- Canada

- /

- Hospitality

- /

- TSX:BRAG

The 11% return this week takes Bragg Gaming Group's (TSE:BRAG) shareholders five-year gains to 354%

We think all investors should try to buy and hold high quality multi-year winners. While not every stock performs well, when investors win, they can win big. Don't believe it? Then look at the Bragg Gaming Group Inc. (TSE:BRAG) share price. It's 354% higher than it was five years ago. And this is just one example of the epic gains achieved by some long term investors. On top of that, the share price is up 87% in about a quarter.

The past week has proven to be lucrative for Bragg Gaming Group investors, so let's see if fundamentals drove the company's five-year performance.

Check out our latest analysis for Bragg Gaming Group

Bragg Gaming Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Bragg Gaming Group saw its revenue grow at 25% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 35% per year in that time. Despite the strong run, top performers like Bragg Gaming Group have been known to go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

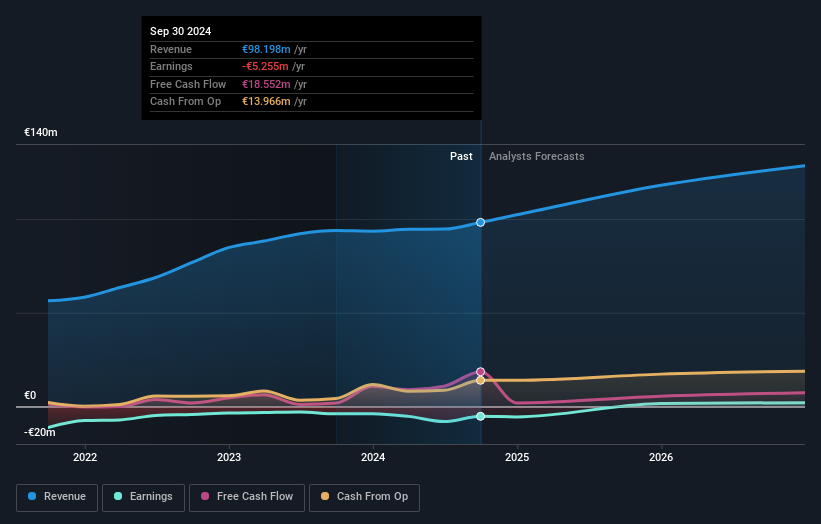

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So it makes a lot of sense to check out what analysts think Bragg Gaming Group will earn in the future (free profit forecasts).

A Different Perspective

Bragg Gaming Group's TSR for the year was broadly in line with the market average, at 21%. We should note here that the five-year TSR is more impressive, at 35% per year. Although the share price growth has slowed, the longer term story points to a business well worth watching. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Bragg Gaming Group is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bragg Gaming Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BRAG

Bragg Gaming Group

Operates as an iGaming content and technology solutions provider serving online and land-based gaming operators with its proprietary and exclusive content.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives