- Canada

- /

- Metals and Mining

- /

- TSXV:CANX

Discover TSX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the Canadian economy continues to show resilience, bolstered by strong consumer spending and positive wage growth, investors are paying close attention to opportunities in the market. Penny stocks, though an older term, remain relevant as they often represent smaller or newer companies with potential for growth at lower price points. With a focus on financial health and solid fundamentals, these stocks can offer intriguing prospects for those looking to explore this niche investment area.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.465 | CA$13.32M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.34 | CA$118.05M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.59 | CA$556.63M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.30 | CA$223.45M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.475 | CA$968.15M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.23 | CA$32.24M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.08 | CA$3.22B | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.87 | CA$185.31M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.85 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 930 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

MedBright AI Investments (CNSX:MBAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: MedBright AI Investments Inc. focuses on investing in healthcare technology companies and has a market cap of CA$2.21 million.

Operations: The company's revenue segment includes Pharmaceuticals, which reported CA$-0.09 million.

Market Cap: CA$2.21M

MedBright AI Investments Inc., with a market cap of CA$2.21 million, is pre-revenue and has reported negative revenue figures, indicating significant financial challenges. The company is debt-free but faces a cash runway of less than a year due to its current free cash flow situation. Despite having short-term assets exceeding liabilities, the company has experienced shareholder dilution with shares growing by 9.3% over the past year. Additionally, MedBright's board lacks seasoned experience and its share price has been highly volatile recently, reflecting investor uncertainty in this penny stock environment.

- Dive into the specifics of MedBright AI Investments here with our thorough balance sheet health report.

- Understand MedBright AI Investments' track record by examining our performance history report.

CANEX Metals (TSXV:CANX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CANEX Metals Inc. is a junior exploration company focused on acquiring, exploring, and developing mineral properties in Canada and the United States, with a market cap of CA$4.90 million.

Operations: No revenue segments are reported.

Market Cap: CA$4.9M

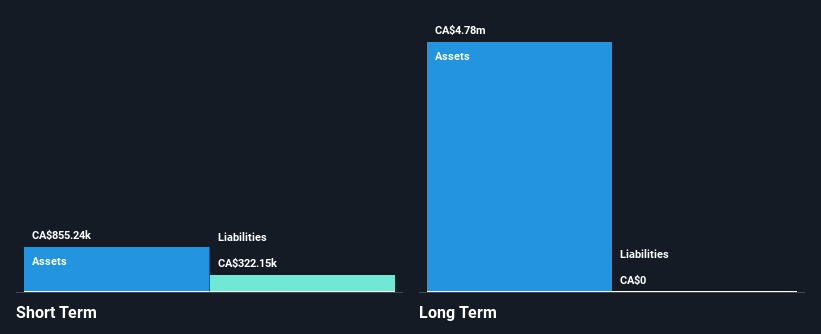

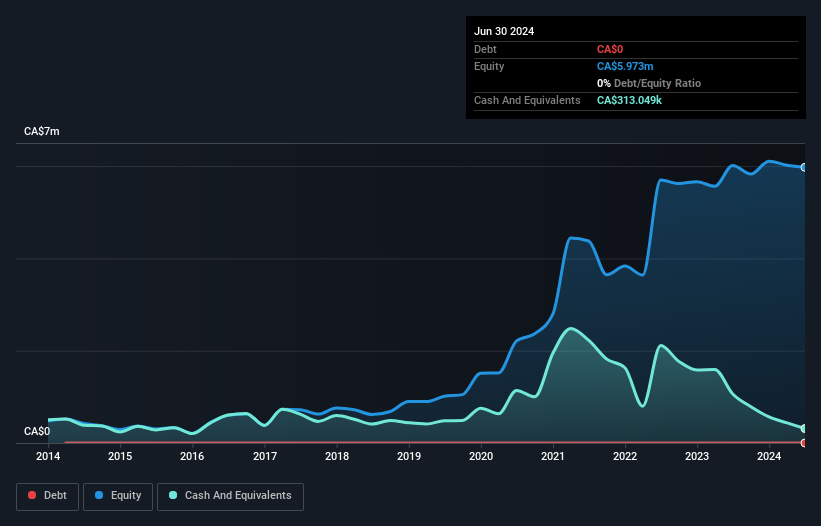

CANEX Metals Inc., with a market cap of CA$4.90 million, is pre-revenue and currently unprofitable, facing increased losses over the past five years. The company has no debt but has experienced shareholder dilution with a 7.2% increase in shares outstanding recently. Despite its short-term assets covering liabilities, CANEX's cash runway is limited to four months based on free cash flow estimates, though additional capital was raised recently. The company is advancing exploration activities at the Louise Copper-Gold Porphyry project in British Columbia, supported by recent financing and positive engagement with local First Nation groups.

- Click here to discover the nuances of CANEX Metals with our detailed analytical financial health report.

- Explore historical data to track CANEX Metals' performance over time in our past results report.

Tincorp Metals (TSXV:TIN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tincorp Metals Inc. is involved in the exploration and development of mineral properties, with a market cap of CA$10.71 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$10.71M

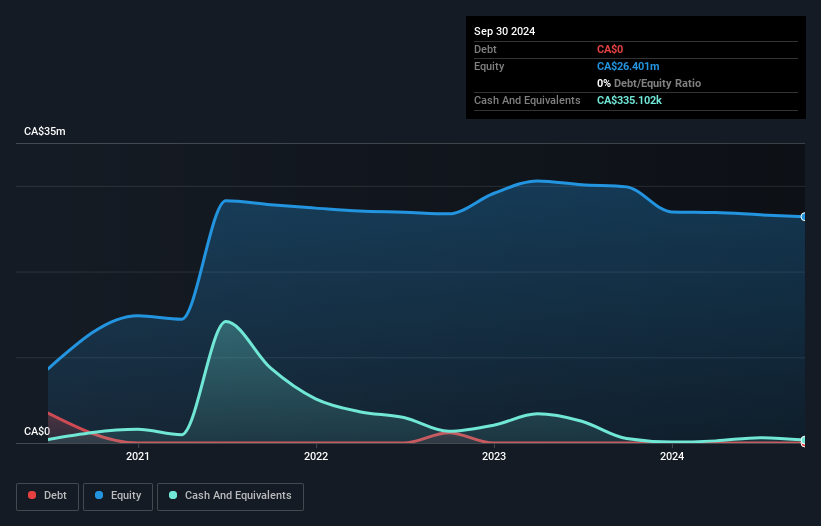

Tincorp Metals Inc., with a market cap of CA$10.71 million, is pre-revenue and currently unprofitable, having experienced increased losses over the past five years at a significant rate. The company remains debt-free but faces challenges as its short-term assets of CA$384K do not cover liabilities totaling CA$5.2M. Recent private placements aim to bolster financial stability, raising up to CA$139,999.95 through share issuance. Although weekly volatility has decreased from 19% to 13%, it remains higher than most Canadian stocks, reflecting continued share price instability amidst ongoing exploration and development activities in the mineral sector.

- Click to explore a detailed breakdown of our findings in Tincorp Metals' financial health report.

- Gain insights into Tincorp Metals' past trends and performance with our report on the company's historical track record.

Summing It All Up

- Click this link to deep-dive into the 930 companies within our TSX Penny Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CANX

CANEX Metals

Explores and develops of mineral properties in Canada and the United States.

Excellent balance sheet moderate.

Market Insights

Community Narratives