- Canada

- /

- Diversified Financial

- /

- TSX:ACD

Accord Financial Corp. (TSE:ACD) Is About To Go Ex-Dividend, And It Pays A 2.3% Yield

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Accord Financial Corp. (TSE:ACD) is about to go ex-dividend in just 3 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. This means that investors who purchase Accord Financial's shares on or after the 13th of August will not receive the dividend, which will be paid on the 1st of September.

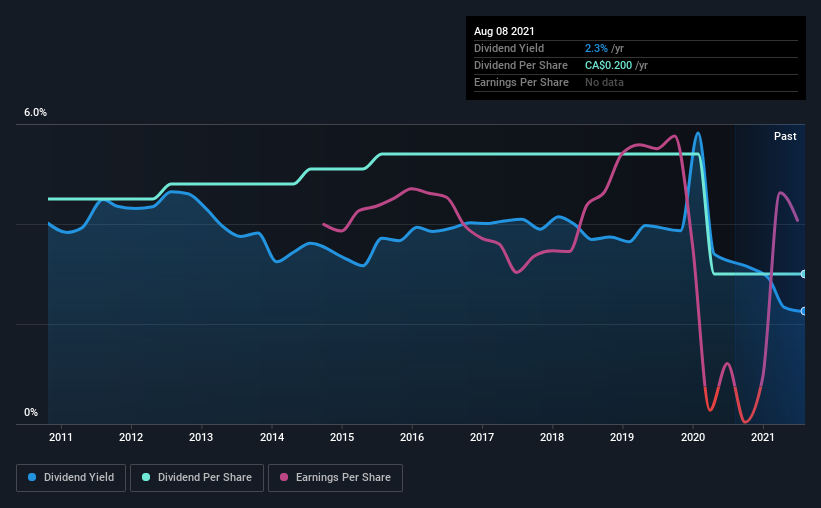

The company's next dividend payment will be CA$0.05 per share, on the back of last year when the company paid a total of CA$0.20 to shareholders. Looking at the last 12 months of distributions, Accord Financial has a trailing yield of approximately 2.3% on its current stock price of CA$8.85. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Accord Financial can afford its dividend, and if the dividend could grow.

View our latest analysis for Accord Financial

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Accord Financial has a low and conservative payout ratio of just 23% of its income after tax.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see how much of its profit Accord Financial paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That's why it's not ideal to see Accord Financial's earnings per share have been shrinking at 3.4% a year over the previous five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Accord Financial's dividend payments per share have declined at 4.0% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

The Bottom Line

From a dividend perspective, should investors buy or avoid Accord Financial? Accord Financial's earnings per share are down over the past five years, although it has the cushion of a low payout ratio, which would suggest a cut to the dividend is relatively unlikely. At best we would put it on a watch-list to see if business conditions improve, as it doesn't look like a clear opportunity right now.

So if you want to do more digging on Accord Financial, you'll find it worthwhile knowing the risks that this stock faces. To that end, you should learn about the 5 warning signs we've spotted with Accord Financial (including 2 which are significant).

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ACD

Accord Financial

Through its subsidiaries, provides asset-based financial services to industrial and commercial enterprises primarily in Canada and the United States.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026