- Canada

- /

- Diversified Financial

- /

- TSX:ACD

We Think Accord Financial Corp.'s (TSE:ACD) CEO Compensation Package Needs To Be Put Under A Microscope

Shareholders will probably not be too impressed with the underwhelming results at Accord Financial Corp. (TSE:ACD) recently. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 05 May 2021. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for Accord Financial

Comparing Accord Financial Corp.'s CEO Compensation With the industry

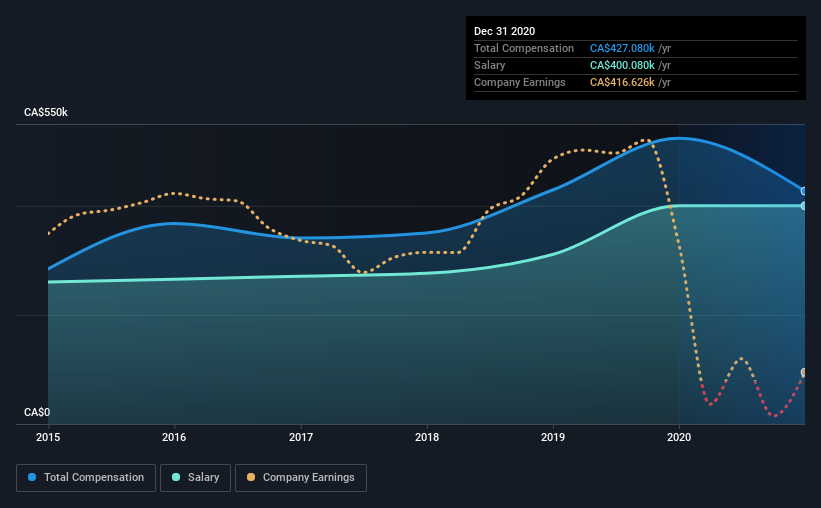

Our data indicates that Accord Financial Corp. has a market capitalization of CA$60m, and total annual CEO compensation was reported as CA$427k for the year to December 2020. We note that's a decrease of 18% compared to last year. Notably, the salary which is CA$400.1k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under CA$247m, the reported median total CEO compensation was CA$250k. This suggests that Simon Hitzig is paid more than the median for the industry. What's more, Simon Hitzig holds CA$1.4m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$400k | CA$400k | 94% |

| Other | CA$27k | CA$124k | 6% |

| Total Compensation | CA$427k | CA$524k | 100% |

Talking in terms of the industry, salary represented approximately 19% of total compensation out of all the companies we analyzed, while other remuneration made up 81% of the pie. Accord Financial is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Accord Financial Corp.'s Growth Numbers

Accord Financial Corp. has reduced its earnings per share by 59% a year over the last three years. Its revenue is down 17% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Accord Financial Corp. Been A Good Investment?

Given the total shareholder loss of 9.3% over three years, many shareholders in Accord Financial Corp. are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 6 warning signs for Accord Financial (of which 2 are a bit unpleasant!) that you should know about in order to have a holistic understanding of the stock.

Important note: Accord Financial is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Accord Financial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ACD

Accord Financial

Through its subsidiaries, provides asset-based financial services to industrial and commercial enterprises primarily in Canada and the United States.

Low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.