- Canada

- /

- Capital Markets

- /

- TSX:BAM

Is Brookfield Asset Management Still Attractive After 4.8% Weekly Surge?

Reviewed by Bailey Pemberton

If you are trying to decide what to do with Brookfield Asset Management stock, you are definitely not alone. Investors have been keeping a close eye on this company, especially after its share price jumped by 4.8% just in the last week, adding to a respectable 3.7% gain over the past 30 days. Year to date, the stock is up 4.0%, and the 1-year return stands out at an impressive 29.1%. These moves say a lot about how the market is viewing Brookfield right now. Optimism has been building, with some seeing continued growth potential while others are debating whether risk is now a bigger factor as the price rises.

But when you dig into valuation, things get even more interesting. Our simple tally of six key valuation checks shows Brookfield Asset Management is undervalued in only 1 out of 6 indicators, giving it a valuation score of just 1. That means, by most traditional measures, the company might not be a bargain at these prices. However, as with all great stocks, there is often a deeper story than just the headline numbers.

Let’s break down exactly what these valuation checks are telling us, where Brookfield stands out or falls short, and why sometimes the usual frameworks do not tell the whole story. An even more insightful approach to valuation is coming up at the end.

Brookfield Asset Management scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Brookfield Asset Management Excess Returns Analysis

The Excess Returns model evaluates a company's ability to generate earnings above its cost of equity, highlighting how effectively management puts shareholders' capital to work. For Brookfield Asset Management, this method compares future sustainable earnings with what shareholders require as a minimum return. This provides a nuanced look at long-term value creation.

For Brookfield, the current Book Value stands at CA$5.25 per share, while the stable Earnings Per Share (EPS) is CA$2.14, as projected by analysts. Based on four analyst estimates, the company is expected to maintain an impressive average Return on Equity of 30.57%. The excess return, which is the amount earnings exceed the cost of equity, totals CA$1.61 per share, well above the CA$0.53 per share cost of equity. The anticipated Stable Book Value is CA$7.00 per share, also derived from analyst forecasts.

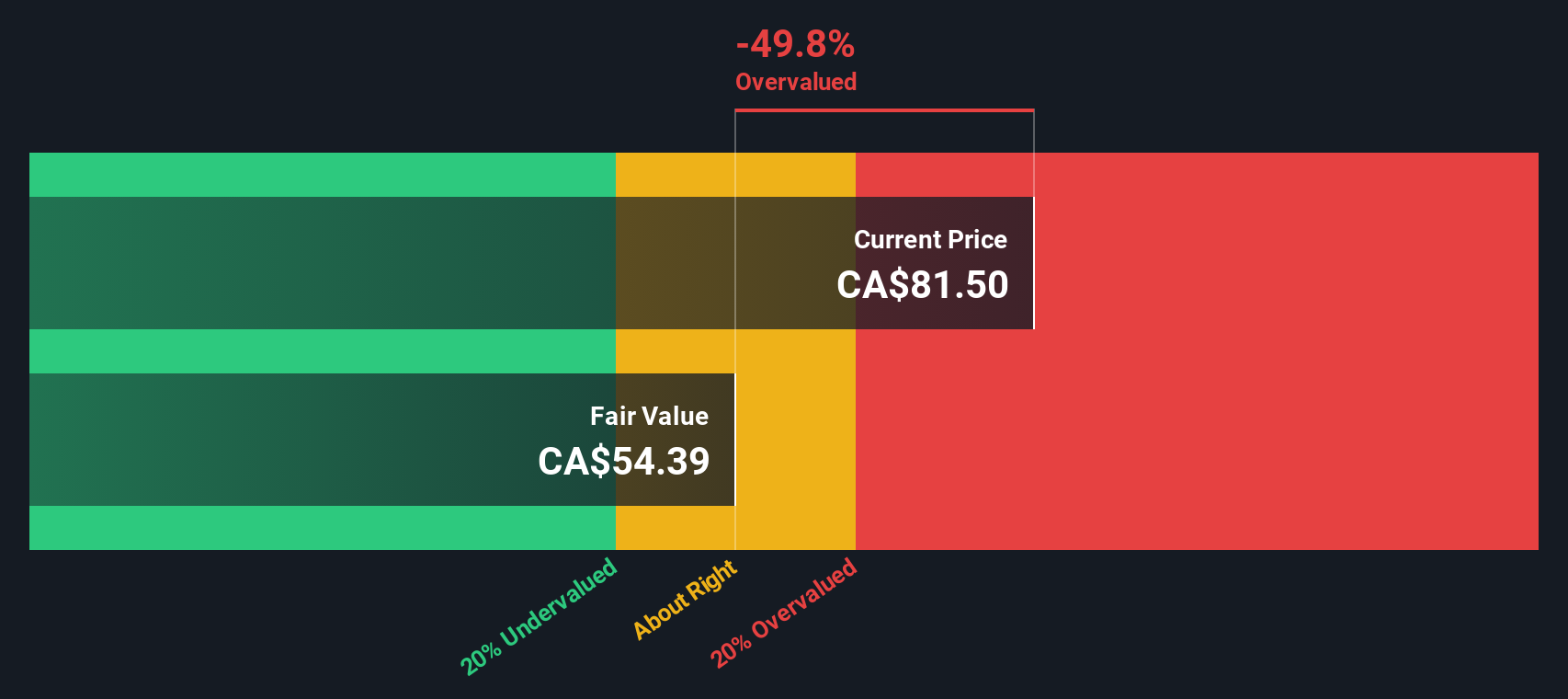

Despite these strong figures, the model calculates an intrinsic value of CA$54.39 per share. Compared to the current market price, this implies the stock is 49.8% overvalued. This suggests investors are currently paying a premium well above the company’s demonstrated ability to produce outsized returns relative to equity.

Result: OVERVALUED

Our Excess Returns analysis suggests Brookfield Asset Management may be overvalued by 49.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Brookfield Asset Management Price vs Earnings

The price-to-earnings (PE) ratio is often seen as the gold standard for valuing consistently profitable companies. It tells investors how much they are paying for each dollar of earnings, making it a useful gauge for companies like Brookfield Asset Management with a solid profit track record.

Expectations of future growth and the level of perceived risk both play a big role in what is considered a “normal” or “fair” PE ratio. A rapidly growing company or one with lower perceived risk can command a higher PE, while slower growth or higher risk typically justifies a lower multiple.

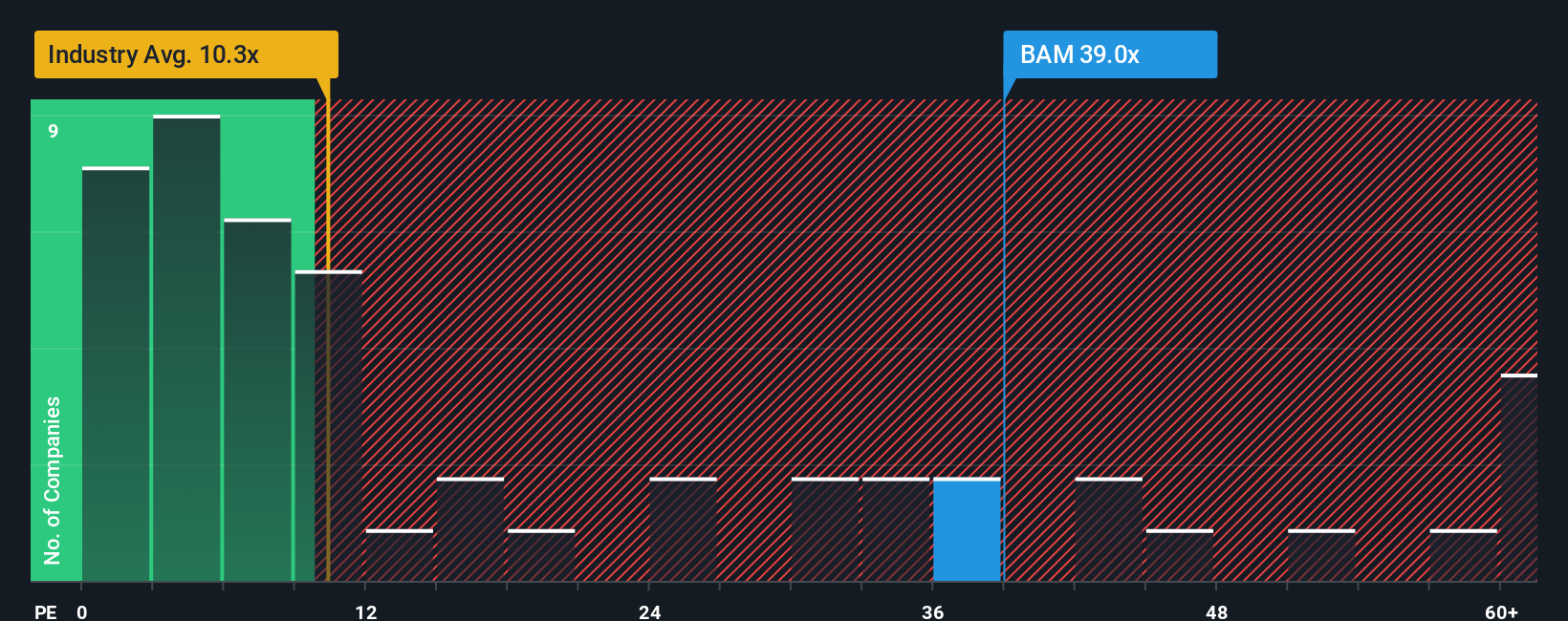

Brookfield’s current PE ratio sits at 38.7x, noticeably higher than both the Capital Markets industry average at 10.3x and its peer average of 53.5x. While at first glance this premium may seem steep, direct comparisons can be misleading if they do not account for the company’s unique growth profile, risk factors, and profit margins.

