviewing these 896 undervalued stocks based on cash flows where current prices may sit well below what future cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Asset Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BAM

Brookfield Asset Management

A private equity firm specializing in acquisitions and growth capital investments.

Outstanding track record with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026