Pizza Pizza Royalty Corp. (TSE:PZA) has announced that it will pay a dividend of CA$0.055 per share on the 15th of July. This makes the dividend yield 6.0%, which will augment investor returns quite nicely.

See our latest analysis for Pizza Pizza Royalty

Pizza Pizza Royalty's Earnings Easily Cover the Distributions

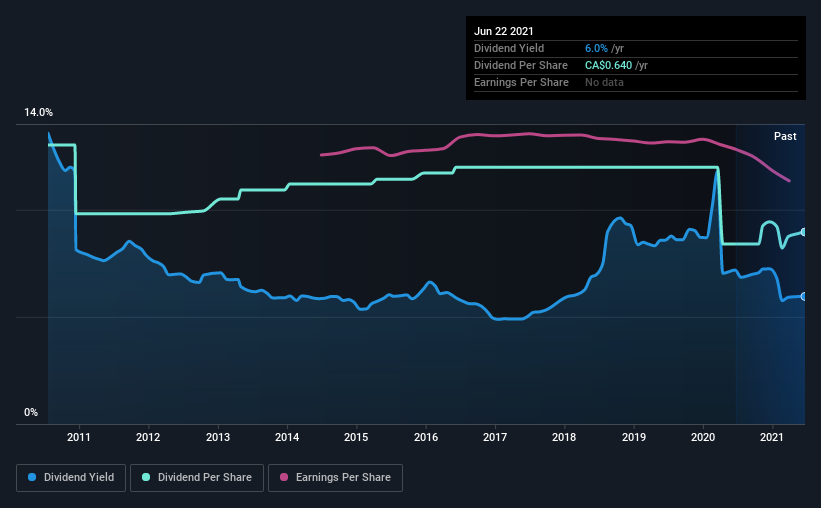

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, Pizza Pizza Royalty was paying out 86% of earnings and more than 75% of free cash flows. This indicates that the company is more focused on returning cash to shareholders than growing the business, but it is still in a reasonable range to continue with.

If the company can't turn things around, EPS could fall by 2.4% over the next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 89% in the next 12 months which is on the higher end of the range we would say is sustainable.

Pizza Pizza Royalty's Track Record Isn't Great

The company hasn't been particularly volatile, but it has been steadily decreasing which of course is not what investors like to see. The first annual payment during the last 10 years was CA$0.93 in 2011, and the most recent fiscal year payment was CA$0.64. This works out to be a decline of approximately 3.7% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend's Growth Prospects Are Limited

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Over the past five years, it looks as though Pizza Pizza Royalty's EPS has declined at around 2.4% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Pizza Pizza Royalty's payments, as there could be some issues with sustaining them into the future. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 1 warning sign for Pizza Pizza Royalty that investors need to be conscious of moving forward. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:PZA

Pizza Pizza Royalty

Through its subsidiary, Pizza Pizza Royalty Limited Partnership, owns and franchises quick service restaurants under the Pizza Pizza and Pizza 73 brands in Canada.

Good value with proven track record and pays a dividend.