- Canada

- /

- Hospitality

- /

- TSX:MTY

Why We Think MTY Food Group Inc.'s (TSE:MTY) CEO Compensation Is Not Excessive At All

Key Insights

- MTY Food Group will host its Annual General Meeting on 2nd of May

- CEO Eric Lefebvre's total compensation includes salary of CA$646.1k

- Total compensation is 84% below industry average

- MTY Food Group's three-year loss to shareholders was 3.6% while its EPS grew by 26% over the past three years

The performance at MTY Food Group Inc. (TSE:MTY) has been rather lacklustre of late and shareholders may be wondering what CEO Eric Lefebvre is planning to do about this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 2nd of May. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for MTY Food Group

Comparing MTY Food Group Inc.'s CEO Compensation With The Industry

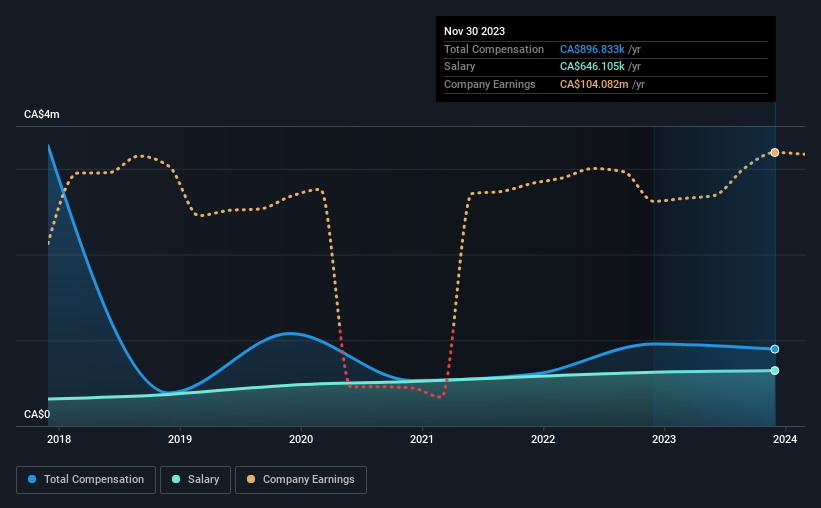

Our data indicates that MTY Food Group Inc. has a market capitalization of CA$1.2b, and total annual CEO compensation was reported as CA$897k for the year to November 2023. That's a slight decrease of 6.3% on the prior year. Notably, the salary which is CA$646.1k, represents most of the total compensation being paid.

For comparison, other companies in the Canadian Hospitality industry with market capitalizations ranging between CA$547m and CA$2.2b had a median total CEO compensation of CA$5.5m. Accordingly, MTY Food Group pays its CEO under the industry median. Moreover, Eric Lefebvre also holds CA$667k worth of MTY Food Group stock directly under their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CA$646k | CA$628k | 72% |

| Other | CA$251k | CA$329k | 28% |

| Total Compensation | CA$897k | CA$957k | 100% |

Speaking on an industry level, nearly 72% of total compensation represents salary, while the remainder of 28% is other remuneration. MTY Food Group is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at MTY Food Group Inc.'s Growth Numbers

Over the past three years, MTY Food Group Inc. has seen its earnings per share (EPS) grow by 26% per year. It achieved revenue growth of 35% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has MTY Food Group Inc. Been A Good Investment?

Given the total shareholder loss of 3.6% over three years, many shareholders in MTY Food Group Inc. are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Despite the strong EPS growth recently, the share price has not performed to expectations and it suggests that other factors might be driving it, apart from fundamentals. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board and assess if the board's plan is likely to improve company performance.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 2 warning signs for MTY Food Group (of which 1 is a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from MTY Food Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MTY

MTY Food Group

Operates and franchises quick-service, fast-casual, and casual dining restaurants in Canada, the United States, and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026