Pizza Pizza Royalty Corp. (TSE:PZA) will increase its dividend on the 15th of December to CA$0.06. This takes the dividend yield from 5.6% to 5.7%, which shareholders will be pleased with.

View our latest analysis for Pizza Pizza Royalty

Pizza Pizza Royalty Doesn't Earn Enough To Cover Its Payments

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, Pizza Pizza Royalty's was paying out quite a large proportion of earnings and 91% of free cash flows. This is usually an indication that the focus of the company is returning cash to shareholders rather than reinvesting it for growth.

Looking forward, EPS could fall by 3.6% if the company can't turn things around from the last few years. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 95%, which could put the dividend under pressure if earnings don't start to improve.

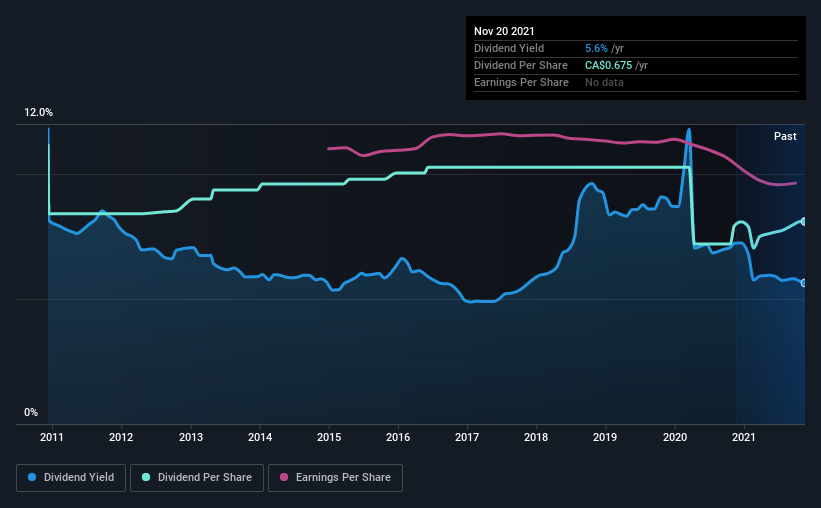

Pizza Pizza Royalty's Track Record Isn't Great

The dividend hasn't seen any major cuts in the last 10 years, but it has slowly been decreasing. Since 2011, the first annual payment was CA$0.93, compared to the most recent full-year payment of CA$0.68. Doing the maths, this is a decline of about 3.2% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Pizza Pizza Royalty has seen earnings per share falling at 3.6% per year over the last five years. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed.

Our Thoughts On Pizza Pizza Royalty's Dividend

In summary, while it's always good to see the dividend being raised, we don't think Pizza Pizza Royalty's payments are rock solid. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 2 warning signs for Pizza Pizza Royalty (of which 1 is concerning!) you should know about. We have also put together a list of global stocks with a solid dividend.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:PZA

Pizza Pizza Royalty

Through its subsidiary, Pizza Pizza Royalty Limited Partnership, owns and franchises quick service restaurants under the Pizza Pizza and Pizza 73 brands in Canada.

Good value with proven track record and pays a dividend.