This is where Simply Wall St’s “Fair Ratio” comes in. Unlike a simple average, the Fair Ratio is tailored to Brookfield by factoring in earnings growth, profitability, size, industry context, and company-specific risks. For Brookfield Asset Management, the Fair Ratio stands at 30.7x, which offers a more nuanced benchmark than just looking at peers or the sector.

Comparing the Fair Ratio with the actual PE ratio suggests that Brookfield’s current valuation is on the expensive side. Investors considering the shares should note the market is pricing in a substantial premium over what would be considered fair by these combined measures.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Brookfield Asset Management Narrative

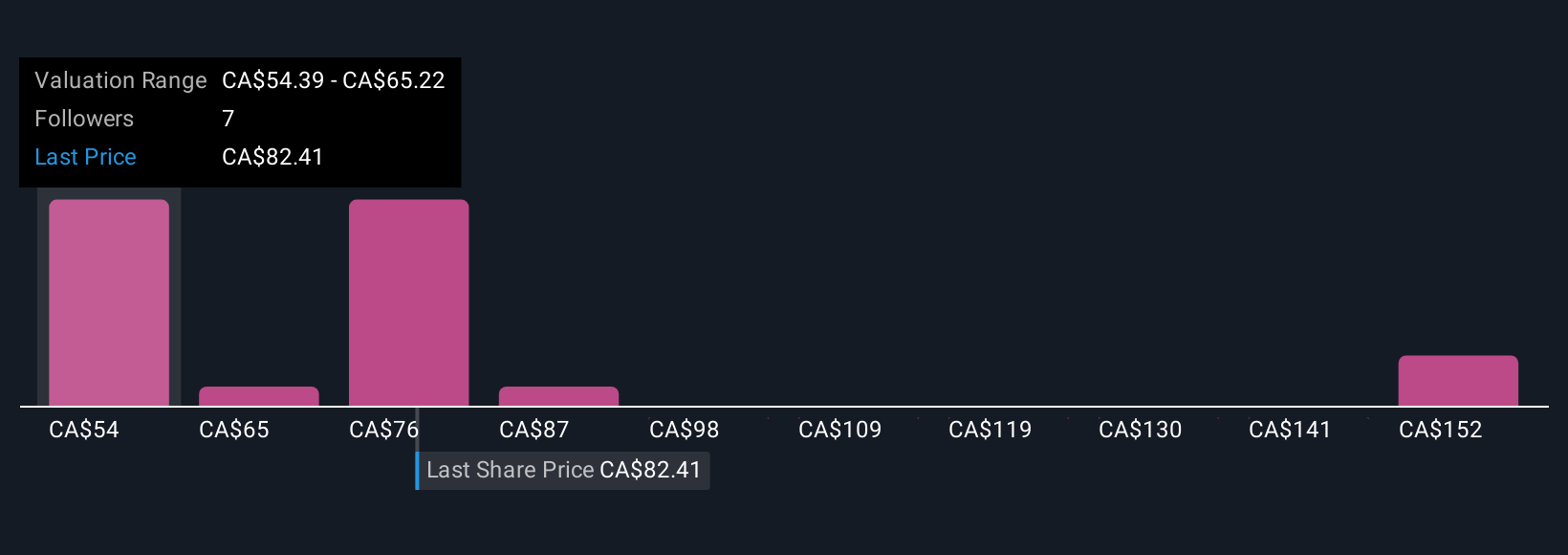

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative goes beyond the numbers, letting you create a story with your own perspective about a company’s future by combining your own assumptions for fair value, growth, earnings, and margins. Narratives help you turn your big-picture view into a financial forecast, which then calculates a fair value and makes it easier to see how your thesis compares to the current share price.

Available on Simply Wall St's platform, Narratives are an intuitive tool already used by millions of investors via the Community page. By entering your Narrative, you can instantly see if Brookfield Asset Management looks attractive relative to what you believe, helping you confidently decide how to act. Narratives automatically update with the latest news and company results, so your analysis stays relevant as circumstances change. For Brookfield, for example, some investors project a much higher fair value based on double-digit revenue growth, while others remain cautious and use more conservative profit margin estimates.

Do you think there's more to the story for Brookfield Asset Management? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Asset Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BAM

Brookfield Asset Management

A private equity firm specializing in acquisitions and growth capital investments.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives